Understand Inverted Hammer Candlestick Patterns

តើអ្វីទៅជា Inverted Hammer Candlestick Pattern?

និយមន័យ

Inverted Hammer គឺជាប្រភេទនៃ Candle Stick ដែលបង្ហាញពីសញ្ញានៃការវិលត្រឡប់ទៅលំហូរឡើង ពោលគឺការផ្លាស់ប្តូរពីលំហូរចុះទៅលំហូរឡើង។ វាបានផ្តល់នូវសញ្ញាថា អាចនឹងមានលទ្ធភាពដែលតម្លៃអាចនឹងចាប់ផ្តើមកើនឡើង។

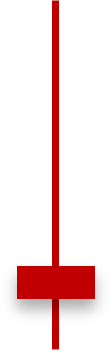

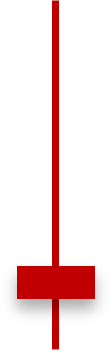

រូបរាង

លក្ខណៈសម្គាល់

Inverted hammer candlestick pattern គឺជាប្រភេទទានដាច់តែឯងមួយដែលតែងតែលេចឡើងបន្ទាប់ពីលំហូរចុះបានកើតឡើង។ វាមានលក្ខណៈស្រដៀងនឹងHammer Candlestick Pattern ប៉ុន្តែត្រឡប់ក្បាលចុះក្រោម។

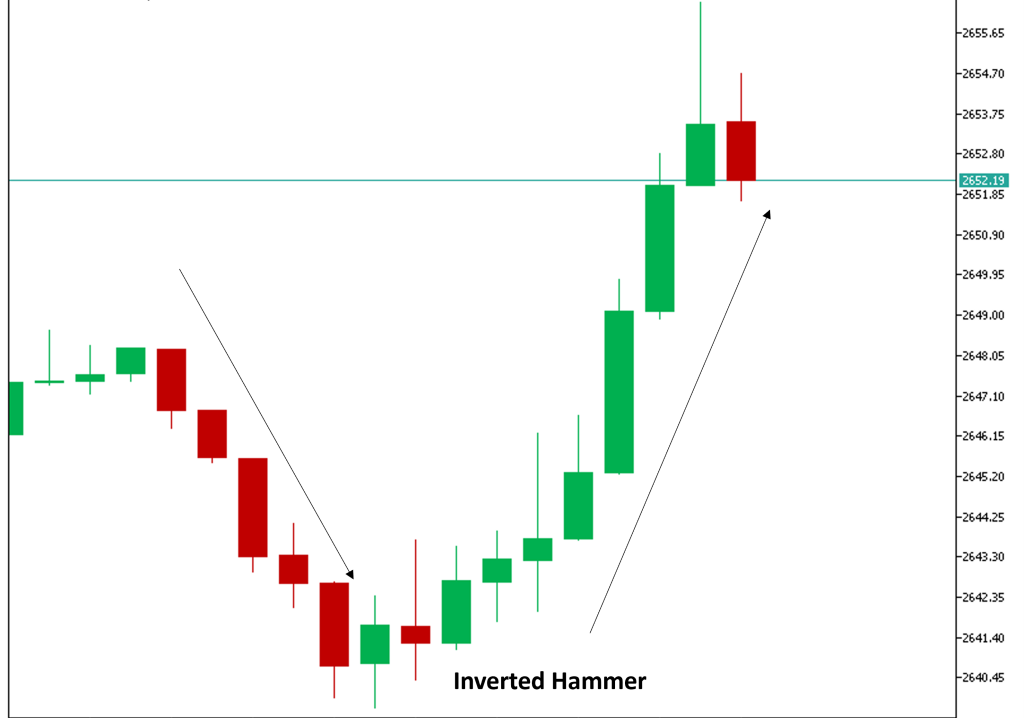

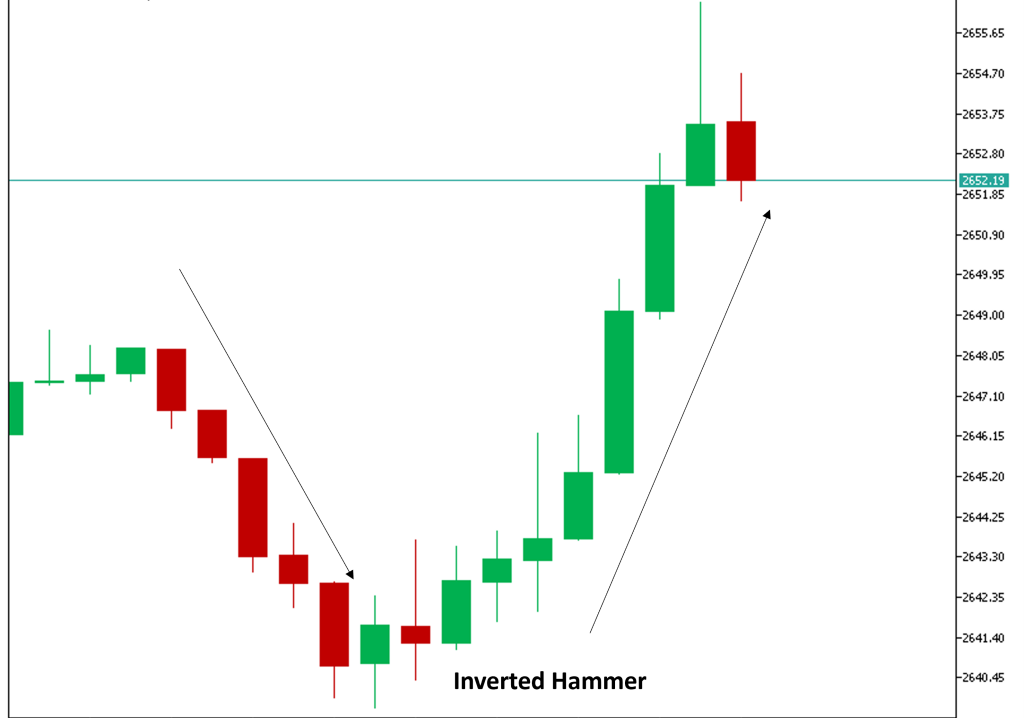

ឩទាហរណ៍

ស្រមោលខាងលើនៃInverted hammer បានបង្ហាញពីកម្លាំងអ្នកទិញចូលមកនៅអំឡុងពេលនោះ ហើយតម្លៃត្រឡប់ទៅកៀកកំរិតតម្លៃបើកវិញ។ ទម្រង់ទាននេះផ្តល់សញ្ញាអោយយើងបានដឹងថា អាចនឹងមានការផ្លាស់ប្តូរលំហូរ ដែលប្រាប់យើងថាកម្លាំងអ្នកទិញទំនងជាចុះខ្សោយ ហើយទីផ្សារអាចនឹងផ្លាស់ប្តូរពីលំហូរចុះមកលំហូរឡើងឆាប់ៗ។

នៅក្នុងការសិក្សារមួយធ្វើឡើងដោយ Corey Rosenbloom, CFA, បោះពុម្ភនៅលើវេបសាយ ” Afraid to Trade” inverted hammer pattern បានបង្ហាញពីអត្រាជោគជ័យប្រហែល65%នៅក្នុងការព្យាករណ៍ពីការប្តូរទិសពីចុះមកឡើងវិញ។ ការស្រាវជ្រាវរបស់ Rosenbloom បានវិភាគប្រវត្តិទិន្នន័យរបស់ទីផ្សារភាគហ៊ុនចេញពីទីផ្សារផ្សេងៗដើម្បីឈ្វេងយល់ពីលទ្ធភាព និងទម្រង់ទានដែលគួរឱ្យទុកចិត្តបានជាច្រើនក្នុងនោះមាន inverted hammerផងដែរ។

English Version

What is a Hammer Candlestick Pattern?

Definition

An inverted hammer candlestick pattern is a bullish reversal candlestick pattern that typically forms after a downtrend. It signals that a potential bottom is forming and that the price may start to rise.

Appearance

Characteristics

The inverted hammer candlestick pattern is a single-candle formation that usually appears after a downtrend. It resembles the hammer pattern but has an upside-down appearance.

Example

The long upper shadow of the inverted hammer indicates that bullish buying pressure surfaced during the session, driving the price back near the opening level. This pattern signals a potential reversal, suggesting that selling pressure may have weakened and the market could be ready for a trend reversal or bullish continuation.

In a study by Corey Rosenbloom, CFA, published on the website “Afraid to Trade,” the inverted hammer pattern demonstrated a success rate of around 65% in predicting bullish reversals. Rosenbloom’s research analyzed historical stock data from various markets to assess the performance and reliability of several candlestick patterns, including the inverted hammer.