ចាប់តាំងពីការបិទទ្វាររដ្ឋាភិបាលសហរដ្ឋអាមេរិកបានបញ្ចប់ ទីផ្សារមានការរំពឹងទុកខ្ពស់ចំពោះរបាយការណ៍ការងារ (ខែកញ្ញា) នៅយប់នេះ ដែលពីមុនត្រូវបានពន្យារពេលអស់រយៈពេលជាច្រើនសប្តាហ៍។

ការរំពឹងទុក៖

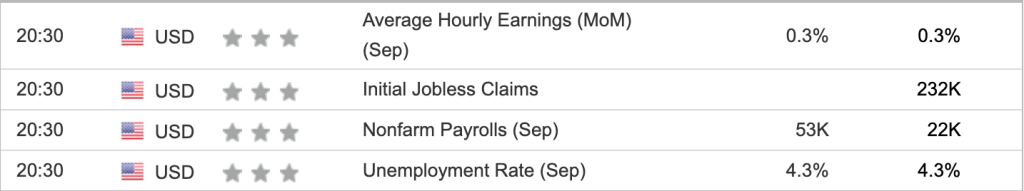

ទិន្នន័យប្រាក់បៀវត្សរ៍មិនមែនកសិកម្ម (Nonfarm Payrolls) ត្រូវបានគេព្យាករណ៍ថានឹងកើនឡើងខ្ពស់ជាងទិន្នន័យពីមុន ខណៈពេលដែលទិន្នន័យផ្សេងទៀតអាចនឹងមានភាគរយច្រើនរក្សាក្នុងកម្រិតដដែលនាពេលនេះ។

តើវាមានន័យយ៉ាងណា?

→ ការព្យាករណ៍ប្រាក់បៀវត្សរ៍មិនមែនកសិកម្មខ្ពស់ជាងទិន្នន័យពីមុន មានន័យថាការងារនឹងត្រូវបានបន្ថែមចំនួន 53,000 នៅក្នុងខែកញ្ញា ដែលអាចត្រូវបានគេមើលឃើញថាជាសារវិជ្ជមានសម្រាប់ស្ថានភាពទីផ្សារការងារ និងអាចពង្រឹងរូបិយប័ណ្ណដុល្លារអាមេរិក។

ហើយរួមផ្សំជាមួយនឹងជំហរប្រុងប្រយ័ត្នថ្មីៗពីកំណត់ហេតុកិច្ចប្រជុំរបស់ធនាគារកណ្តាលអាមេរិក ដែលបានសង្កត់ធ្ងន់លើក្តីបារម្ភនៃការងើបឡើងវិញរបស់អត្រាអតិផរណាទៀតនោះ ប្រសិនបើទិន្នន័យបន្តគាំទ្រទៅលើភាពរឹងមាំនៃទីផ្សារការងារ នោះវានឹងបន្តជំរុញតម្លៃរូបិយប័ណ្ណ USD ឱ្យកាន់តែខ្លាំង ខណៈពេលដែលអាចដាក់សម្ពាធឱ្យតម្លៃមាសកាន់តែទាបជាងមុន។

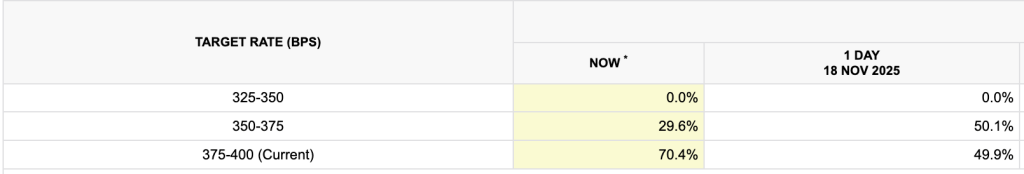

ជាក់ស្តែង ការធ្លាក់ចុះបច្ចុប្បន្ននៃតម្លៃមាសគឺដោយសារតែការកាត់បន្ថយលទ្ធភាពនៃការបន្ទាបអត្រាការប្រាក់នាពេលថ្មីៗនេះ ដែលទីផ្សារឥឡូវនេះជឿជាក់ត្រឹមតែ 30% ឬតិចជាងនេះ (ធ្លាក់ចុះពី 50.1%ពីមុន) ទៅលើការកាត់អត្រា ហើយនេះក៏បង្ហាញពីជំហរបែប Hawkish របស់ពួកគេនោះដែរ។

ទោះជាយ៉ាងណាក៏ដោយ ប្រសិនបើទិន្នន័យបង្ហាញផ្ទុយពីនេះ ស្របតាមការព្យាករណ៍របស់ទីប្រឹក្សាជាន់ខ្ពស់របស់ WH លោក Hassett ពោលគឺ ការព្យាករណ៍ទៅលើ “ការបាត់បង់ការងារចំនួន 60,000 ដោយសារតែការបិទទ្វារពីមុន” នោះវានឹងធ្វើឱ្យស្ថានភាពទីផ្សារការងារមានភាពទន់ខ្សោយ ស្របពេលដែលលទ្ធភាពនៃការកាត់បន្ថយអត្រាអាចនឹងកើនឡើងវិញ។ នេះនឹងគាំទ្រទៅលើការកើនឡើងនៃតម្លៃមាស។

|English Version|

Ever since the US government shutdown ended, the market has had a very high expectation for tonight’s employment report (September) data, which had previously been delayed for weeks.

Expectation:

Nonfarm payroll data is projected to increase higher than the previous figure, while others are likely to remain unchanged this time.

What does it mean?

→ A higher nonfarm payroll projection means jobs will be added by 53,000 in September, which could be seen as a positive message for the labor market conditions and possibly strengthen the USD currency.

And combined with the recent cautious stances from the FED meeting minutes that stressed the inflation resurgence, if the data continues to support having a stronger figure, then this will continue to boost the USD while putting downward pressure on the gold prices.

In fact, the current decline in gold prices due to recent rate cut bets reductions, which the market is now priced in at lower than 30% (down from 50.1%), signals the FED’s hawkish stance.

However, if the data shows otherwise, aligning with WH Sr. Adviser Hassett’s projection on seeing a possible “60,000 job losses due to the shutdown”, then this will only soften the labor market conditions, add a boost to the rate cut back, while also likely supporting the gold prices.