Understanding Shooting Star Candlestick Patterns

តើអ្វីទៅជា Shooting Star Candlestick Pattern?

និយមន័យ

Shooting Star candlestick Pattern គឺជាទម្រង់នៃសញ្ញាវិលត្រឡប់ដែលមានតែមួយទានគត់។ វាមានស្រមោលខាងលើវែងនិងមានតួខ្លួនតូច។ វាប្រាប់យើងថានឹងមានការប្តូរទិសពីឡើងមកចុះ នៅពេលដែលវាកើត។

រូបរាង

លក្ខណៈសម្គាល់

ក្នុងទិសដៅកើនឡើង Shooting Star បានបង្កើតឡើងនៅពេលដែលតម្លៃព្យាយាមឡើងខ្ពស់ ប៉ុន្តែជាមួយនឹងចំនួនអ្នកទិញច្រើនដែលអាចធ្វើឱ្យតម្លៃបានធ្លាក់ចុះ នោះShooting Star ត្រូវបានបង្កើតឡើង។ ទាំងនេះបានសបញ្ជាក់ថា ចំនួនអ្នកទិញមានច្រើន ហើយការផ្លាស់ប្តូរទិសអាចនឹងកើតមានឡើង។

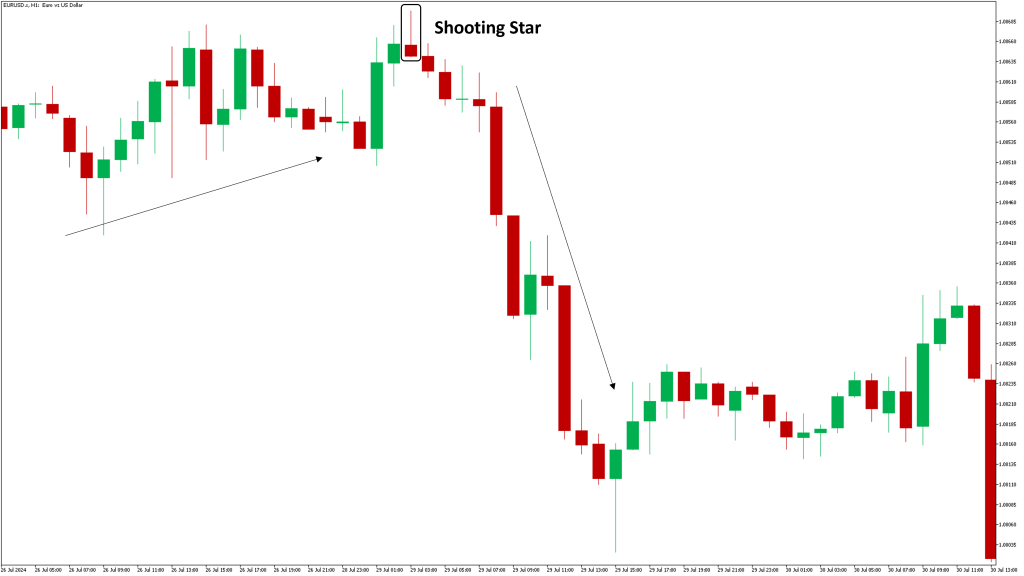

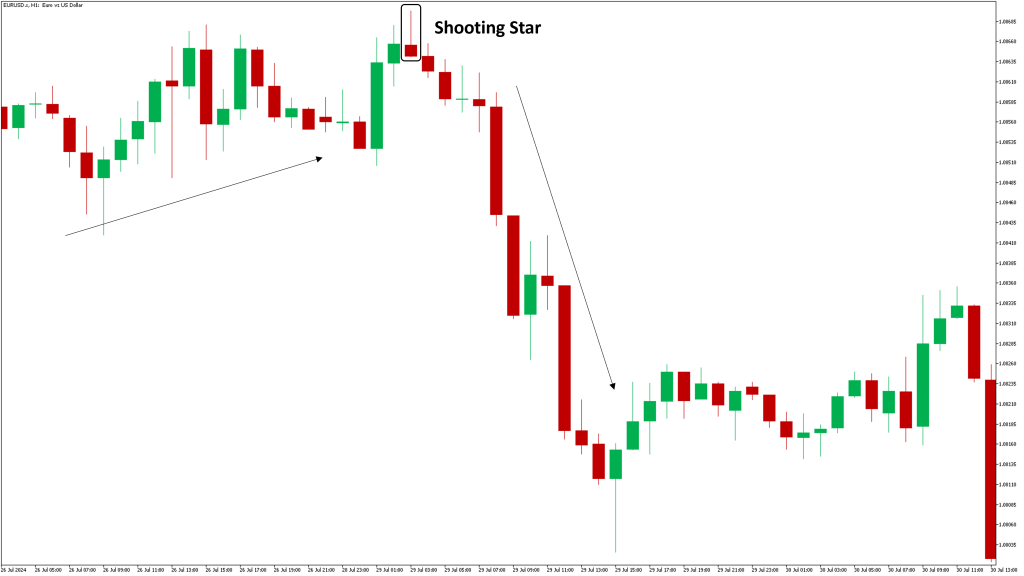

ឩទាហរណ៍

Shooting Star patternកើតឡើងនៅពេលដែលទីផ្សារស្រាប់តែមានការឈប់ភា្លមៗនៅពេលដែលវាកំពុងរត់ក្នុងលំហូរឡើង។ ស្រមោលខាងលើកាន់តែវែងបញ្ជាក់ប្រាប់យើងថាអ្នកទិញព្យាយាមរុញទីផ្សារអោយឡើង ប៉ុន្តែអ្នកលក់បានរុញវាត្រឡប់មកវិញយ៉ាងជោគជ័យ បង្កើតបានទៅជាស្រមោលដ៏វែង។ ទម្រង់បែបនេះផ្តល់សញ្ញាប្រាប់យើងថាអាចហ្នឹងមានការផ្លាស់ប្តូរសន្ទុះកម្លាំងនៅក្នុងទីផ្សារ ដែលប្រាប់យើងថាអ្នកលក់កំពុងគ្រប់គ្រងទីផ្សារ ហើយលំហូរដែលកំពុងតែឡើងអាចហ្នឹងប្តូរមកចុះវិញ។

ការសិក្សារមួយក្រោមប្រធានបទ “The Performance of Candlestick Patterns in Financial Markets” ដែលបានបោះពុម្ភផ្សារយនៅក្នុង Journal of Technical Analysis ដោយលោកDr. Thomas Bulkowski ដែលឈានមុខគេក្នុងការវិភាគ chart patternsបានរកឃើញថា Shooting Star pattern មានអត្រាជោគជ័យរហូតដល់ 59% ក្នុងការព្យាករណ៍ថាទិសដៅផ្សារនឹងមានការវិលត្រឡប់ពីឡើងមកចុះវិញ។

What is Shooting Star Candlestick Pattern?

Definition

A shooting star is a bearish reversal candlestick pattern that typically forms after an uptrend. It signals that a potential top is forming and that the price may start to fall.

Appearance

Characteristics

The shooting star candlestick pattern is a bearish reversal signal that consists of a single candle. It features a long upper wick and a small or non-existent body. Confirmation of this pattern occurs when a strong bearish candle appears after the shooting star.

Example

The shooting star pattern forms when the market suddenly rejects bullish momentum. The long upper wick signifies that buyers tried to drive the price up, but sellers successfully pushed it back down, creating the extended wick. This pattern signals a possible shift in market sentiment, indicating that bears may be gaining control and the uptrend could reverse.

In a study titled “The Performance of Candlestick Patterns in Financial Markets” published in the Journal of Technical Analysis, Dr. Thomas Bulkowski, a leading authority on chart patterns, found that the Shooting Star pattern has a success rate of around 59% in forecasting bearish reversals.