Understanding the National Debt

ដូចទៅនឹងអ្វីដែលការខ្ចីប្រាក់របស់ប្រជាជនពីម្ចាស់បំណុល ឬធនាគារដែលការធ្វើបែបនេះនឹងបង្កឱ្យបំណុលកាន់តែកើនឡើង ហើយបំណុលជាតិវិញក៏ដូចគ្នាដែរ។ តស់! ទៅឈ្វេងយល់ពីបំណុលជាតិ។ បំណុលជាតិគឺពិតជាទិន្នន័យសំខាន់ ដោយសារតែវានឹងតាមដានទៅលើសុខភាពហិរញ្ញវត្ថុនៃសេដ្ឋកិច្ចទាំងមូល ដូច្នេះកាលណាដែលបំណុលមានកាន់តែខ្ពស់ នោះមានន័យថារដ្ឋាភិបាលខ្ចីប្រាក់ពីម្ចាស់បំណុលកាន់តែច្រើន ដែលនឹងធ្វើឱ្យពួកគេមានការស្ទាក់ស្ទើរក្នុងការចាយវាយបន្ថែមទៀត។ តើហេតុអ្វីបានជាដូច្នេះ?

តើអ្នកចាំទេ នៅពេលដែលយើងនិយាយអំពីឱនភាពសារពើពន្ធកាលពីអត្ថបទលើកមុន ដែលរដ្ឋាភិបាលចំណាយលើសចំណូលលើហេដ្ឋារចនាសម្ព័ន្ធផ្សេងៗដូចជា សាលារៀនសាធារណៈ មន្ទីរពេទ្យនិងផ្លូវថ្នល់ជាដើម? ហើយនៅពេលដែលការចាយវាយនេះលើសបានកើតឡើង នោះពួកគេនឹងខ្ចីប្រាក់ពីទីផ្សារមូលបត្របំណុលតាមរយៈការចេញប័ណ្ណបំណុលរដ្ឋាភិបាលដល់វិនិយោគិន។ លើសពីនេះ អត្រាប័ណ្ណ (អត្រាដែលរដ្ឋាភិបាលត្រូវបង់ទៅឱ្យអ្នកទិញ ឬវិនិយោគិន)នឹងដើរតួដូចជាអត្រាការប្រាក់ដូចគ្នា ហើយនេះនឹងក្លាយជាបំណុលរបស់រដ្ឋាភិបាល។ នៅពេលដែលបំណុលកើនឡើង ហើយរដ្ឋាភិបាលមិនអាចសងទាន់ពេល នោះបំណុលជាតិនឹងកាន់តែខ្ពស់។

ឧទាហរណ៍៖

រដ្ឋាភិបាល៖ ចេញប័ណ្ណរតនាគារចំនួន 100 ដែលនីមួយៗមានតម្លៃ 100 ដុល្លារ។

វិនិយោគិន៖ ទិញប័ណ្ណរតនាគារ (Treasury Notes) ចំនួន 10 ក្នុងតម្លៃសរុប $1,000 និងរយៈពេល 5 ឆ្នាំ។

ការទូទាត់ការប្រាក់៖

រដ្ឋាភិបាល៖ បង់ការប្រាក់ប្រចាំឆ្នាំដល់វិនិយោគិន។

អត្រាការប្រាក់ប្រចាំឆ្នាំ៖ 10%

បង់ការប្រាក់ប្រចាំឆ្នាំ៖ 1,000 ដុល្លារ * 10% = 100 ដុល្លារ

វិនិយោគិន៖ ទទួលបានការប្រាក់ 100 ដុល្លារក្នុងមួយឆ្នាំ។

នៅពេលដែលប័ណ្ណបំណុលនេះដល់ពេលកំណត់៖

រដ្ឋាភិបាល៖ សងវិនិយោគិននូវតម្លៃដើមគឺ 1,000 ដុល្លារ។

វិនិយោគិន៖ ទទួលបាន 1,000 ដុល្លារពីរដ្ឋាភិបាល។

លំហូរសាច់ប្រាក់សរុបសម្រាប់វិនិយោគិន៖

ការវិនិយោគដំបូង៖ ១០០០ ដុល្លារ

ការទូទាត់ការប្រាក់ប្រចាំឆ្នាំ៖ +100 ដុល្លារ

ការទូទាត់តាមកាលកំណត់៖ + $1,000

លំហូរសាច់ប្រាក់សុទ្ធ៖ -$1,000 +$100×5 + $1,000 = +$500

ដូច្នេះវិនិយោគិននឹងទទួលបានប្រាក់ចំណេញ 500 ដុល្លារ (ហើយនោះគឺជាការចំណាយការប្រាក់មួយ8ទៀតសម្រាប់រដ្ឋាភិបាល)

ដូច្នេះឥឡូវនេះ អ្នកយល់ច្បាស់អំពីបំណុលជាតិ។ ប៉ុន្តែក្រៅពីការចេញមូលបត្របំណុល តើមានវិធីសាស្ត្រអ្វីទៀតដែលរដ្ឋាភិបាលអាចខ្ចីបាន? ទោះបីជាទីផ្សារមូលបត្របំណុលអាចជាដំណោះស្រាយដែលរដ្ឋាភិបាលតែងតែអនុវត្តក៏ដោយ ក៏ពួកគេស្វែងរកជំនួយពីធនាគារកណ្តាលដែលយើងស្គាល់ផងដែរថាជា “monetizing the debt” ឬពីស្ថាប័នហិរញ្ញវត្ថុអន្តរជាតិដូចជាមូលនិធិរូបិយវត្ថុអន្តរជាតិ (IMF)ជាដើម។

ឥឡូវសាកស្រមៃមើលទាំងអស់គ្នា តើនឹងមានអ្វីកើតឡើងនៅពេលដែលប្រាក់ចំណូលរបស់រដ្ឋាភិបាលកាត់បន្ថយ (ឬកាត់បន្ថយពន្ធ) និងការកើនឡើងការចំណាយរបស់រដ្ឋាភិបាល? តើនេះមិនគួរនាំបំណុលជាតិកើនឡើងទេ? ឥឡូវដកបំណុលដ៏ច្រើនដែលយើងកំពុងមាននៅពេលនេះ ហើយគិតថាថវិការដ្ឋាភិបាលនឹងចាប់ផ្តើមលែងមាន (ឬប្រាក់អវិជ្ជមានគឺនៅជំពាក់គេ) ចាប់ពីពេលនេះ ដូច្នេះ តើអ្វីនឹងជាការផ្លាស់ប្តូរដ៏ធំសម្រាប់កំណើនសេដ្ឋកិច្ចនៅប៉ុន្មានឆ្នាំខាងមុខ?

- សម្ពាធអតិផរណាខ្ពស់៖ ប្រសិនបើរដ្ឋាភិបាលជ្រើសរើសសងបំណុលវិញតាមរយៈការបោះពុម្ពលុយ នោះការផ្គត់ផ្គង់លុយលើសនឹងនាំឱ្យអតិផរណាកាន់តែខ្ពស់។ ចុងក្រោយ តម្លៃប្រាក់រូបិយប័ណ្ណនឹងធ្លាក់ចុះ។

- តម្រូវការតិច និងការបង្កើតការងារទាប៖ នៅពេលដែលតម្លៃឡើងថ្លៃពេក និងកាត់បន្ថយតម្រូវការ អាជីវកម្មទំនងជានឹងបង្កកសកម្មភាពជ្រើសរើសបុគ្គលិកបន្ថែមទៀត និងកាត់បន្ថយចំនួនការងារ។ បំណុលខ្ពស់ក៏នឹងកៀបរដ្ឋាភិបាលក្នុងការចាយវាយលើគម្រោងវិនិយោគផ្សេងៗ។ ទាំងនេះសុទ្ធតែធ្វើឱ្យកាត់បន្ថយនូវឱកាសការងារ។

- រារាំងដល់កំណើនសេដ្ឋកិច្ច៖ កត្តាទាំងអស់នេះបង្ខំឱ្យកំណើនសេដ្ឋកិច្ចធ្លាក់ចុះ ដោយសារតែការថយចុះនៃទំនុកចិត្តវិនិយោគិន និងអ្នកចាយវាយនៅទីនោះ។

ជាក់ស្តែង

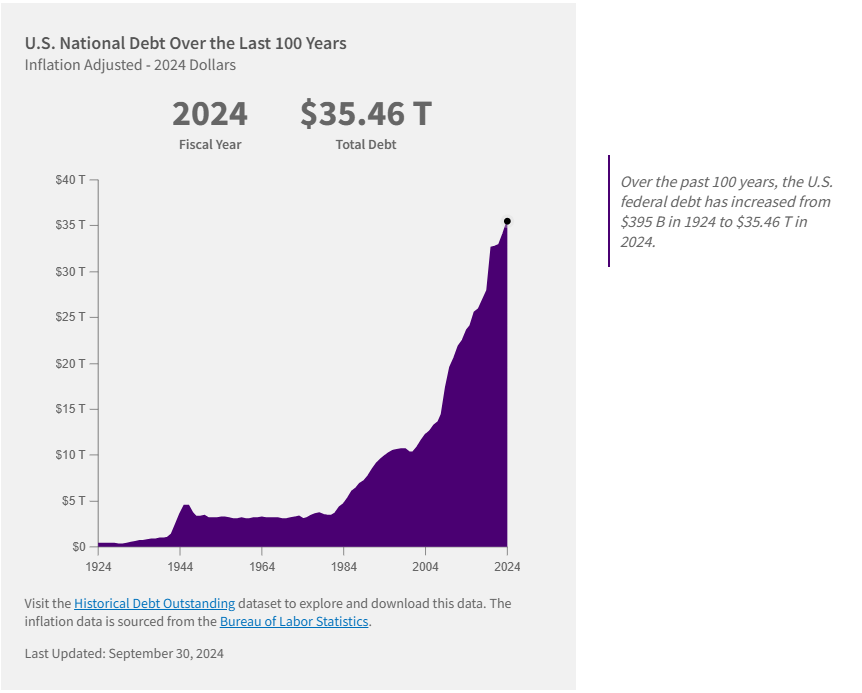

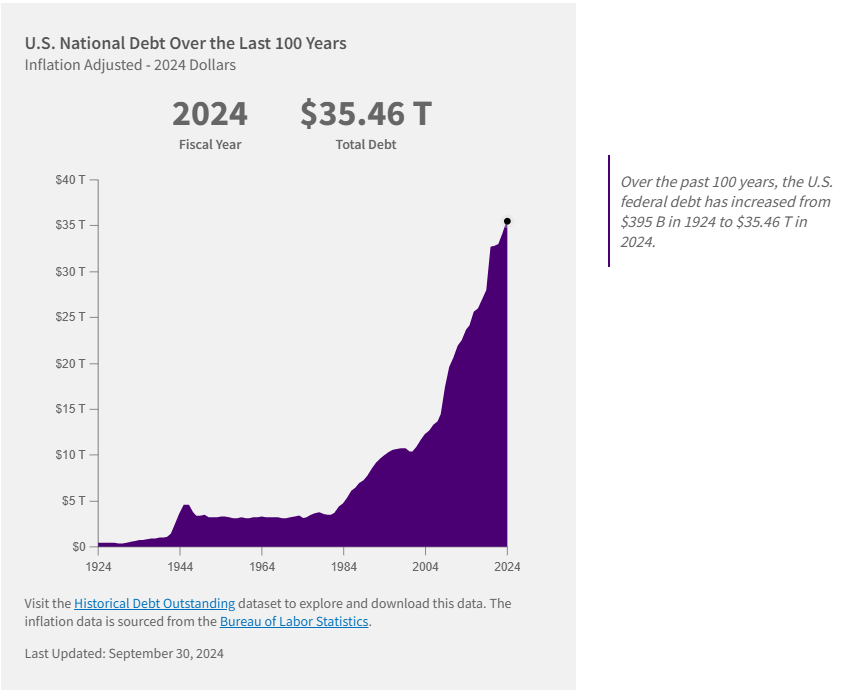

យោងតាមទិន្នន័យ Fiscal Data Treasury.gov ការចំណាយសំខាន់ៗរបស់រដ្ឋាភិបាលសហព័ន្ធគឺផ្តោតលើ៖ ប្រាក់ចំណូល សន្តិសុខសង្គម សុខភាព ការការពារជាតិ និងការថែទាំសុខភាព។ ហើយឥឡូវនេះ បំណុលជាតិរបស់សហរដ្ឋអាមេរិកបានកើនឡើងពី 34.11 ទ្រីលានដុល្លារក្នុងឆ្នាំ 2023 ដល់ 35.46 ទ្រីលានដុល្លារក្នុងឆ្នាំ 2024។

(English Version)

Just like how typical consumers borrow money from creditors or banks that build up the debt expense over time, national debt does the same. Let’s get a quick overview of the national debt. As heard by many, national debt is really important data, as this will also be used to assess the financial health of the whole economy, so the higher the national debt, the higher the government borrows from creditors, and the more reluctant they are willing to spend as much as they want. Why is that?

Do you remember when we talked about the fiscal deficit, where the government overspends its income on infrastructure such as public schools, hospitals, roads, etc.? And when they do, they will likely borrow the money from the bond market by issuing government bonds to the investor. Plus, the coupon rate that acts as the interest rate expense will be the government debt. Once the debt builds up and the government is unable to pay it on time, the higher the national debt will be.

Example:

Government: Issues 100 Treasury Notes, each with a face value of $100.

Investor: Purchases 10 Treasury Notes for a total of $1,000 over the 5-year period

Interest Payment:

Government: Pays the investor an annual interest payment.

Annual interest rate: 10%

Annual interest payment: $1,000 * 10% = $100

Investor: Receives $100 per year in interest.

Maturity:

Government: Repays the investor the face value of the Treasury Note, which is $1,000.

Investor: Receives $1,000 from the government.

Total Cash Flow for the Investor:

Initial Investment: -$1,000

Annual Interest Payment: +$100

Maturity Payment: +$1,000

Net Cash Flow: -$1,000 +$100×5 + $1,000 = +$500

So the investor will gain a profit of $500 (and that is another interest expense for the government)

So now you get a good grasp of the national debts. But aside from issuing the bond, what are the other methods the government can borrow from?

Although the bond market can be the common path the government always strives for, they also seek help from the central bank, also known as “monetizing the debt,” or from an international financial institution such as the International Monetary Fund (IMF) itself.

Imagine together: what would happen when the government income is reduced (or tax cut) and government expenses increased (stimulus programs)? Should not this lead to a growing national debt? Let’s exclude the huge piles of debt we are having right now, Think of how the government budget will start to have a negative amount starting from now So what will be the big changes for the economic growth in the next few years?

- Higher Inflationary Pressures: If the government chooses to replay debt through printing money, then excessive money supply will lead to higher inflation as the money becomes devalued.

- Less Demand and Low Job Creation: When prices become too expensive and reduce demand, businesses are likely to freeze hiring activities and reduce the employment level. Higher debt will also tie the government’s hand in creating more projects that possibly result in less opportunity for unemployment.

- Hinder on economic growth: All of these are forcing economic growth to be restrained due to a lack of confidence from investors and consumers.

Fun Fact:

As per data from the Fiscal Data Treasury.gov, major spending from the federal government is mainly on income security, social security, health, national defense, and Medicare. And now the U.S. national debt has increased from $34.11 trillion in 2023 to $35.46 trillion in 2024.