The Ultimate Guide to Forex Trading Sessions: Best Times to Trade

ទីផ្សាររូបិយប័ណ្ណអន្តរជាតិគឺមានលក្ខណៈពិសេស ប្រតិបត្តិការ 24 ម៉ោងក្នុងមួយថ្ងៃ ប្រាំថ្ងៃក្នុងមួយសប្តាហ៍។ ប៉ុន្តែនោះមិនមានន័យថាម៉ោងទាំងអស់គឺល្អដូចគ្នាសម្រាប់ការជួញដូរនោះទេ។ ដើម្បីក្លាយជាអ្នកជួញដូរដែលទទួលបានជោគជ័យ វាជារឿងសំខាន់ក្នុងការយល់ដឹងពីរបៀបដែលវគ្គ Forex Session ដំណើរការ និងរបៀបដែលវាប៉ះពាល់ដល់ចលនាតម្លៃ និងសន្ទនីយភាព (Liquidity)។

នៅក្នុងអត្ថបទនេះយើងនឹងចូលទៅសិក្សារលំអិតអំពី Forex Trading Session និងពេលវេលាល្អបំផុតក្នុងការជួញដូរ។ តស់ចាប់ផ្តើម!

អ្វីទៅជា Trading Session?

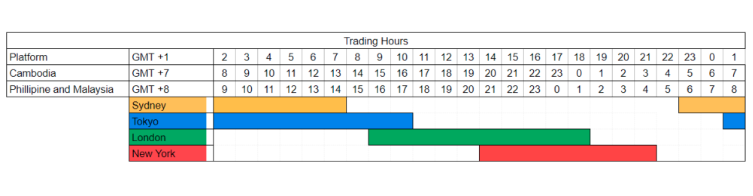

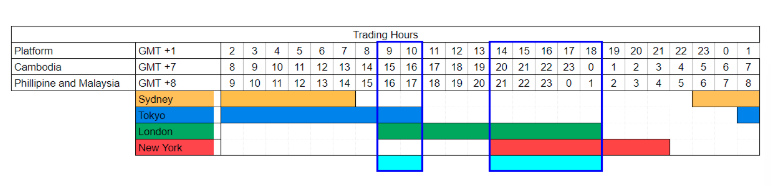

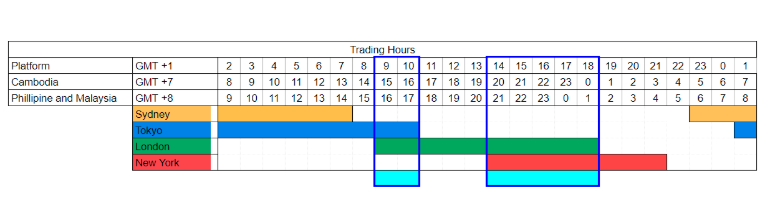

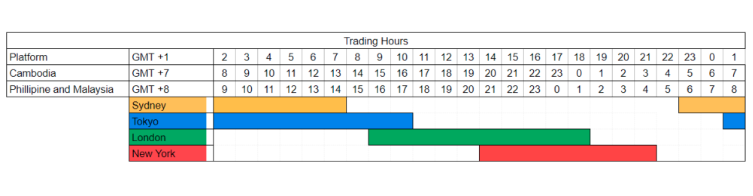

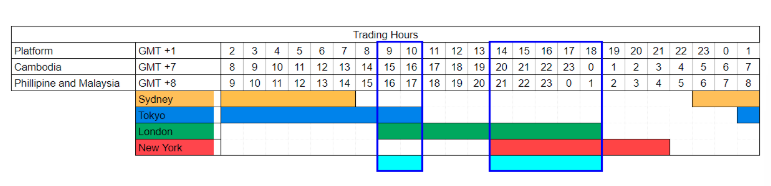

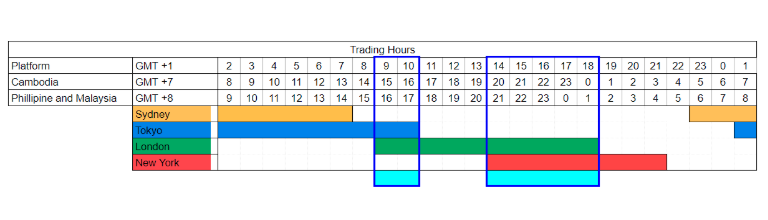

ទីផ្សារ Forex ដំណើរការតាមរយៈវគ្គជួញដូរសំខាន់ៗចំនួនបួន ដែលត្រូវនឹងមជ្ឈមណ្ឌលហិរញ្ញវត្ថុសំខាន់ៗរបស់ពិភពលោក៖ ទីក្រុងឡុងដ៍ ញូវយ៉ក ស៊ីដនី និងតូក្យូ។ ទីក្រុងទាំងនេះនីមួយៗមានពេលវេលាជាក់លាក់មួយ នៅពេលដែលទីផ្សាររបស់វាសកម្មបំផុត ដែលបង្កើតវគ្គជួញដូរនៅពេលថ្ងៃ។ វគ្គទាំងនេះត្រួតលើគ្នានៅពេលវេលាជាក់លាក់ ដោយផ្តល់ឱកាសពិសេសមួយសម្រាប់ធ្វើការជូញដូរ។

1. Sydney Session

- Open: 10:00 PM GMT

- Close: 7:00 AM GMT

- Key Pairs: AUD/USD, NZD/USD

ទីក្រុងស៊ីដនីបើកដើមសប្តាហ៍ទីផ្សារ Forex នៅថ្ងៃចន្ទ។ ខណៈពេលដែលវាត្រូវបានចាត់ទុកថាជាវគ្គដែលមានការប្រែប្រួលតិចតួចបំផុតដោយសារតែបរិមាណជួញដូរទាប វានៅតែអាចបង្ហាញពីឱកាស ជាពិសេសសម្រាប់គូដែលទាក់ទងនឹងប្រាក់ដុល្លារអូស្រ្តាលី និងនូវែលសេឡង់។

2. Tokyo Session

- Open: 12:00 AM GMT

- Close: 9:00 AM GMT

- Key Pairs: USD/JPY, EUR/JPY

វគ្គជួញដូរនៅទីក្រុងតូក្យូមើលឃើញសកម្មភាពច្រើនជាងទីក្រុងស៊ីដនី និងជាវគ្គជួញដូរធំបំផុតនៅអាស៊ី។ គូ JPY មានសកម្មភាពខ្លាំងក្នុងអំឡុងពេលវគ្គនេះ។ លើសពីនេះ ព័ត៌មានទីផ្សារអាស៊ីមាននិន្នាការប៉ះពាល់ដល់ប្រាក់យ៉េនជប៉ុន និងរូបិយប័ណ្ណអាស៊ីផ្សេងទៀតក្នុងអំឡុងពេលម៉ោងទាំងនេះ។

3. London Session

- Open: 8:00 AM GMT

- Close: 5:00 PM GMT

- Key Pairs: GBP/USD, EUR/USD

វគ្គនៅទីក្រុងឡុងដ៍គឺជាកន្លែងដែលសកម្មភាពកើនឡើង។ ក្នុងនាមជាមជ្ឈមណ្ឌលហិរញ្ញវត្ថុដ៏ធំបំផុតមួយ ទីក្រុងឡុងដ៍មើលឃើញចលនាទីផ្សារជាច្រើន និងសម្បូរទៅដោយសន្ទនីយភាព (Liquidity) ខ្ពស់។ អ្នកជួញដូរជាច្រើនចាត់ទុកវគ្គជួញដូរនៅទីក្រុងឡុងដ៍គឺជាពេលវេលាដ៏ល្អបំផុតសម្រាប់ការជួញដូរប្រចាំថ្ងៃ ជាពិសេសសម្រាប់គូរូបិយប័ណ្ណសំខាន់ៗដូចជា GBP/USD និង EUR/USD។

4. New York Session

- Open: 1:00 PM GMT

- Close: 10:00 PM GMT

- Key Pairs: USD/CAD, EUR/USD, GBP/USD

ជាវគ្គចុងក្រោយនៃថ្ងៃនោះ វគ្គជួញដូរនៅទីក្រុងញូវយ៉កត្រួតលើគ្នាជាមួយទីក្រុងឡុងដ៍រយៈពេលពីរទៅបីម៉ោង ដោយបង្កើតបម្រែបម្រួល និងសន្ទនីយភាព (liquidity) ខ្ពស់ ជាពិសេសសម្រាប់គូរូបិយប័ណ្ណដុល្លារ។ រយៈពេលត្រួតស៊ីគ្នានេះច្រើនតែសកម្មបំផុត ហើយជាពេលវេលាសំខាន់សម្រាប់ពាណិជ្ជករដើម្បីចូលទីផ្សារ ព័ត៌មានសេដ្ឋកិច្ចពីសហរដ្ឋអាមេរិកក៏ជះឥទ្ធិពលយ៉ាងខ្លាំងដល់ចលនាទីផ្សារក្នុងអំឡុងពេលនេះផងដែរ។

ពេលវេលាល្អបំផុតដើម្បីធ្វើការជួញដូរ៖ អំឡុងពេលត្រួតស៊ីគ្នា

ខណៈពេលដែលវគ្គនីមួយៗផ្តល់ឱកាសធ្វើការជួញដូរ ពេលវេលាដែលប្រែប្រួលបំផុតគឺនៅពេលដែលវគ្គត្រួតលើគ្នា៖

- London & New York (1:00 PM – 5:00 PM GMT): នេះគឺជាការត្រួតស៊ីគ្នាដ៏សកម្មបំផុត ដែលគូរូបិយប័ណ្ណសំខាន់ៗជាច្រើនជួបប្រទះបរិមាណជួញដូរខ្ពស់បំផុត និងចលនាតម្លៃដ៏មុតស្រួច។

- Tokyo & London (8:00 AM – 9:00 AM GMT): ទោះបីជាការត្រួតស៊ីគ្នាមានរយៈពេលខ្លីជាងក៏ដោយ វាជាពេលវេលាដ៏សំខាន់សម្រាប់អ្នកជួញដូរដែលចាប់អារម្មណ៍លើរូបិយប័ណ្ណអាស៊ី និងអឺរ៉ុប ដូចជា EUR/JPY ជាដើម។

ពេលវេលាអាក្រក់បំផុតដើម្បីធ្វើការជួញដូរ

ខណៈពេលដែលទីផ្សារ Forex បើក 24/5 ពេលខ្លះមិនសូវអំណោយផលសម្រាប់ការជួញដូរដោយសារតែការប្រែប្រួល និងទំហំជួញដូរទាប។ ជាទូទៅ វាជាការល្អក្នុងការជៀសវាងការជួញដូរនៅពេលវេលាខាងក្រោម៖

- Late Friday: ទីផ្សារធ្លាក់ចុះ ហើយliquidityធ្លាក់ចុះ នៅពេលដែលអ្នកជួញដូរចាកចេញពីទីផ្សារមុនចុងសប្តាហ៍។

- Sunday evenings: ទីផ្សារទើបតែភ្ញាក់ឡើង ជាមួយនឹងចលនាតម្លៃតិចតួច រហូតដល់ទីក្រុងស៊ីដនី និងតូក្យូចាប់ផ្តើមដំណើរការ។

គន្លឹះសម្រាប់កំណត់ពេលវេលាជួញដូររបស់អ្នក

- Trade the Overlaps: ផ្តោតលើការជួញដូរនៅពេលដែលវគ្គសំខាន់ៗពីរជាន់គ្នានៅពេលដែលមានការកើនឡើងliquidity និងគម្លាតតម្លៃទាប។

- Know the Economic Calendar: របាយការណ៍សេដ្ឋកិច្ច និងព្រឹត្តិការណ៍ព័ត៌មានអាចជះឥទ្ធិពលយ៉ាងខ្លាំងដល់ទីផ្សារ។ រៀបចំផែនការជួញដូរជុំវិញរបាយការណ៍សំខាន់ៗ ដូចជាបញ្ជីប្រាក់បៀវត្សរ៍មិនមែនកសិកម្ម (NFP) ឬការប្រកាសរបស់ធនាគារកណ្តាល។

- Pair Liquidity with Strategy: ប្រសិនបើអ្នកជាអ្នកជំនួញ scalper ឬអ្នកជួញដូរថ្ងៃ សាច់ប្រាក់ងាយស្រួលខ្ពស់គឺចាំបាច់។ អ្នកជួញដូរ swing ជាញឹកញាប់អាចទទួលបានអត្ថប្រយោជន៍ពីទីផ្សារស្ងប់ស្ងាត់ដើម្បីកំណត់អត្តសញ្ញាណនិន្នាការទីផ្សាររយៈពេលវែង។

Conclusion

ការយល់ដឹងអំពី Forex sessionsគឺមានសារៈសំខាន់សម្រាប់ការជួញដូរប្រកបដោយប្រសិទ្ធភាព។ គន្លឹះសំខាន់គឺថា ខណៈពេលដែលទីផ្សារ Forex ដំណើរការ 24/5 មិនមែនម៉ោងទាំងអស់សុទ្ធតែទទួលបានផលចំណេញស្មើគ្នានោះទេ។ ផ្តោតលើការជួញដូរក្នុងអំឡុងពេលវគ្គត្រួតគ្នា ឬពេលវេលានៃសាច់ប្រាក់ងាយស្រួល និងការប្រែប្រួលខ្ពស់ ដើម្បីបង្កើនឱកាសជោគជ័យរបស់អ្នក។ តាមរយៈការតម្រឹមយុទ្ធសាស្រ្តជួញដូររបស់អ្នកជាមួយនឹងចង្វាក់នៃទីផ្សារ អ្នកអាចធ្វើការសម្រេចចិត្តដែលមានការយល់ដឹងកាន់តែច្រើន និងបង្កើនសក្តានុពលប្រាក់ចំណេញរបស់អ្នក។

(English Version)

The Forex market is unique, operating 24 hours a day, five days a week. But that doesn’t mean all hours are equally good for trading. To become a successful trader, it’s important to understand how Forex sessions work and how they impact price movements and liquidity.

In this post, we’ll dive into the major Forex trading sessions and explore when the best times to trade are. Let’s get started!

What Are Forex Trading Sessions?

The Forex market operates through four main trading sessions, corresponding to the world’s major financial hubs: London, New York, Sydney, and Tokyo. Each of these cities has a specific time frame when its market is most active, which creates trading sessions during the day. These sessions overlap at certain times, offering unique trading opportunities.

1. Sydney Session

- Open: 10:00 PM GMT

- Close: 7:00 AM GMT

- Key Pairs: AUD/USD, NZD/USD

Sydney opens the Forex market week on Monday. While it’s often considered the least volatile session due to lower trading volume, it can still present opportunities, especially for pairs related to the Australian and New Zealand dollars.

2. Tokyo Session

- Open: 12:00 AM GMT

- Close: 9:00 AM GMT

- Key Pairs: USD/JPY, EUR/JPY

The Tokyo session sees more activity than Sydney and is the largest trading session in Asia. The JPY pairs are highly active during this session. Additionally, Asian market news tends to affect the Japanese yen and other Asian currencies during these hours.

3. London Session

- Open: 8:00 AM GMT

- Close: 5:00 PM GMT

- Key Pairs: GBP/USD, EUR/USD

The London session is where the action really picks up. As one of the biggest financial centers, London sees a lot of market movement and high liquidity. Many traders consider the London session to be the best time for day trading, especially for major currency pairs like GBP/USD and EUR/USD.

4. New York Session

- Open: 1:00 PM GMT

- Close: 10:00 PM GMT

- Key Pairs: USD/CAD, EUR/USD, GBP/USD

As the final session of the day, the New York session overlaps with London for a few hours, creating high volatility and liquidity, particularly for the USD pairs. This overlap period is often the most active and is prime time for traders to enter positions. Economic news from the U.S. also significantly affects market movements during this time.

Best Times to Trade: The Overlap Periods

While each session offers trading opportunities, the most volatile times are when the sessions overlap:

- London & New York (1:00 PM – 5:00 PM GMT): This is the most active overlap, where many major currency pairs experience the highest trading volume and sharp price movements.

- Tokyo & London (8:00 AM – 9:00 AM GMT): Though the overlap is shorter, it’s an important time for traders interested in Asian and European currencies, like EUR/JPY.

Worst Times to Trade

While the Forex market is open 24/5, some times are less favorable for trading due to lower volatility and volume. Generally, it’s wise to avoid trading:

- Late Friday: The market winds down, and liquidity drops as traders close positions ahead of the weekend.

- Sunday evenings: Markets are just waking up, with little price movement until Sydney and Tokyo kick into gear.

Tips for Timing Your Trades

- Trade the Overlaps: Focus on trading when two major sessions overlap for increased liquidity and tighter spreads.

- Know the Economic Calendar: Economic reports and news events can significantly impact the market. Plan trades around key reports like non-farm payrolls (NFP) or central bank announcements.

- Pair Liquidity with Strategy: If you’re a scalper or day trader, high liquidity is essential. Swing traders can often benefit from quieter markets to identify long-term trends.

Conclusion

Understanding Forex sessions is crucial for effective trading. The key takeaway is that while the Forex market runs 24/5, not all hours are equally profitable. Focus on trading during session overlaps or times of high liquidity and volatility to increase your chances of success. By aligning your trading strategy with the rhythm of the market, you can make more informed decisions and potentially increase your profitability.