កត្តាដែលជំរុញឱ្យតម្លៃមាសធ្លាក់ចុះនាពេលថ្មីៗនេះ៖

កត្តាទី 1៖ ធនាគារកណ្តាលអាមេរិក (FED)

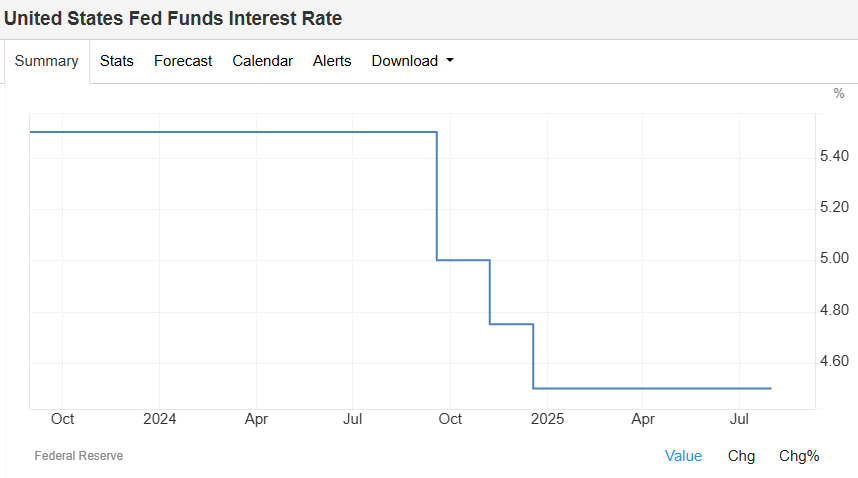

ធនាគារកណ្តាលអាមេរិក (FED) បានផ្តល់សេចក្តីថ្លែងការណ៍បែប hawkish មួយ បន្ទាប់ពីពួកគេរក្សាអត្រាការប្រាក់នៅក្នុងកម្រិតដដែលគឺ 4.5% ចាប់តាំងពីខែធ្នូ ឆ្នាំ 2024 មកម្លេះ។ ក្រៅពីនេះ ពួកគេក៏មិនបានផ្តល់នូវព័ត៌មានបន្ថែមទៀតទាក់ទងនឹងការសម្រេចចិត្តលើអត្រាការប្រាក់នាកិច្ចប្រជុំបន្ទាប់ដែរ។ ជាក់ស្តែង ពួកគេបានរាយការណ៍អំពីភាពរឹងមាំនៃស្ថានភាពសេដ្ឋកិច្ច និងទីផ្សារការងារ ស្របពេលដែលអត្រាអតិផរណានៅតែល្អប្រសើរ ហើយអាចរងផលប៉ះពាល់ដោយពន្ធគយខ្ពស់។ សរុបមក ភាពមិនប្រាកដប្រជាមួយចំនួននៅតែមាន ដែលអាចជំរុញឱ្យពួកគេរក្សាអត្រាការប្រាក់បន្ថែមទៀត។ សូម្បីតែឧបករណ៍ CME Fedwatch ក៏បានបង្ហាញថា ទីផ្សារ 50% នៅតែអាចរក្សាអត្រាការប្រាក់នាកិច្ចប្រជុំបន្ទាប់។

កត្តាទី 2៖ ការអភិវឌ្ឍន៍ពន្ធរបស់ Trump

សេតវិមានបានចេញផ្សាយអត្រាពន្ធម្តងទៀត ដែលនឹងចូលជាធរមានក្នុងរយៈពេលប្រាំពីរថ្ងៃបន្ទាប់នៅម៉ោង 12:01 ព្រឹក ម៉ោងនៅទីក្រុងវ៉ាស៊ីនតោន។ ពោលគឺពួកគេនឹងដាក់ពន្ធអប្បបរមា 10% ជាសកល និង 15% ឬខ្ពស់ជាងនេះសម្រាប់ប្រទេសដែលមានអតិរេកពាណិជ្ជកម្មជាមួយសហរដ្ឋអាមេរិក។ ទន្ទឹមនឹងនេះ ពន្ធគយរបស់ប្រទេសកាណាដាត្រូវបានដំឡើងពី 25% ទៅ 35% ហើយពន្ធគយរបស់ម៉ិកស៊ិកនឹងត្រូវបានពន្យាររយៈពេល 90 ថ្ងៃ។

ជាងនេះទៅទៀត ការនាំចូលទំនិញឱសថ សារធាតុ semiconductors សារធាតុរ៉ែសំខាន់ៗ និងផលិតផលឧស្សាហកម្មសំខាន់ៗផ្សេងទៀត ត្រូវបានគេរំពឹងថានឹងចេញផ្សាយក្នុងប៉ុន្មានសប្តាហ៍ខាងមុខនេះ។

ទាំងអស់នេះកំពុងបញ្ជូនសញ្ញាចម្រុះសម្រាប់អ្នករាល់គ្នា ដោយបង្កើនការសង្ស័យថាតើការអភិវឌ្ឍបន្ថែមទៀតនឹងបន្ថយការព្រួយបារម្ភ ឬបន្ថែមភាពតានតឹងពន្ធគយបន្ថែមទៀត។

កត្តាទី 3៖ របាយការណ៍ប្រាក់ចំណូលពីភាគហ៊ុនធំៗ

ក្រុមហ៊ុន Meta Platforms និង Microsoft បានប្រកាសពីប្រាក់ចំណូលដ៏ច្រើន ខណៈពេលដែលពួកគេក៏បានប្រកាសអំពីការចំណាយកាន់តែច្រើនចូលទៅក្នុង CAPEX—ពោលគឺភាគច្រើនការចំណាយទៅលើ AI។ នេះបានជំរុញឱ្យមានទស្សន៍វិស័យកាន់តែល្អប្រសើរចំពោះវិស័យបច្ចេកវិទ្យា ព្រមទាំងជំរុញឱ្យតម្លៃភាគហ៊ុនរបស់ពួកគេកើនឡើងថែមទៀតផង។

Morgan Stanley បានព្យាករណ៍ថា ពួកគេអាចនឹងចំណាយ 2.9 ទ្រីលានដុល្លារលើបន្ទះឈីប ម៉ាស៊ីនមេ និងហេដ្ឋារចនាសម្ព័ន្ធមជ្ឈមណ្ឌលទិន្នន័យចាប់ពីឆ្នាំ 2025 ដល់ឆ្នាំ 2028 ស្របពេលដែលធនាគារមួយចំនួនបានលើកឡើងថា ការវិនិយោគនេះនឹងរួមចំណែកប្រហែល 0.5% នៃកំណើនផលិតផលក្នុងស្រុកសរុបនៅសហរដ្ឋអាមេរិកនៅឆ្នាំនេះ និងឆ្នាំក្រោយ។

→ ទីផ្សារភាគហ៊ុនវិជ្ជមាន → តម្លៃប្រាក់ដុល្លារអាចនឹងកើនឡើង និងតម្លៃមាសអាចនឹងធ្លាក់ចុះ។

*** មតិ៖ ហានិភ័យធំគឺថាតើការវិនិយោគដ៏ធំនេះអាចនឹងចេញផ្សាយដូចការរំពឹងទុកដែរ ឬទេ។ ដូច្នេះ សូមប្រយ័ត្នចំពោះ AI boom/AI bubble។***

ទិន្នន័យទន្ទឹងរង់ចាំ៖

របាយការណ៍ការងារនៅយប់នេះ រួមមានបញ្ជីប្រាក់បៀវត្សរ៍មិនមែនកសិកម្ម (NFP) អត្រាគ្មានការងារធ្វើ និងប្រាក់ចំណូលជាមធ្យមក្នុងមួយម៉ោង។

NFP ខ្ពស់ + ប្រាក់ចំណូលជាមធ្យមខ្ពស់ + អត្រាគ្មានការងារធ្វើទាប → ស្ថានភាពទីផ្សារការងារកាន់តែរឹងមាំ។ និងច្រាសមកវិញ។

ប្រសិនបើរបាយការណ៍បង្ហាញថា ស្ថានភាពទីផ្សារការងារកាន់តែរឹងមាំ នោះវានឹងនាំឱ្យ FED រក្សាអត្រាការប្រាក់ខ្ពស់បានយូរ ហើយតម្លៃមាសអាចនឹងបន្តចុះក្រោម។ និងច្រាសមកវិញ។

|English Version|

Factors that pushed the gold prices down recently:

Factor 1: The Federal Reserve (FED):

The FED delivered a hawkish statement after the interest rate was unchanged at 4.5% since December 2024, leaving no call for the next meeting decision. In fact, they reported on having strong economic growth and a solid labor market, while inflation is still persistent and may be affected by the high tariffs. All in all, several uncertainties remain unsolved, which lead to holding the interest rate further. The CME Fedwatch Tool stands at 50-50 chances in the next decision.

Factor 2: Trump’s tariff development:

The White House released its modified tariff rate, which will take effect in seven days at 12:01 a.m., Washington Time, and impose a 10% global minimum and 15% or higher duties for countries with trade surpluses with the US. Meanwhile, Canadian tariffs were raised from 25% to 35% and Mexican tariffs will be extended for 90 days.

Other than that, goods imports of pharmaceuticals, semiconductors, critical minerals, and other key industrial products are expected to be reported separately in the coming weeks.

All of these are sending a mixed signal for everyone, raising doubts on whether further development will diminish the concerns or add another phase of tariff tensions.

Factor 3: Earnings report from 7 magnificent stocks.

Meta Platforms and Microsoft posted strong earnings while announcing more spending will be pulled into CAPEX—aka, mostly to the AI expenses, which is enhancing tech sector sentiment and driving their stock prices up.

Morgan Stanley expects that $2.9 trillion will be spent on chips, servers, and data center infrastructure from 2025 to 2028, while other investment banks reported that all of these will likely contribute roughly 0.5% to U.S. GDP growth this year and next.

→ positive stock market → appreciate dollar value and depreciate the gold prices.

***Warning opinion: the big risk is whether this huge investment will be paid off later or not; beware of the AI boom/AI bubble.***

Looking Forward:

Tonight’s employment reports include the nonfarm payroll (NFP), unemployment rate, and average hourly earnings.

Higher NFP + High Average hourly earnings + Low unemployment rate → strong labor market conditions. And vice versa.

- If the report suggests stronger labor market conditions, then this will lead the FED to hold the interest rate high for longer and possibly lead to a depreciation of the gold price. And vice versa.