Understanding Hammers and Shooting Stars in Forex Trading

នៅក្នុងវិស័យរូបិយប័ណ្ណអន្តរជាតិ ការឈ្វេងយល់ពីប្រភេទនៃ Candle Stick អាចនឹងជួយលោកអ្នកក្នុងការព្យាករណ៍ទៅលើបម្រែបម្រួលទីផ្សារ ព្រមទាំងធ្វើឱ្យការសម្រេចចិត្តជួញដូរកាន់តែប្រសើរជាងមុន។ ប្រភេទនៃ Candle Stick ដែលពេញនិយមជាងគេគឺ Hammer និង Shooting Star។ នៅក្នុងអត្ថបទខាងក្រោមនេះ លោកអ្នកនឹងឈ្វេងយល់ពីប្រភេទនៃ Candle Stick របៀបកំណត់អត្តសញ្ញាណ និងរបៀបប្រើប្រាស់វាឱ្យមានប្រសិទ្ធភាពក្នុងយុទ្ធសាស្រ្តជួញដូររបស់អ្នក។

តើអ្វីទៅជា Hammer?

និយមន័យ

Hammer គឺជាប្រភេទនៃ Candle Stick ដែលបង្ហាញពីសញ្ញានៃការវិលត្រឡប់ទៅលំហូរឡើង ពោលគឺការផ្លាស់ប្តូរពីលំហូរចុះទៅលំហូរឡើង។ វាបានផ្តល់នូវសញ្ញាថា អាចនឹងមានលទ្ធភាពដែលតម្លៃអាចនឹងចាប់ផ្តើមកើនឡើង។

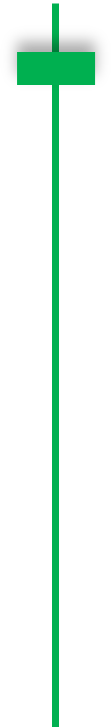

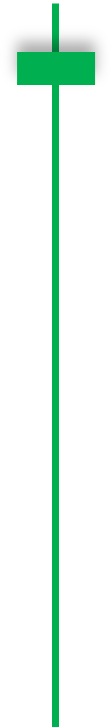

រូបរាង

លក្ខណៈសម្គាល់

នៅក្នុងលំហូរចុះ ប្រភេទ Hammer គឺចាប់ផ្តើមបង្កើតឡើងនៅពេលដែលតម្លៃព្យាយាមរុញចុះទៅក្រោមបន្តទៀត ប៉ុន្តែគួបផ្សំជាមួយនឹងចំនួនអ្នកទិញកាន់តែច្រើនដែលធ្វើឱ្យតម្លៃកើនឡើង។ ទាំងនេះបានបង្កើតជាទម្រង់ Hammer ដែលបង្ហាញថាចំនួនអ្នកទិញមានច្រើននៅក្នុងទីផ្សារ ហើយបម្រែបម្រួលអាចនឹងកើតមាន។

ការកំណត់អត្តសញ្ញាណ Hammer

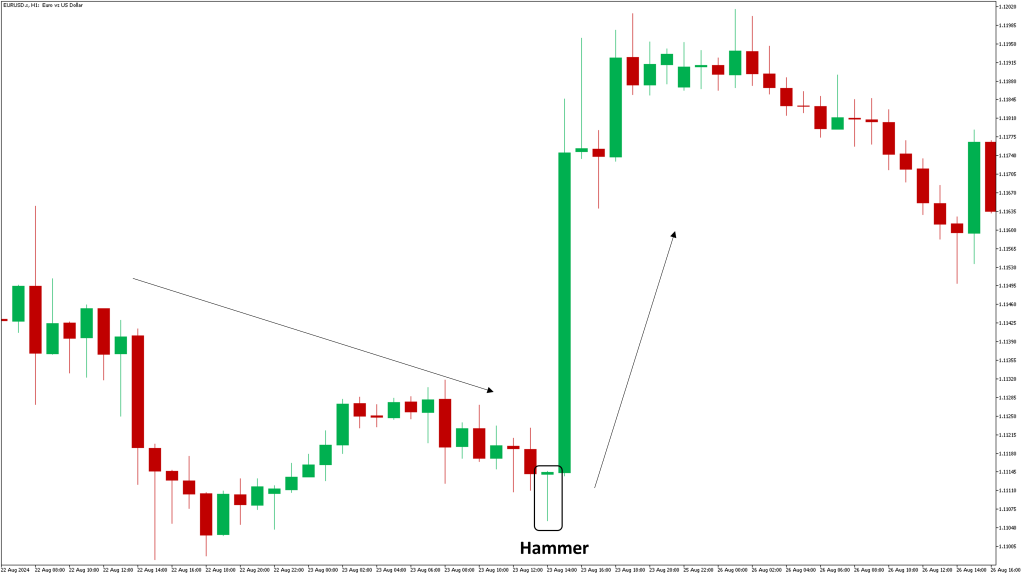

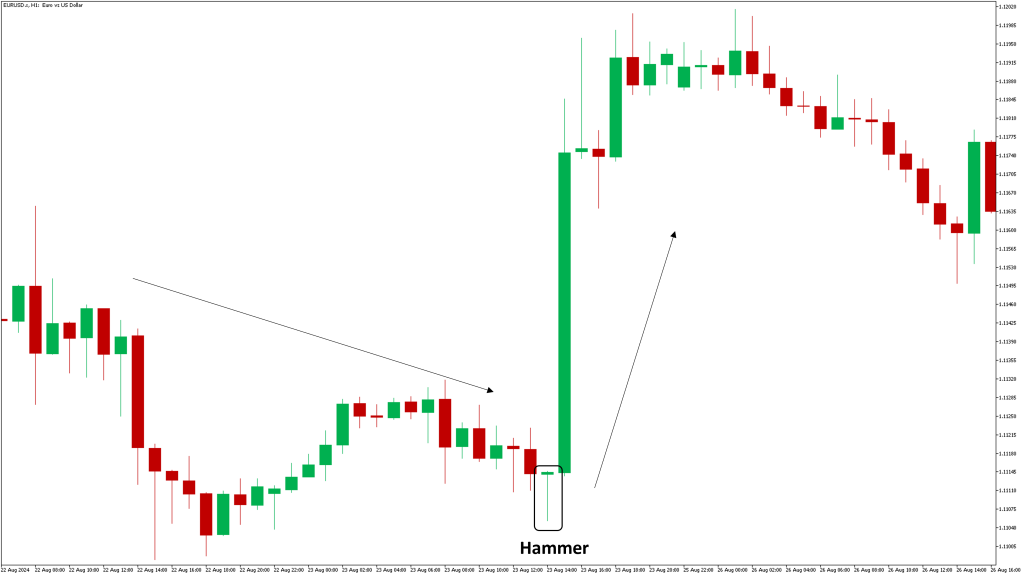

ឧទាហរណ៍

Hammer ចាប់ផ្តើមលេចឡើងបន្ទាប់ពីមានការធ្លាក់ចុះ ដែលបង្ហាញពីសញ្ញាបញ្ច្រាសនិន្នាការឬលទ្ធភាពដែលអាចមានបម្លាស់ប្តូរទិសដៅឡើងទៅលើ។

តើអ្វីទៅជា Shooting Star?

និយមន័យ

Shooting Star គឺជាប្រភេទនៃ Candle Stick ដែលបង្ហាញពីសញ្ញានៃការវិលត្រឡប់ទៅលំហូរចុះ ពោលគឺការផ្លាស់ប្តូរពីលំហូរឡើងទៅលំហូរចុះ។ វាបានផ្តល់នូវសញ្ញាថា អាចនឹងមានលទ្ធភាពដែលតម្លៃអាចនឹងចាប់ផ្តើមធ្លាក់ចុះ។

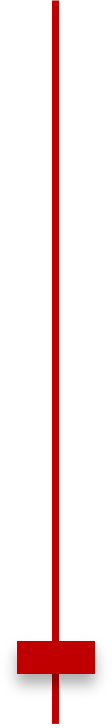

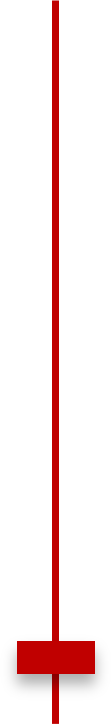

រូបរាង

លក្ខណៈសម្គាល់

ក្នុងទិសដៅកើនឡើង Shooting Star បានបង្កើតឡើងនៅពេលដែលតម្លៃព្យាយាមឡើងខ្ពស់ ប៉ុន្តែជាមួយនឹងចំនួនអ្នកទិញច្រើនដែលអាចធ្វើឱ្យតម្លៃបានធ្លាក់ចុះ នោះShooting Star ត្រូវបានបង្កើតឡើង។ ទាំងនេះបានសបញ្ជាក់ថា ចំនួនអ្នកទិញមានច្រើន ហើយការផ្លាស់ប្តូរទិសអាចនឹងកើតមានឡើង។

កំណត់អត្តសញ្ញាណ Shooting Star

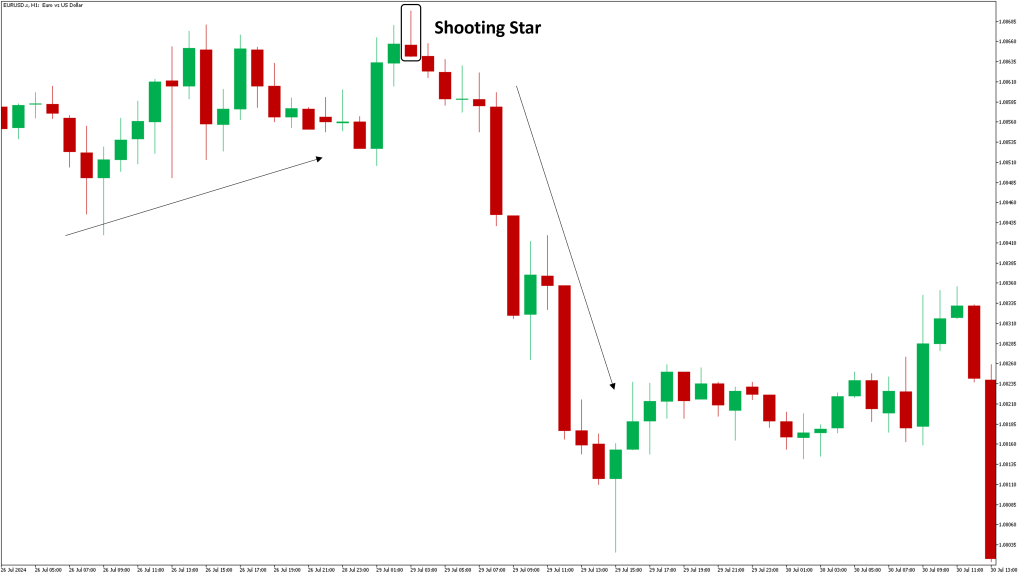

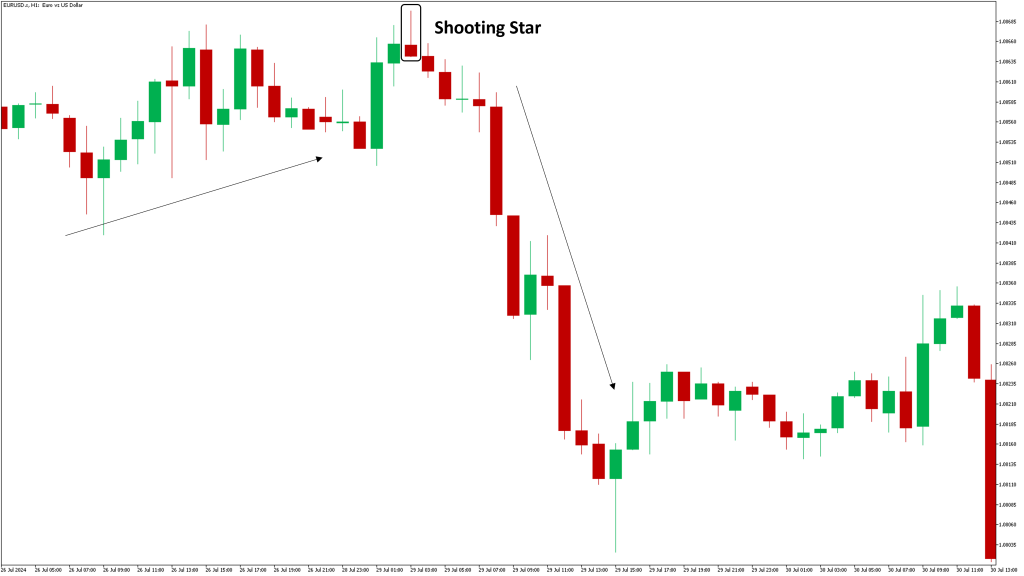

ឧទាហរណ៍

Shooting Star បានលេចចេញឡើងបន្ទាប់ពីមាននិន្នាការកើនឡើង បង្កើតឱ្យមានបម្រែបម្រួលខ្ពស់ដោយសារតែមានសញ្ញានៃការផ្លាស់ប្តូរទិសទៅក្រោម។

ការគ្រប់គ្រងហានិភ័យ

ធ្វើការវិភាគទៅលើការសម្រេចចិត្តការជួញដូររបស់លោកអ្នកដោយប្រុងប្រយ័ត្ន ដោយប្រើប្រាស់ទៅលើទំហំលើការជួញដូរ ព្រមទាំងកំណត់នៅតំបន់ Stop-loss ដើម្បីការពារទៅលើប្រាក់ទុនរបស់លោកអ្នក។

សេចក្តីសន្និដ្ឋាន

ការឈ្វេងយល់ ព្រមទាំងកំណត់អត្តសញ្ញាណឱ្យបានត្រឹមត្រូវទៅលើប្រភេទ Hammer និង Shooting Star អាចនឹងបង្កើនភាពជោគជ័យទៅលើយុទ្ធសាស្រ្តជួញដូររបស់អ្នកយ៉ាងខ្លាំង។ គំរូទាំងនេះផ្តល់នូវការយល់ដឹងដ៏មានតម្លៃចំពោះការផ្លាស់ប្តូរទិសដៅនៅក្នុងទីផ្សារ ប៉ុន្តែពួកគេក៏គប្បីប្រើប្រាស់ជាមួយនឹងសូចនាករផ្សេងទៀត និងវិធីសាស្រ្តក្នុងការកំណត់ហានិភ័យនោះដែរ។

(English Version)

In the dynamic world of Forex trading, understanding candlestick patterns can significantly enhance your ability to predict market movements and make more accurate trading decisions. Two of the most reliable reversal patterns are the hammer and the shooting star. In this blog post, we will explore what these patterns are, how to identify them, and how to use them effectively in your trading strategy.

What is a Hammer?

Definition

A hammer is a bullish reversal candlestick pattern that typically forms after a downtrend. It signals that a potential bottom is forming and that the price may start to rise.

Appearance

Characteristics

In a downtrend, a hammer forms when the price attempts to push lower but is met with strong buying pressure that drives the price back up, creating the hammer shape. This indicates that buyers are taking control of the market and a reversal may occur.

Identifying a Hammer on a Chart

Example

A hammer appears after a downtrend, signaling a potential trend reversal.

Appearance

What is a Shooting Star?

Definition

A shooting star is a bearish reversal candlestick pattern that typically forms after an uptrend. It signals that a potential top is forming and that the price may start to fall.

Appearance

Characteristics

In an uptrend, a shooting star forms when the price tries to push higher but is met with strong selling pressure that drives the price back down, creating the shooting star shape. This indicates that sellers are taking control of the market and a reversal may occur.

Identifying a Shooting Star on a Chart

Example

A shooting star appears after an uptrend, increasing its significance as a bearish reversal signal.

Appearance

Risk Management

Assess your trading decisions carefully. Use appropriate position sizing and manage trades using stop-loss orders to protect your capital.

Conclusion

Understanding and correctly identifying hammer and shooting star patterns can greatly enhance your trading strategy. These patterns provide valuable insights into potential market reversals, but they should be used in conjunction with other technical indicators and risk management practices.