ព័ត៌មានដែលសំខាន់ហើយជះឥទ្ធិពលទៅលើបម្រែបម្រួលតម្លៃកាលពីម្សិលមិញ គឺទាក់ទងនឹងសុន្ទរកថារបស់ធនាគារកណ្តាលអាមេរិក សេតវិមាន និងប្រតិកម្មរបស់ទីផ្សារបន្ទាប់ពីការបិទទ្វាររបស់សហរដ្ឋអាមេរិកបានបញ្ចប់។

ធនាគារកណ្តាលអាមេរិក និង IMF

សមាជិកធនាគារកណ្តាលអាមេរិកជាច្រើនឥឡូវនេះកំពុងបង្កើនការសង្ស័យលើការកាត់បន្ថយអត្រាការប្រាក់នៅក្នុងខែធ្នូ ដែលទាំងអស់នេះបណ្តាលមកពីបញ្ហាអតិផរណា ទោះបីជាមានការព្យាករណ៍ពីភាពទន់ខ្សោយមួយចំនួននៅក្នុងស្ថានភាពទីផ្សារការងារក៏ដោយ។ មន្ត្រីធនាគារកណ្តាលអាមេរិកលោក Daly និង Hammack បានសង្កត់ធ្ងន់ថា អតិផរណានៅតែមានកម្រិតខ្ពស់ពេក ហើយធនាគារកណ្តាល “នៅតែមានការងារត្រូវធ្វើបន្ថែមទៀត (ដែលសំដៅទៅលើការផ្លាស់ប្តូរគោលនយោបាយរូបិយវត្ថុ)” ដើម្បីឈានដល់គោលដៅអត្រាអតិផរណា 2%។ លើសពីនេះ IMF បានព្រមានអំពីហានិភ័យការកើនឡើងនៃអត្រាអតិផរណា ដែលបណ្តាលមកពីបញ្ហាពន្ធ បើទោះបីជាអតិផរណាកំពុងមានទិសដៅទៅរក 2%ក៏ដោយ។

ដូច្នេះ វាមិនទាន់ដល់ពេលទេក្នុងការកាត់បន្ថយអត្រាការប្រាក់ខែធ្នូ ដោយលោក Daly បានសង្កត់ធ្ងន់លើការរង់ចាំទិន្នន័យ ឬព័ត៌មានបន្ថែម ខណៈពេលដែល IMF បានកត់សម្គាល់ថាកង្វះទិន្នន័យបានធ្វើឱ្យស្មុគស្មាញដល់ការវាយតម្លៃសេដ្ឋកិច្ចរបស់ពួកគេ។

សេតវិមាន

ទន្ទឹមនឹងនេះ ទីប្រឹក្សាជាន់ខ្ពស់របស់សេតវិមាន លោក Kevin Hassett មិនយល់ស្របលើគំនិតនៃការរក្សាអត្រាការប្រាក់នោះទេ ទោះបីជាមានការព្រមានអំពីការព្យាករណ៍បាត់បង់ការងារចំនួន 60,000 ដោយសារតែការបិទទ្វារពីមុនក៏ដោយ។ លោកក៏បានបង្ហើបពីការចេញផ្សាយរបាយការណ៍ការងារខែកញ្ញានៅសប្តាហ៍ក្រោយ ខណៈពេលដែលបានបង្ហាញថា ទិន្នន័យអតិផរណា (CPI) បច្ចុប្បន្ននៅតែស្របនឹងលទ្ធភាពនៃការកាត់បន្ថយអត្រាការប្រាក់បន្ថែមទៀត។

ប្រតិកម្មទីផ្សារ

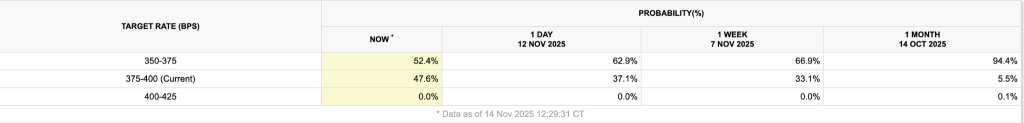

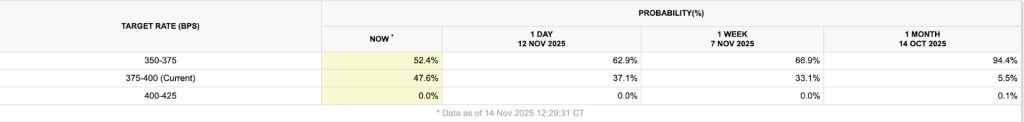

ដូច្នេះឥឡូវនេះ លទ្ធភាពនៃការសម្រេចចិត្តកាត់បន្ថយអត្រាការប្រាក់របស់ធនាគារកណ្តាលអាមេរិកក្នុងខែធ្នូនៅតែទាបជាង 55% នៅពេលនេះ ដោយពាក់កណ្តាលទៀតគាំទ្រទៅលើការរក្សាអត្រាការប្រាក់។

→ រក្សាអត្រាការប្រាក់ ឬថយចុះប្រូបាប៊ីលីតេនៃការកាត់បន្ថយអត្រាការប្រាក់ + ការបិទទ្វាររបស់សហរដ្ឋអាមេរិកបានបញ្ចប់ → រុញតម្លៃមាសឱ្យធ្លាក់ចុះ។

|English Version|

The most important part of yesterday’s price movement is the result of these events, particularly in the Federal Reserve, the White House, and the market after the US shutdown ended.

The Federal Reserve and IMF

Several FED members are now raising doubts over the interest rate cut in December, which all comes down to the inflation problem, despite some projected weakness in labor market conditions. Fed officials Daly and Hammack emphasized that inflation is still too high and that the central bank “still has work to do” to reach the 2% target. Furthermore, the IMF agrees inflation is on the path to 2% but warns of upside risks from factors like tariffs.

Therefore, it is premature to make a definitive call on a December rate cut, with Daly stressing the “premium on waiting” for more information, while the IMF noted that the lack of data has complicated their assessment of the economy.

The Whitehouse

Meanwhile, the White House Senior Advisor Kevin Hassett disagreed on the idea of holding the interest rate, despite the warning of a 60,000 job loss projection due to the prior shutdown. With that being said, he also hinted at releasing the September job report next week while suggesting that the current CPI number still aligns with the possibility of more rate cuts.

The Market Reaction

So now, the FED Fund rate cut decision in December remained below 55% this time, with the other half standing for holding the rate.

→ Holding rate or receding the rate cut probability + US shutdown ended → push down the gold prices.