Bullish Engulfing and Bearish Engulfing

អ្វីទៅជា Bullish Engulfing?

និយមន័យ

ទម្រង់ Bullish Engulfing គឺជាសញ្ញានៃការប្តូរទិសពីលំហូរចុះមកឡើងវិញ ដែលភាគច្រើនវាបង្ហាញនៅចុងនៃលំហូរចុះ។

រូបរាង

លក្ខណៈសម្គាល់

គំរូ Bullish Engulfingមាន២ខេនដល ដែលខេនដលទីមួយពណ៌ក្រហម(តម្លៃបិទទាបជាងតម្លៃបើកផ្សារ) និង ខេនដលទី២ ពណ៌បៃតង(តម្លៃបិទផ្សារខ្ពស់ជាងតម្លៃបើកផ្សារ) ដែលខេនដលទី២ក្តោមពីលើខេនដលទី១ វាបង្ហាញថាអ្នកទិញចូលមកគ្រប់គ្រងនៅក្នុងទីផ្សារ។ នៅក្នុងលំហូរចុះតម្លៃព្យាយាមបុកបំបែកទៅតំបន់ដែលទាបជាងមុន ប៉ុន្តែវាបានបង្កើតជាទម្រង់ Bullish Engulfing វាជាសញ្ញានៃកាវិលត្រឡប់នៃលំហូរចុះ។

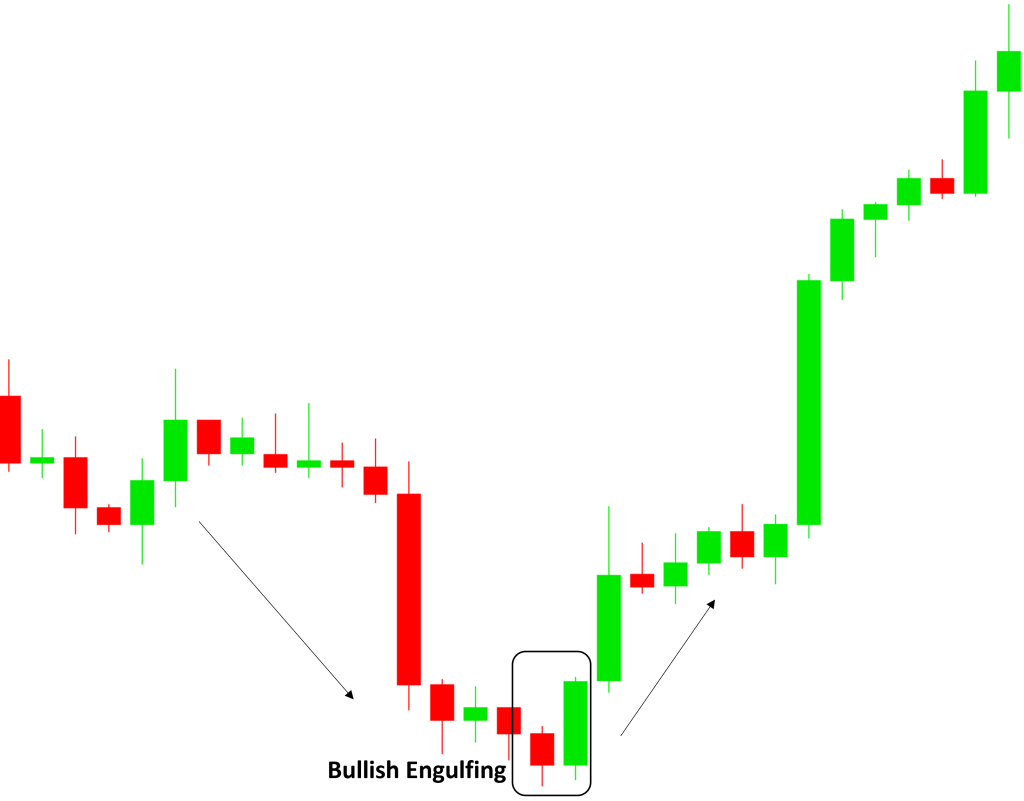

ឧទារហរណ៍

នៅខាងចុងនៃលំហូចុះ បង្កើតបានជាទម្រង់ Bullish Engulfing

ទម្រង់ Bullish engulfing ត្រូវបានបង្កើតឡើងនៅពេលដែលទីផ្សារបើកមកនៅទាបជាងតម្លៃបិទកាលពីម្សិលមិញប៉ុន្តែអ្នកទិញក៏បានឃើញអ្នកទិញចូលមកក្នុងទីផ្សារហើយរុញតម្លៃអោយឡើងទៅលើ ហើយបិទនៅលើតម្លៃបើកកាលពីម្សិលមិញ។ ទម្រង់ Bullish Engulfing កំណត់ប្រាប់យើងថាមានការផ្លាស់ប្តូរ ពីសន្ទស្សន៍អារម្មណ៍របស់អ្នកលក់ទៅជាមានសន្ទស្សន្ទអារម្មណ៍អ្នកទិញចូលមកគ្រប់គ្រងទីផ្សារ ហើយវាជាពេលវេលាល្អក្នុងការរកឱកាសដើម្បីរកតម្លៃចូលទិញ។

យោងតាមការសិក្សាអំពី “Technical Analysis and Candlestick Patterns” ដែលធ្វើឡើងដោយ សកលវិទ្យាល័យនៃ Michiganនៅក្នុងឆ្នាំ 2018 ទម្រង់engulfing pattern មានអត្រាជោគជ័យប្រហែល 65% ក្នុងការព្យាករណ៍ថាតម្លៃនៅពេលខាងមុនហ្នឹងមានការកើនឡើង។ ការសិក្សានេះគូសបញ្ជាក់អំពីប្រសិទ្ធភាពនៃការប្រើប្រាស់ប្រវត្តិទិន្នន័យតម្លៃ និងទម្រង់ខេនដល ដូចជាទម្រង់ bullish engulfing ដើម្បីវាស់ស្ទង់អារម្មណ៍ទីផ្សារ និងធ្វើការសម្រេចចិត្តក្នុងការជួញដូរដែលមានប្រសិទ្ធភាពជាងមុន។

អ្វីទៅជា Bearish Engulfing?

និយមន័យ

គំរូ Bearish Engulfing គឺជាសញ្ញានៃការផ្លាស់ប្តូរទិសរបស់លំហូរឡើង ដែលភាគច្រើនវាបង្ហាញនៅចុងនៃលំហូរឡើង។

រូបរាង

លក្ខណៈសម្គាល់

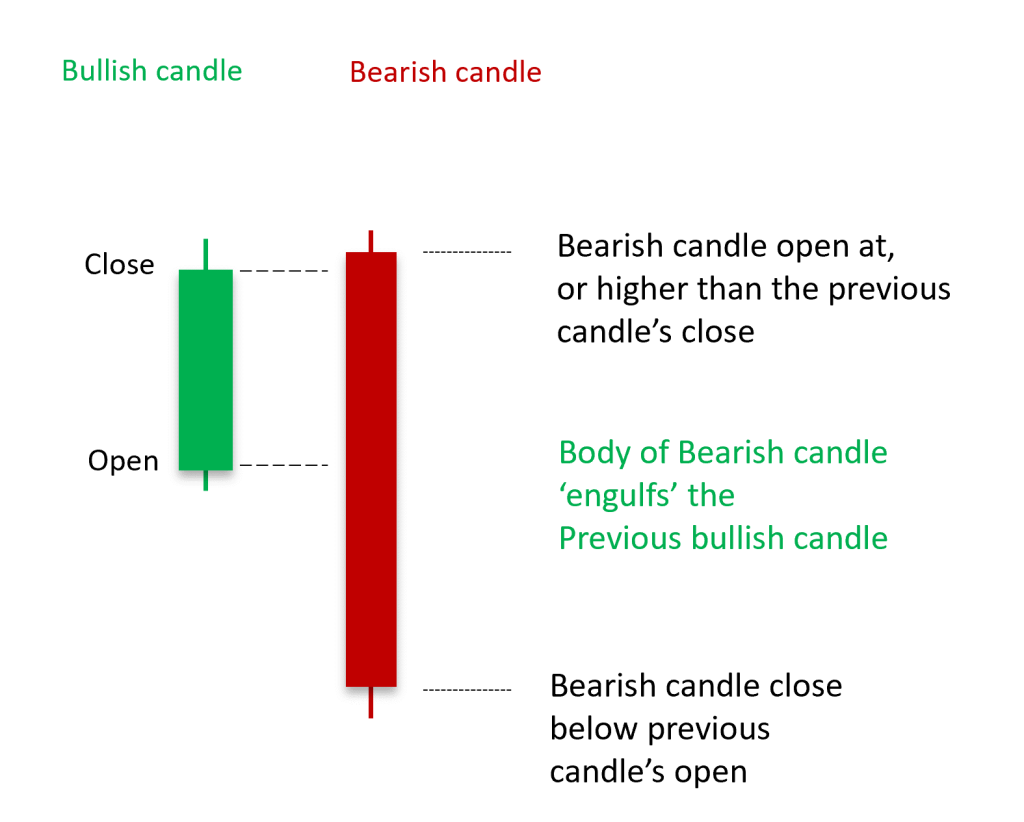

គំរូ Bearish Engulfing មាន២ខេនដល ដែល ខេនដលទីមួយពណ៌បៃតង(តម្លៃបិទផ្សារខ្ពស់ជាងតម្លៃបើកផ្សារ) និង ខេនដលទី២ពណ៌ក្រហម(តម្លៃបិទទាបជាងតម្លៃបើកផ្សារ) ដែលខេនដលទី២ក្តោមពីលើខេនដលទី១ វាបង្ហាញថាអ្នកលក់ចូលមកគ្រប់គ្រងទីផ្សារ។ នៅក្នុងលំហូរឡើង ទីផ្សារបានព្យាយាមបុកបំបែកទៅតំបន់ដែលខ្ពស់ជាងមុន ប៉ុន្តែវាបានបង្កើតជាទម្រង់ Bearish Engulfing នេះជាសញ្ញានៃកាវិលត្រឡប់នៃលំហូរ។

ឧទារហរណ៍

នៅខាងចុងនៃលំហូរឡើងវាបង្កើតបានជាទម្រង់ Bearish Engulfing

ទម្រង់ Bearish Engulfing មានខេនដលពីរ៖ ទីមួយគឺជាខេនដលដែលមានសន្ទុះតូចជាង ហើយទីពីរគឺជាខេនដលដែលមានទំហំធំជាងដែលគ្រប់ដណ្តប់ពេញតួនៃទៀនទីមួយ។ ការបង្កើតនេះបង្ហាញពីការផ្លាស់ប្តូរសន្ទុះពីអ្នកទិញទៅអ្នកលក់។

យោងតាមការសិក្សាដែលធ្វើឡើងដោយ Technical Analysis Research & Education (TARE) Foundation ដែលបានបោះពុម្ពផ្សាយនៅក្នុងរបាយការណ៍របស់ពួកគេដែលមានចំណងជើងថា “Analyzing the Efficacy of Candlestick Patterns in Modern Markets,” ទម្រង់ Bearish Engulfing មានអត្រាជោគជ័យប្រហែល 72% ក្នុងការព្យាករណ៍ថាហ្នឹងមានការប្តូរទិសពីឡើងមកចុះ។

(English Version)

What is the Bullish Engulfing Pattern?

Definition

A Bullish Engulfing pattern is a bullish reversal pattern that typically appears at the end of a downtrend.

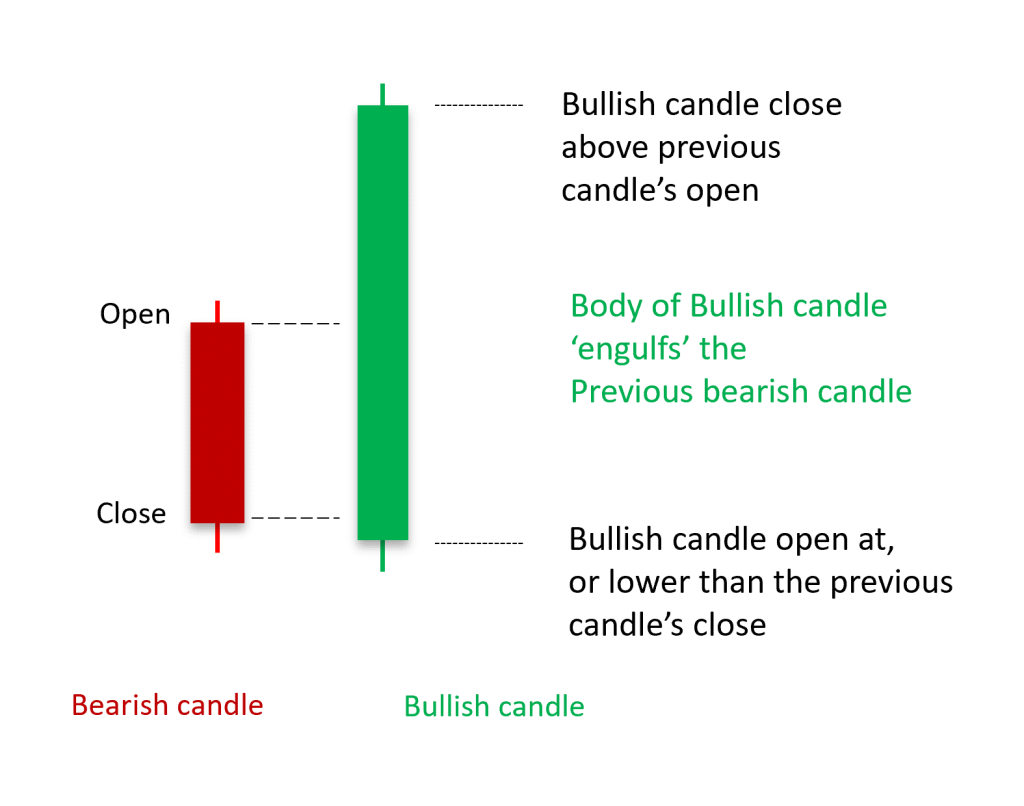

Appearance

Characteristics

The Bullish Engulfing pattern contains two candlesticks, the first candlestick is bearish, andthe second candlestick is bullish engulfing the first candlestick, indicating buyer take control in the market. During a downtrend, prices attempt to break into lower regions, but the formation of a Bullish Engulfing pattern signals a potential reversal.

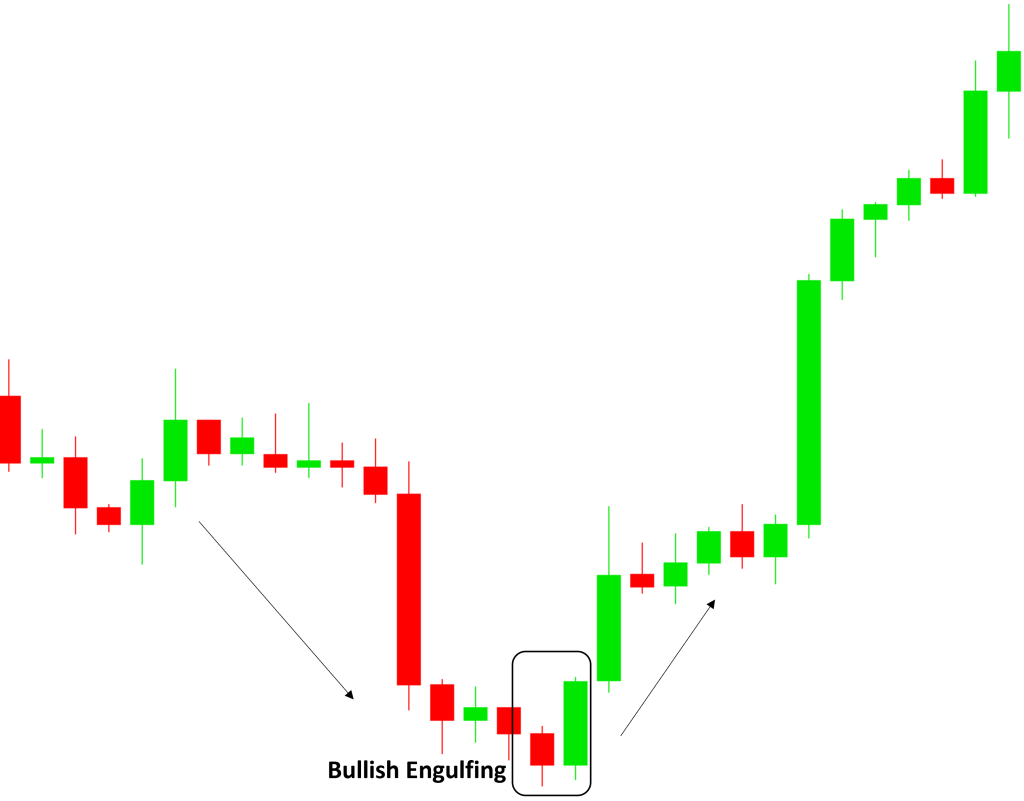

Example

Look for the pattern at the end of a downtrend, where a larger bullish candle engulfs the previous bearish candle.

The bullish engulfing candlestick pattern is formed when the market opens lower than the previous day’s close, but then buyers step in and push the price higher, closing above the previous day’s open. The bullish engulfing candlestick pattern marks a clear transition from bearish to bullish market sentiment and an opportunity to take long positions.

According to the “Technical Analysis and Candlestick Patterns” study conducted by the University of Michigan in 2018, the bullish engulfing pattern has a success rate of approximately 65% in predicting future price increases. This study underscores the effectiveness of using historical price data and candlestick patterns, such as the bullish engulfing pattern, to gauge market sentiment and make informed trading decisions.

What is the Bearish Engulfing Pattern?

Definition

A Bearish Engulfing pattern is a bearish reversal pattern that typically appears at the end of an uptrend.

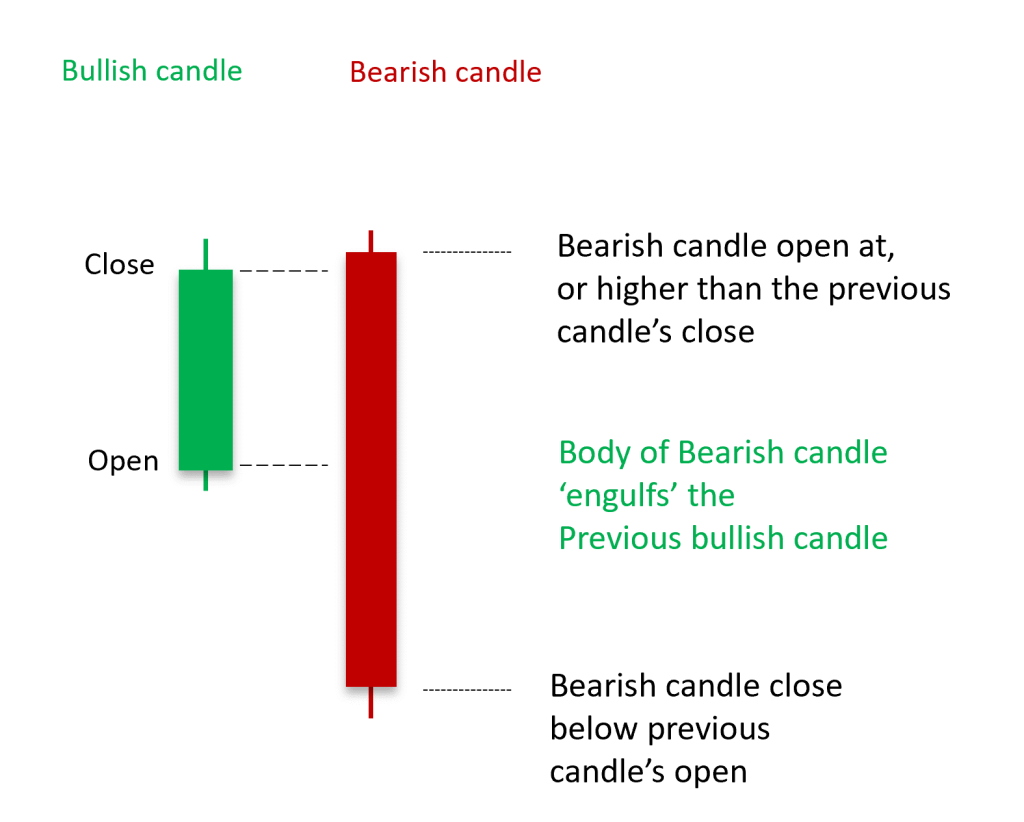

Appearance

Characteristics

The Bearish Engulfing pattern contains two candlestick, first candlestick is bullish and second candlestick is bearish engulfs the first candlestick indicates a shift from buyer control to seller control. During an uptrend, prices attempt to break into higher regions, but the formation of a Bearish Engulfing pattern signals a potential reversal.

Example:

Look for the pattern at the end of an uptrend, where a larger bearish candle engulfs the previous bullish candle.

The Bearish Engulfing pattern consists of two candles: the first is a smaller bullish candle, and the second is a larger bearish candle that completely engulfs the body of the first candle. This formation suggests a shift in momentum from buyers to sellers.

According to a study conducted by the Technical Analysis Research & Education (TARE) Foundation, published in their report titled “Analyzing the Efficacy of Candlestick Patterns in Modern Markets,” the bearish engulfing pattern has a success rate of approximately 72% in predicting bearish reversals.