របាយការណ៍នេះនឹងផ្តល់នូវការវិភាគអំពីកត្តាចម្បងដែលជះឥទ្ធិពលលើតម្លៃមាស ទៅកាន់វិនិយោគិន។

***ព័ត៌មានទាំងអស់ដែលបង្ហាញគឺសម្រាប់ក្នុងគោលបំណងអប់រំតែប៉ុណ្ណោះ ហើយមិនគួរត្រូវប្រើប្រាស់ជាដំបូន្មានហិរញ្ញវត្ថុ ឬការណែនាំសម្រាប់ការសម្រេចចិត្តលើការជួញដូរ ឬការវិនិយោគនោះទេ។

ការវិភាគជាមូលដ្ឋាន ឬការវិភាគបែបសេដ្ឋកិច្ច

ការសង្ខេបស្ថានភាពសេដ្ឋកិច្ចពីមុន៖ កាលពីខែមុន ធនាគារកណ្តាលអាមេរិកបានកាត់បន្ថយអត្រាការប្រាក់បន្ថែមទៀត ទោះបីជាពួកគេនៅតែមានក្តីបារម្ភទៅលើបញ្ហាពីរធំៗក៏ដោយ។ ពោលគឺ បញ្ហាទីផ្សារការងារ និងបញ្ហាអតិផរណា ដែលទីផ្សារភាគច្រើននាពេលនេះកំពុងពិចារណាថា តើបញ្ហាមួយណាដែលអាចជះឥទ្ធិពលខ្លាំងទៅលើកំណើនសេដ្ឋកិច្ចជាងគេមុនពេលពួកគេធ្វើការសម្រេចចិត្តលើអត្រាការប្រាក់នាពេលខាងមុខ។ ទោះយ៉ាងណាមិញ ពួកគេនៅតែឃើញមានការកើនឡើងគួរឲ្យកត់សម្គាល់ទៅលើទិន្នន័យផលិតផលក្នុងស្រុកសរុបសម្រាប់ត្រីមាសទី 2 ស្របពេលដែលការចំណាយទូទៅរបស់ប្រជាជននៅទីនោះនៅតែមាន។ បើយោងតាមប្រភព Bloomberg ពួកគេលើកឡើងថា នេះអាចបណ្តាលមកពី “ការដើរទិញឥវ៉ាន់មុនពេលចូលរៀន”។ ជាងនេះទៅទៀត នៅមានកត្តាផ្សេងទៀតដែលរួមចំណែកផងដែរ ដូចជាភាពតានតឹងភូមិសាស្ត្រនយោបាយ សង្គ្រាមពាណិជ្ជកម្ម ការបិទរដ្ឋាភិបាលរបស់សហរដ្ឋអាមេរិកជាដើម។ ជាមួយនឹងហេតុផលទាំងនេះ តម្លៃមាសបានឡើងថ្លៃជាង 11% ក្នុងខែនេះ។

ការតាមដានទៅលើព្រឹត្តិការណ៍នាពេលខាងមុខ

ដូច្នេះឥឡូវនេះ មុនពេលការសម្រេចចិត្តអត្រាការប្រាក់មួយផ្សេងទៀតនៅក្នុងខែតុលាចូលមកដល់ តើមានកត្តាអ្វីខ្លះដែលត្រូវពិចារណា?

ស្ថានភាពសេដ្ឋកិច្ចអាមេរិក៖ បើតាមដានទៅលើសូចនាករសេដ្ឋកិច្ច យើងកំពុងពិចារណាលើទិន្នន័យសំខាន់ពីរ ដូចជារបាយការណ៍ស្ថានភាពការងារ ដែលត្រូវបានពន្យារពេលដល់ថ្ងៃទី 10 ខែតុលា ឆ្នាំ 2025 (ទំនងជាត្រូវពន្យារពេលបន្ថែមទៀត) ដោយសារការបិទរដ្ឋាភិបាលសហរដ្ឋអាមេរិក និងទិន្នន័យអតិផរណានៅថ្ងៃទី 15 ខែតុលា។

ដូច្នេះប្រសិនបើទិន្នន័យទាំងពីរនៅតែបង្ហាញពីភាពទន់ខ្សោយ មានន័យថាកម្លាំងពលកម្មនៅតែទន់ខ្សោយជាងមុន ហើយអតិផរណាបានធ្លាក់ចុះទៀតនោះ វាអាចនឹងជំរុញឲ្យទីផ្សារនៅតែជឿជាក់ថា ការកាត់បន្ថយអត្រាការប្រាក់នៅតែមានច្រើន ហើយសមាជិកធនាគារកណ្តាលក៏អាចមានទំនោរទៅលើការកាត់បន្ថយបែប Dovish នោះដែរ។

បើមិនអញ្ចឹងទេ ក្នុងករណីដែលកម្លាំងពលកម្មខ្សោយ ប៉ុន្តែអតិផរណានៅតែបន្តកើនឡើង នោះទីផ្សារនឹងដាក់សម្ពាធបន្ថែមទៀតលើទិន្នន័យអតិផរណា។ នេះមានន័យថា ពួកគេនៅតែព្រួយបារម្ភទៅលើបញ្ហាអតិផរណា ដោយជំរុញឲ្យធនាគារកណ្តាលកាត់បន្ថយអត្រាការប្រាក់ដែរ ប៉ុន្តែអាចកាត់បន្ថយបែប Hawkish វិញ (កាត់បន្ថយម្តងហើយ លែងកាត់ទៀត)។

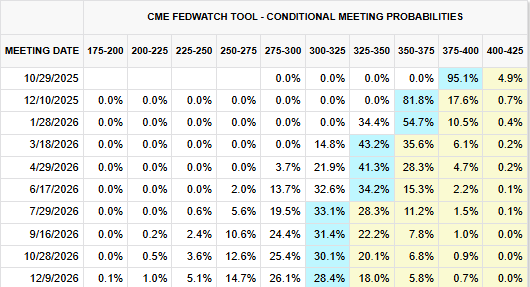

ខាងក្រោមនេះគឺជា ការព្យាករណ៍កាត់បន្ថយអត្រាការប្រាក់ដោយទីផ្សារជឿជាក់ថាអាចនឹងមានការកាត់ 2 ដងទៀតមុនដំណាច់ឆ្នាំ នេះបើយោងតាម CME Fedwatch Tool។

ជាពិសេសនៅពេលដែលយើងមិនទាន់ដឹងច្បាស់ថា តើការផ្អាកដំណើរការរបស់រដ្ឋាភិបាលអាមេរិកនេះអាចដល់ពេលណា។ ក្នុងករណីធម្មតាបំផុត ការបិទនេះមិនគួរត្រូវបានពន្យារពេលទៀតទេ ព្រោះថាប្រសិនបើវានៅតែមានការផ្អាកដូច្នេះ វានឹងជះឥទ្ធិពលកាន់តែអាក្រក់ទៅកាន់សេដ្ឋកិច្ចពួកគេដូចជា ការបញ្ឈប់ការងារយ៉ាងច្រើន ឱនភាពថវិកា ការផ្អាកការចំណាយជំនួយ ការថយចុះនៃកំណើនសេដ្ឋកិច្ចជាដើម។

→ កត្តាទាំងនេះសុទ្ធតែរួមចំណែកធ្វើឱ្យតម្លៃមាសកើនឡើង។

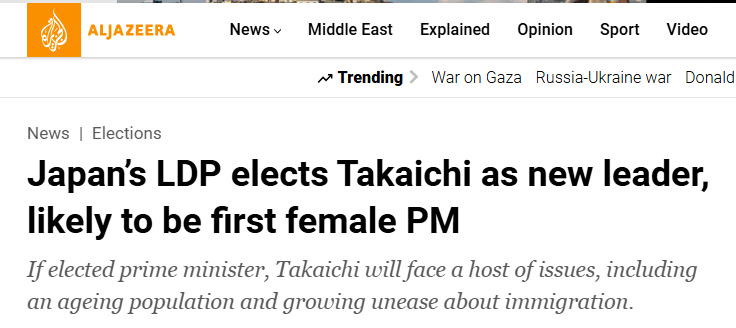

ក្រៅពីការសម្រេចចិត្តអត្រាប្រាក់របស់ធនាគារកណ្តាលអាមេរិកក្នុងខែនេះ ព្យាយាមតាមដានទៅលើការសម្រេចចិត្តអត្រាការប្រាក់របស់ធនាគារកណ្តាលផ្សេងទៀតដូចជាមកពីប្រទេសជប៉ុន កាណាដា និងអឺរ៉ុប។ ជាពិសេសនៅពេលដែលប្រទេសជប៉ុនទើបតែបោះឆ្នោតជ្រើសរើសនាយករដ្ឋមន្ត្រីថ្មីគឺលោកស្រី Sanae Takaichi ដែលមនុស្សជាច្រើនរំពឹងថានឹងឃើញការបន្ធូរបន្ថយគោលនយោបាយមួយចំនួនពីលោកស្រី។

ភាពតានតឹងភូមិសាស្ត្រនយោបាយ

ការពិភាក្សាបទឈប់បាញ់នៅអេហ្ស៊ីប៖ ភាពតានតឹងភូមិសាស្ត្រនាពេលបច្ចុប្បន្ននេះត្រូវបានកាត់បន្ថយ ដោយសារតែមានកិច្ចចរចាបទឈប់បាញ់នៅក្នុងប្រទេសអេហ្សុីបរវាងភាគី អុីស្រាអែល ក្រុមហាម៉ាស់ និងបេសកជនអាមេរិកលោក Steve Witkoff។ ជាក់ស្តែង ពួកគេបានបញ្ជូនសញ្ញាវិជ្ជមានមួយចំនួនទៅលើការចរចាមួយនេះ បើទោះបីជាពួកគេមិនទាន់ចេញសេចក្តីថ្លែងការណ៍ជាផ្លូវការពេញលេញក៏ដោយ។ យោងតាមប្រភព Al Jazeera បានឱ្យដឹងថា កិច្ចពិភាក្សានេះនឹងផ្តោតទៅលើការដោះលែងចំណាប់ខ្មាំងនៅសប្តាហ៍នេះ ខណៈពេលដែលនាយករដ្ឋមន្រ្តីអុីស្រាអែលលោក Netanyahu បានសន្យាថានឹងលុបបំបាត់ការគ្រប់គ្រងរបស់ក្រុម Hamas និង “ធានាថា Gaza នឹងមិនបង្កការគំរាមកំហែងដល់អុីស្រាអែលទៀតទេ”។ ទោះបីជាយ៉ាងណាក៏ដោយ ប្រភពខ្លះក៏បានរាយការណ៍ថា អុីស្រាអែលនៅតែបន្តបាញ់ប្រហារទៅកាន់ប៉ាឡេស្ទីន ចំពេលមានការចរចារ។

ការអភិវឌ្ឍន៍រុស្ស៊ី-អ៊ុយក្រែន៖ រុស្សីបន្តធ្វើកូដកម្មប្រឆាំងនឹងអ៊ុយក្រែន ដែលបង្កការខូចខាតយ៉ាងខ្លាំងទៅលើផលិតកម្មឧស្ម័នអ៊ុយក្រែន និងរោងចក្រថាមពលនុយក្លេអ៊ែរជាដើម។ សូម្បីតែប្រធានាធិបតីអាមេរិកលោក Donald Trump បានសន្និដ្ឋានថារុស្ស៊ីលែងចាប់អារម្មណ៍លើកិច្ចព្រមព្រៀងសន្តិភាពទៀតហើយ ពោលគឺរូបលោកនាពេលនេះកំពុងពិចារណាលើការផ្តល់នូវជំនួយ Tomahawk ដល់អ៊ុយក្រែន។ ពោលគឺនេះអាចចាត់ទុកថា ជាការដាក់សម្ពាធទៅលើការបញ្ចប់សង្គ្រាមរវាងប្រទេសអ៊ុយក្រែន និងរុស្សុី បើទោះបីជាមានការព្រមានរបស់លោកពូទីនក៏ដោយ។

→ ដរាបណាភាពតានតឹងក្នុងជម្លោះសង្រ្គាម និងបទឈប់បាញ់មិនអាចសម្រេចបាន នេះនឹងបន្តជួយឱ្យតម្លៃមាសឡើងថ្លៃ។

វិភាគបច្ចេកទេស

ទិដ្ឋភាពទីផ្សារ Gold — ខែតុលា ឆ្នាំ 2025

មាសបច្ចុប្បន្នស្ថិតនៅក្នុងតម្លៃ $4032.72 ដោយបន្តសម្ពាធទិញខ្លាំងក្នុងបរិបទនៃការបិទរដ្ឋាភិបាលសហរដ្ឋអាមេរិក។ តាមផ្ទាំងគំនូសបង្ហាញថា មានសម្ពាធទិញខ្លាំងចាប់តាំងពីម៉ោងអាស៊ី។

តំបន់បច្ចេកទេសសំខាន់ៗ

- តម្លៃបច្ចុប្បន្ន $4034.09 — កំពុងជួញដូរនៅលើពីតំបន់ធំៗនៃ resistance level ទាំងអស់ ដោយឡើង 7 សប្តាហ៍ជាប់ៗគ្នា។

- POC (Point of Control) សប្តាហ៍មុននៅតម្លៃ $3981.81 ៖ ជាតម្លៃដែលមានបរិមាណជួញដូរខ្ពស់បំផុតក្នុងសប្តាហ៍មុន ហើយនេះសំដៅ ទៅលើតំបន់ដែលអ្នកជួញដូរចូលចិត្តធ្វើការជួញដូរ។ នេះអាចចាត់ទុកថាជា Supportទី1។

- Volume Cluster នៅតម្លៃ $3773 — អាចដើរតួរនាទីជា Supportទី2។

យុទ្ធសាស្ត្រជួញដូរ

- ទិសដៅឡើង (Bullish Bias)៖ និន្នាការបច្ចុប្បន្ននៅតែមានលក្ខណៈឡើង ដោយបានឡើងជាប់គ្នា 7 សប្តាហ៍។ ទោះជាយ៉ាងណា ការឡើងយូរនេះអាច បង្កើនឱកាសនៃការថយចុះក្នុងរយៈពេលខ្លី។ អ្នកដែលកំពុងស្វែងរក ឱកាសទិញគួរតែប្រុងប្រយ័ត្ន ព្រោះឱកាសនៃការបន្តឡើងអាចមានកម្រិតទាបជាងមុន។

- សេណារីយ៉ូ Pullback៖ ក្នុងករណីមានកិច្ចព្រមព្រៀងឈប់បាញ់រវាងរុស្ស៊ី និងអ៊ុយក្រែន ហើយតម្លៃបំបែកចុះក្រោម POC របស់ម្សិលមិញនៅ $3982 ទីផ្សារអាចនឹងធ្លាក់ទៅរក តំបន់ Volume Cluster នៅ $3773។

|English Version|

Monthly Report in October, 2025

Executive Summary

This report provides an analysis of the primary factors influencing gold prices, offering insights for investors.

***All information presented is for educational purposes only and should not be interpreted as financial advice or a recommendation for trading or investment decisions.

Fundamental Analysis

Previous Recap of the Whole Economy: Last month, the Federal Reserve reduced the interest rate further, despite having concerns about the dual mandate. One is the labor fragility, and another one is the inflation problem, which many still consider to what extent one of those have the most weight on the economic growth before making any decision? Regardless, we are still seeing some improvement in the GDP in the second quarter, while the consumer spending is still resilient, possibly due to the “back-to-school shopping,” as per a Bloomberg source. Other than that, there are other factors contributing as well, such as the geopolitical tensions, trade war, US government shutdown, etc. With these reasons, the gold prices have climbed by more than 11% this month.

Forward-Looking

So, now, before another interest rate decision in October comes into place, what are the factors to consider?

US economy: Economic indicator-wise, we are considering two main data points, such as the employment situation report, which has been delayed to October 10, 2025 (likely to be further delayed) due to the US government shutdown, and inflation data on October 15.

So if both data are showing softening—meaning labor is weakening and inflation is also declining—all of these will likely support a rate cut bet this month, and the FED will have no choice but to deliver a more dovish tone to the market.

But if not, let’s say labor is weak, but the inflation is persistent, then the market will put more pressure on the inflation data, just like how it did in the September rate cut. This could also mean a hawkish rate cut, which would make the FED less confident in the next decision.

Below is the interest rate cut projection in accordance with the CME Fedwatch Tool, which many still project to see two more before the year’s end.

Especially, we are still unsure about the extent of the US shutdown. In the most normal case, this shutdown should not be delayed any further, as the further it goes on, the worse it will be, such as massive layoffs, budget deficits, aid expense halts, weakening economic growth, etc.

→ In other terms, the factor contributes to the gold price surge.

Aside from the Federal Reserve rate decision this month, also focus on the rate decisions from other central banks in Japan, Canada, and Europe. Especially when Japan just elected a new prime minister, Sanae Takaichi, who many expect to see some stimulus coming from her.

The Geopolitical Tension

Egypt ceasefire: The current tension has become less intense as the ongoing ceasefire talks that have taken place in Egypt between Israel, Hamas, and the US envoy Steve Witkoff have been sending a positive outlook on the negotiation, albeit nothing is fully disclosed yet. The focus will fall on the release of hostages this week, while Israeli Prime Minister Netanyahu pledged to eliminate Hamas’ rule and “ensure Gaza won’t pose a threat to Israel,” according to the Al Jazeera source. Regardless, some sources also reported that Israel continues to shoot down and injure the Palestinians amid the negotiation talks.

Russia-Ukraine Development: Russia continues to strike against Ukraine, causing significant damage to Ukrainian gas production and Nuclear Power Plant facilities. Even US President Donald Trump came to the conclusion that Russia is no longer interested in a peace deal, which is now considering supplying Tomahawk to Ukraine, putting pressure to end this conflict, despite Putin’s warning.

→ As long as the tension in the war conflict and the ceasefire are unable to be reached, this will continue to support the gold price going up.

Technical Analysis

Gold Market Overview — September 2025

Gold is currently trading at $4032.72, continuing its bullish momentum amid the US government shutdown. The chart reveals a strong buying pressure since the Asian session.

Key Technical Zones

- Current Price: $3,646.09 — Trading above all major resistance zones with 7 weeks straight up.

- Last Week Point of Control (POC) at 3981.81: Highest volume level from last week, indicating where market participants found the most value act as first support level.

- Last Week Volume Cluster at $3,773.00 — A high-volume “fair value” zone from last week, can act as a second support level.

Trading Strategy

- Bullish Bias: The current trend remains bullish, having climbed for seven consecutive weeks. However, the extended rally increases the likelihood of a short-term correction. Traders looking for long opportunities should be cautious, as the probability of continuation may be lower at this stage.

- Pullback Scenario: if cease fire agreement between Russia and Ukraine is agreed and price breaks below yesterday’s Point of Control 3982 the market could retest volume cluster area at 3773.