ធនាគារកណ្តាលនៅកាណាដា

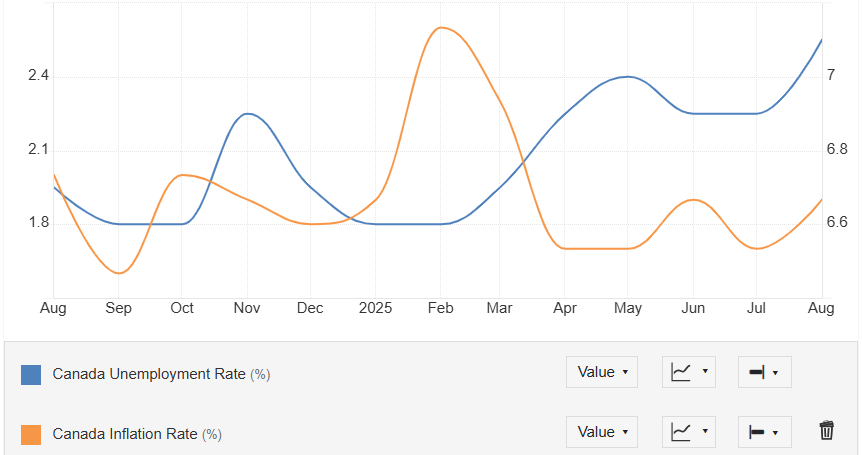

ធនាគារកណ្តាលកាណាដាត្រូវបានគេព្យាករណ៍ថា អាចនឹងមានការកាត់បន្ថយអត្រាការប្រាក់ចំនួន 25 bps នៅយប់នេះដោយចាប់ផ្តើមពី 2.75% ទៅ 2.50%។ នេះអាចបណ្តាលមកពីអត្រាអតិផរណានៅពេលបច្ចុប្បន្នមានកម្រិតទាបជាងអត្រាគោលដៅ ស្របពេលដែលទីផ្សារការងារកំពុងមានសភាពទន់ខ្សោយ។

យោងតាមរបាយការណ៍សន្ទស្សន៍អ្នកគ្រប់គ្រងការទិញ ពួកគេបានមើលឃើញពីការកើនឡើងនៃតម្លៃផលិត ដោយសារតែបញ្ហាពន្ធ គួបផ្សំជាមួយនឹងការឡើងថ្លៃនៃប្រាក់ឈ្នួលបុគ្គលិកនាពេលថ្មីៗនេះ។ ទោះបីជាយ៉ាងណាក៏ដោយ ក៏អតិផរណាសរុបនៅតែបន្តធ្លាក់ចុះក្រោម 2% ហើយអត្រាអ្នកគ្មានការងារធ្វើកើនឡើងគួរឲ្យកត់សម្គាល់។

ធនាគារកណ្តាលអាមេរិក

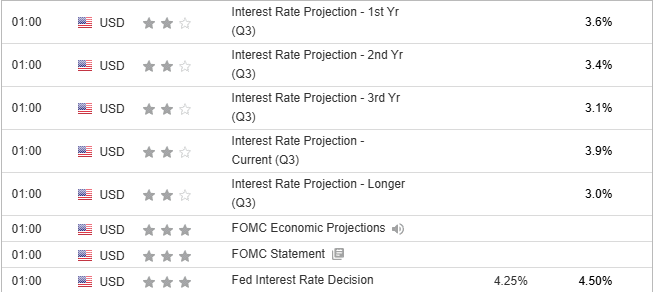

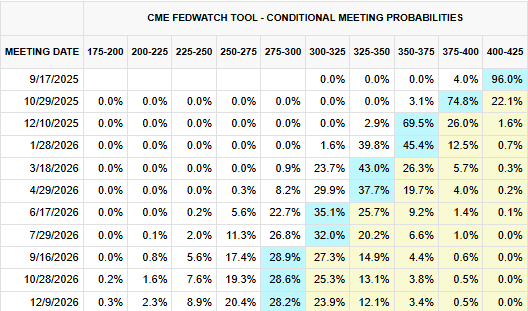

ដូចគ្នាជាមួយនឹងធនាគារកណ្តាលនៅកាណាដា ធនាគារកណ្តាលអាមេរិកក៏ត្រូវបានគេព្យាករណ៍ថាអាចនឹងបន្ទាបអត្រាការប្រាក់ចំនួន 25 bps ស្របពេលមនុស្សមួយចំនួនជឿជាក់ថាអាចនឹងកាត់ 50 bps ។ ប៉ុន្តែសំណួរពិតប្រាកដគឺថា តើអ្នកណានឹងបោះឆ្នោតឲ្យជម្រើសមួយណា? ផែនការបន្ទាប់នាពេលអនាគត? ហើយតើប្រធានធនាគារកណ្តាលអាមេរិកលោក Jerome Powell នឹងមានទស្សនវិស័យបែបណាបន្ថែមទៀត?

ចំណាំសំខាន់នៅទីនេះគឺថា Stephen Miran ក៏នឹងចូលរួមក្នុងការសម្រេចចិត្តរបស់ធនាគារកណ្តាលអាមេរិកដែលរូបគាត់មានភាគរយច្រើនដើរតាមគោលបំណងរបស់លោកប្រធានាធិបតី Trump។ ពោលគឺការកាត់បន្ថយអត្រាការប្រាក់ចំនួន 50 bps ខណៈពេលដែលលោក Bowman និងលោក Waller ក៏នឹងមានទិសដៅដូចគ្នានោះដែរ។

ដូច្នេះប្រសិនបើគេពិតជាកាត់ 25 bps ដូចការរំពឹងទុកមែននោះ ហើយលោកប្រធានធនាគារកណ្តាលអាមេរិក powell ប្រកាន់ខ្ជាប់នូវអ្វីដែលលោកបានលើកឡើងនៅក្នុងកិច្ចប្រជុំ Jackson Hole ពោលគឺក្តីបារម្ភលើទីផ្សារការងារ នោះវានឹងបង្ហាញសញ្ញា Dovish ហើយអាចនឹងមានភាគរយច្រើនដែលមាសកើនឡើង។

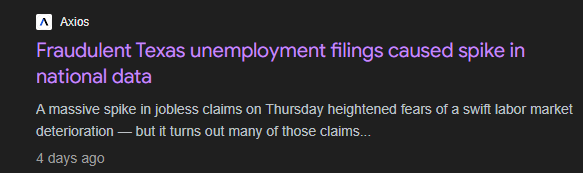

ទោះជាយ៉ាងណាក៏ដោយ ប្រសិនបើគាត់ជឿថាទីផ្សារការងារនៅតែរឹងមាំ ដោយសារការទាមទារអត្ថប្រយោជន៍សម្រាប់អ្នកគ្មានការងារធ្វើនាពេលថ្មីៗនេះត្រូវបានក្លែងបន្លំនៅរដ្ឋតិចសាស់ ខណៈដែលអតិផរណានៅតែជាក្តីបារម្ភរបស់ពួកគេ ហើយវាអាចនាំឱ្យមានវិធីសាស្រ្តប្រុងប្រយ័ត្នជាងមុន។ ពេលនោះគឺតម្លៃមាសក៏អាចនឹងធ្លាក់ចុះបន្តិចនោះដែរ។

ក្នុងករណីផ្សេងទៀត ដែលពួកគេអាចនឹងកាត់បន្ថយ 50 bps ដោយមិននឹកស្មានដល់ នោះវានឹងធ្វើឱ្យទីផ្សារភ្ញាក់ផ្អើល ហើយតម្លៃមាសក៏អាចនឹងកើនឡើងដូចគ្នា ដោយសារការបន្ធូរបន្ថយគោលនយោបាយរូបិយវត្ថុអាចធ្វើឱ្យប្រាក់ដុល្លារធ្លាក់ចុះ។

សម្រាប់ពេលនេះ ការធ្លាក់ចុះតម្លៃមាសអាចបណ្តាលមកពី Profit-Taking (មានន័យថា ទីផ្សារមួយចំនួនបានបិទ ឬដកប្រាក់ចំណេញចេញពីទីផ្សារ) ខណៈដែលអ្នកខ្លះកំពុងរង់ចាំប្រតិកម្មទីផ្សារនៅយប់នេះ។

|English Version|

The Bank of Canada

Starting off with the Bank of Canada, which many expect to see a 25 bps rate cut tonight, from 2.75% to 2.50%, and that could be the result of reaching the desired inflation level while seeing some sluggishness in the labor market conditions.

As per the purchasing managers’ index report, they cited seeing some marginal increase in the input price due to higher supplier charges from tariff uncertainty, along with the rising employment costs. Yet the overall inflation continues to slip below 2% while the unemployment rate has still risen noticeably.

The Federal Reserve

The same fate falls on the Federal Reserve with a 25 bps rate cut projection, while some still priced in for a 50 bps. But the real question is, who will vote for which? The dot plot, the future guidance, and how the Federal Reserve Chair Jerome Powell will lean toward more?

Key note here is that Stephen Miran will also join this FED decision, which is most likely to stand by Trump’s desired rate of 50 bps, while Bowman and Waller will also likely follow the same.

So if 25 bps come as expected, and the FED powell sticks to the same communication as in Jackson Hole—weak labor market concern—then this will signal a dovish sign and will likely support the gold price.

However, if he believes that the labor market is still solid, given how the recent jobless claims were fraudulent in Texas, while inflation concerns are still on their minds, and that could lead to a more cautious approach, the gold pullback scenario will come into play.

In the other case, where 50 bps come unexpectedly, then this will surprise the market, and gold prices will most likely rise as easing weakens the USD.

For now, the gold price decline could potentially result from profit-taking while some await tonight’s market reaction.