⭐️ គន្លឹះសំខាន់ ⭐️ ឈ្វេងយល់ពី Fed Rate Fed Rate គឺជាអត្រាការប្រាក់គោលដៅ ដែលកំណត់ដោយ FOMC (គណៈកម្មាធិការទីផ្សារបើកចំហសហព័ន្ធ) សម្រាប់ធនាគារពាណិជ្ជខ្ចី និងផ្តល់ប្រាក់កម្ចីបម្រុងលើសរបស់ពួកគេឱ្យគ្នាទៅវិញទៅមក ហើយគោលបំណងចម្បងនៃការផ្លាស់ប្តូរនេះគឺដើម្បីប្រយុទ្ធប្រឆាំងនឹងអត្រាអតិផរណា។ ⭐️ គោលដៅនៃ Fed Rate គោលដៅនៃ Fed Rate៖ ដើម្បីលើកកម្ពស់កំណើនសេដ្ឋកិច្ចប្រកបដោយនិរន្តរភាព បង្កើនអត្រាមានការងារធ្វើឱ្យបានខ្ពស់ អត្រាការប្រាក់រយៈពេលវែងកម្រិតមធ្យម និងដើម្បីរក្សាអំណាចទិញនៃប្រាក់ដុល្លារអាមេរិក។ ⭐️ កាតព្វកិច្ចរបស់ Federal Reserve ត្រូវបានបែងចែកជាបួនផ្នែកទូទៅ៖ ⭐️ តើ Fed Rate ត្រូវបានកំណត់យ៉ាងដូចម្តេច? Fed Rate ត្រូវបានកំណត់ដោយ៖ ⭐️ សារៈសំខាន់នៃ Fed Rate វាមានសារៈសំខាន់សម្រាប់ហេតុផល២បែបគឺ៖ ក. អត្រាការប្រាក់ឡើងថ្លៃ ដែលធ្វើឱ្យធនាគារពិបាកក្នុងការខ្ចីប្រាក់ ខ. ធ្វើឱ្យសេដ្ឋកិច្ចធ្លាក់ចុះ ដោយសារតែអាជីវកម្មផ្សេងៗពិបាកក្នុងការខ្ចីប្រាក់យកទៅវិនិយោគ ក. អត្រាការប្រាក់ចុះថោក ដូចនេះធនាគារងាយស្រួលក្នុងការខ្ចីប្រាក់ ខ. ជួយជម្រុញឱ្យមានកំណើនសេដ្ឋកិច្ច ដោយសារតែមានការខ្ចីប្រាក់ពីបណ្តាក្រុមហ៊ុន និងវិនិយោគិនផ្សេងៗយកទៅវិនិយោគ ⭐️ ឥទ្ធិពលនៃ Fed Rate |English Version| ⭐️ Key takeaway ⭐️ Understand about Fed Rate The Fed Rate is not an indicator but is the target rate set by the FOMC (Federal Open Market Committee) for commercial banks to borrow and lend their excess reserves to each other overnight. Thus, the primary purpose of this change is to combat with inflation rate. ⭐️ The goal of Fed Rate The goal of the Fed Rate is to promote sustainable economic growth, high employment rates, moderate long-term interest rates, and to preserve the purchasing power of the U.S. dollar. ⭐️ What are the duties of the Federal Reserve? The Fed’s main duties include: ⭐️ How is the fed rate determined? Fed Rate is determined by: ⭐️ The importance of Fed Rate It is important for 2 reasons: a. More expensive for banks to borrow money b. Helps to slow down the economy by making it more expensive for businesses to borrow money and invest. a. Cheaper for banks to borrow money. b. Helps to stimulate the economy by making it cheaper for businesses to borrow money and invest. ⭐️ The impact of Fed Rate

Nonfarm Payroll (NFP)

⭐️ គន្លឹះសំខាន់ ⭐️ ឈ្វេងយល់ពី Nonfarm Payroll (NFP) NFP (NonFarm Payroll) គឺជាសូចនាករសេដ្ឋកិច្ច ដែលផ្តល់ព័ត៌មានសំខាន់ៗស្ដីពីនិកម្មភាព (ភាពគ្មានការងារធ្វើ) កំណើនការងារ និងបញ្ជីប្រាក់បៀវត្សរ៍ ដោយមិនរាប់បញ្ចូលនូវចំនួនកសិករ ឬអ្នកមិនជាប់ពន្ធកាត់ទុកឡើយ។ ⭐️ តើទិន្នន័យ Nonfarm Payroll (NFP) តែងតែចេញផ្សាយនៅពេលណា? ទិន្នន័យនេះតែងតែចេញផ្សាយនៅ ថ្ងៃសុក្រនៃសប្តាហ៍ទី១ នៅចន្លោះពីម៉ោង១៩:៣០ និង២០:៣០ នាទីល្ងាច (ម៉ោងនៅក្នុងព្រះរាជាណាចក្រកម្ពុជា) ជារៀងរាល់ខែ ហើយទិន្នន័យ NFP របស់ខែកក្កដា នឹងចេញផ្សាយនៅខែសីហាជានិច្ច។ ⭐️ សារៈសំខាន់នៃរបាយការណ៍ Nonfarm Payroll (NFP) NFP (NonFarm Payroll) មានសារៈសំខាន់ ព្រោះវាផ្តល់នូវការយល់ដឹងសំខាន់ៗអំពីស្ថានភាពបច្ចុប្បន្ននៃទីផ្សារការងារ ការជះឥទ្ធិពលលើការរំពឹងទុកនៃអត្រាការប្រាក់ ការប៉ះពាល់ដល់អារម្មណ៍ទីផ្សារ និងជាពិសេសវាអាចជួយឱ្យអ្នកត្រេតអាចសម្រេចចិត្តនៅក្នុងការជួញដូរដ៏ត្រឹមត្រូវបានផងដែរ។ ចំនួនការងារត្រូវបានបង្កើតបន្ថែម ឬបាត់បង់ក្នុងរយៈពេលជាក់លាក់មួយ អាចបង្ហាញពីភាពរឹងមាំនៃសេដ្ឋកិច្ចរបស់ប្រទេស ព្រមទាំងអាចឲ្យសញ្ញាណពីការសម្រេចចិត្ត ឬសកម្មភាពលើគោលនយោបាយរូបិយប័ណ្ណ (Monetary Policy) នៃធនាគារកណ្តាល។ ⭐️ កត្តាដែលជះឥទ្ធិពលលើ Nonfarm Payroll (NFP) កត្តាដែលជះឥទ្ធិពលលើការ NFP អាចប្រែប្រួលអាស្រ័យលើលក្ខខណ្ឌសេដ្ឋកិច្ច និងទីផ្សារការងារផ្សេងៗ។ តែទោះជាយ៉ាងណាក៏ដោយ មានកត្តាទូទៅមួយចំនួនដែលអាចប៉ះពាល់ដល់ NFP រួមមាន ទិន្នន័យគ្មានការងារធ្វើប្រចាំសប្តាហ៍ ADP employment changes របាយការណ៍ Purchasing Managers’ Index ប្រចាំខែក៏អាចមានឥទ្ធិពលលើរបាយការណ៍ NFPផងដែរ។ ⭐️ ឥទ្ធិពលនៃ Nonfarm Payroll (NFP) |English Version| ⭐️ Key takeaway ⭐️ Understand about NFP Nonfarm Payroll (NFP) is an economic indicator that provides important information on the unemployment rate, employment growth, and payroll, excluding the number of farmers or non-taxpayers. ⭐️ When is the NFP data released? Nonfarm Payroll (NFP) is usually released on the Friday of the first week between 19:30 and 20:30 pm (Cambodian time) each month, and the July NFP data will be released in August. ⭐️ The importance of Nonfarm Payroll (NFP) Nonfarm Payroll (NFP) is important because it provides important insights into the current state of the labor market, the impact on interest rate expectations, the impact on market sentiment, and in particular it can help traders make proper decisions in trading as well. Non-farm payrolls offer insights into the state of employment across the country. The number of jobs added or lost in a month can indicate the strength of the economy and how the Federal Reserve might act on monetary policy. ⭐️ Factors that influence this indicator Other employment figures such as weekly jobless data, ADP employment changes, and employment constituents of the monthly data and Purchasing Managers’ Index report may also influence non-farm payroll reports. ⭐️ The impact of NFP (Nonfarm Payroll) 👉Influence of NFP (Nonfarm Payroll) on the economy The non-farm payroll report is an important economic indicator that reflects the health of the labor market. It measures how many people are employed in the US, excluding farm workers and some other job types. A rising non-farm payroll number indicates a growing economy. However, if non-farm payrolls rise too rapidly, it could lead to inflation which could hurt the economy as well. And vice versa. 👉Influence of NFP (Nonfarm Payroll) on the dollar The non-farm payroll report is an important economic indicator that can affect the dollar price. If the non-farm payroll number rises, it may lead to expectations of higher interest rates which can push the dollar higher. Conversely, if the non-farm payroll number declines, it may lead to expectations of lower interest rates which can cause the dollar to depreciate.

ADP Nonfarm Employment Change

គន្លឹះសំខាន់ – ADP Nonfarm Employment Change គឺជារបាយការណ៍សេដ្ឋកិច្ចប្រចាំខែនៃការងារដែលចេញផ្សាយដោយវិទ្យាស្ថានស្រាវជ្រាវ ADP។ – ADP Nonfarm Employment Change ផ្តល់នូវការព្យាករណ៍អំពីចំនួនការងារដែលបានបន្ថែម ឬបាត់បង់នៅក្នុងវិស័យឯកជននៅក្នុងសេដ្ឋកិច្ចសហរដ្ឋអាមេរិក។ – កត្តាដែលជះឥទ្ធិពលដល់ ADP Nonfarm Employment Change – សារៈសំខាន់នៃ ADP Nonfarm Employment Change ឈ្វេងយល់ពី ADP Nonfarm Employment Change ADP Nonfarm Employment Change ឬជាភាសាខ្មែរហៅថា ទិន្នន័យការងារ ADP គឺជារបាយការណ៍សេដ្ឋកិច្ចប្រចាំខែដែលចេញផ្សាយដោយវិទ្យាស្ថានស្រាវជ្រាវ ADP ដែលវាស់វែងលើការផ្លាស់ប្តូរនៃចំនួនបុគ្គលិកនៅក្នុងវិស័យឯកជន ដែលមិនរាប់បញ្ចូលនូវវិស័យកសិកម្មឡើយ។ របាយការណ៍នេះគឺផ្អែកទៅលើទិន្នន័យប្រាក់បៀវត្សរ៍ ដែលបានមកពីបណ្តាអាជីវកម្មនានាប្រហែល 400,000 នៅឯសហរដ្ឋអាមេរិក ដោយក្នុងនោះមានបុគ្គលិកប្រហែល 23 លាននាក់។ តើទិន្នន័យ ADP Nonfarm Employment Chang តែងតែចេញផ្សាយនៅពេលណា? ADP Nonfarm Employment Change តែងតែចេញផ្សាយជារៀងរាល់ពីរថ្ងៃមុនការចេញផ្សាយរបាយការណ៍ស្ថានភាពការងាររបស់ការិយាល័យស្ថិតិការងារ ដែលជាទូទៅគឺនៅរៀងរាល់ថ្ងៃសុក្រនៃសប្តាហ៍ដំបូងនៃខែនីមួយៗ។ សារៈសំខាន់នៃរបាយការណ៍ ADP Nonfarm Employment Change ADP Nonfarm Employment Change មានសារៈសំខាន់ ព្រោះវាផ្តល់នូវការព្យាករណ៍អំពីចំនួនការងារដែលបានបន្ថែម ឬបាត់បង់នៅក្នុងវិស័យឯកជននៃសេដ្ឋកិច្ចសហរដ្ឋអាមេរិក។ លើសពីនេះទៅទៀត របាយការណ៍ ADP គឺជាសូចនាករសេដ្ឋកិច្ចដែលមានឥទ្ធិពល ដែលអាចប៉ះពាល់ដល់ទីផ្សារហិរញ្ញវត្ថុ រួមទាំងទីផ្សារ Forex និងទីផ្សារភាគហ៊ុនផងដែរ។ ដូច្នេះ នៅពេលដែលទិន្នន័យនៃសូចនាករនេះកើនឡើង វាបង្ហាញថាមនុស្សភាគច្រើនមានការងារធ្វើនៅក្នុងវិស័យមិនមែនកសិកម្ម ដែលជាសញ្ញាវិជ្ជមានសម្រាប់សេដ្ឋកិច្ច។ ការកើនឡើងនេះអាចនាំឱ្យមានការកើនឡើងនៃការចំណាយរបស់អ្នកប្រើប្រាស់ និងកំណើនសេដ្ឋកិច្ចទាំងមូលបានផងដែរ។ ម្យ៉ាងវិញទៀត នៅពេលដែលទិន្នន័យ ADP Nonfarm Employment Change មានការថយចុះ វាបង្ហាញថាមានចំនួនមនុស្សតិចជាងមុនដែលធ្វើការនៅក្នុងវិស័យមិនមែនកសិកម្ម ដែលជាសញ្ញាអវិជ្ជមានសម្រាប់សេដ្ឋកិច្ច។ ការថយចុះនេះអាចនាំឱ្យមានការថយចុះនៃការចំណាយរបស់អ្នកប្រើប្រាស់ និងធ្វើឱ្យសេដ្ឋកិច្ចទាំងមូលធ្លាក់ចុះផងដែរ។ កត្តាសំខាន់ៗដែលមានឥទ្ធិពលលើ ADP Nonfarm Employment Change៖ |English Version| Key Takeaways – ADP Nonfarm Employment Change is an employment monthly economic report published by the ADP Research Institute. – ADP Nonfarm Employment Change provides a forecast of the number of jobs added or lost in the private sector of the US economy. – Factors that influence ADP Nonfarm Employment Change – The importance of ADP Nonfarm Employment Change Understand about ADP Nonfarm Employment Change ADP Nonfarm Employment Change is a monthly economic report published by the ADP Research Institute that measures the change in the number of employed people in the nonfarm private sector of the United States economy. The report is based on payroll data from around 400,000 U.S. businesses, covering around 23 million employees. When will the ADP Nonfarm Employment Changes data be released? The ADP Nonfarm Employment Change is released two days prior to the Bureau of Labor Statistics’ employment situation report, which is available on the first Friday of each month. The Importance of ADP Nonfarm Employment Change ADP Nonfarm Employment Status is important because it provides a forecast of the number of jobs added or lost in the private sector of the US economy. Moreover, the ADP report is an important economic indicator that can impact financial markets, including the forex and stock markets. So when this indicator increases, it indicates that more people have been employed in the nonfarm sector compared to the previous month, which is generally seen as a positive sign for the economy. This can lead to an increase in consumer spending and overall economic growth. On the other hand, when the ADP Nonfarm Employment Change decreases, it suggests that fewer people have been employed in the nonfarm sector compared to the previous month, which is generally seen as a negative sign for the economy. This can lead to a decrease in consumer spending and overall economic growth. The key factors that influence the ADP Nonfarm Employment Status report:

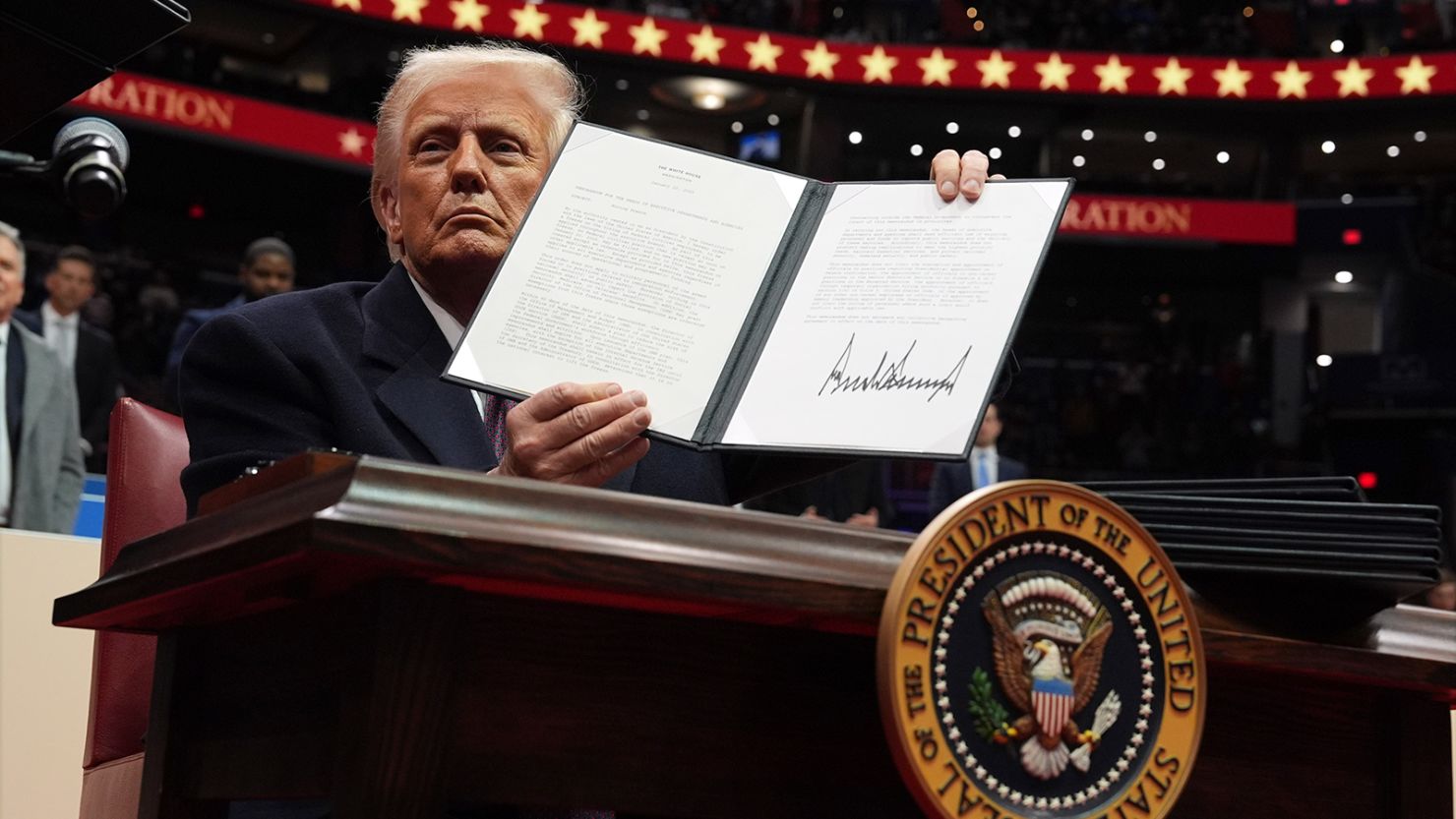

Latest Highlights from Yesterday’s Economic News: Insights from Trump’s Speech and the Federal Reserve

សុន្ទរកថារបស់លោក Trump ធនាគារកណ្តាលអាមេរិក ធនាគារកណ្តាលអាមេរិកបានសម្តែងការព្រួយបារម្ភអំពីបញ្ហាអត្រាអតិផរណា ជាពិសេសស្របពេលដែលកំពុងមានភាពច្របូកច្របល់លើពន្ធ។ ដូចគ្នានេះដែរ Fitch Ratings ក៏មានក្តីបារម្ភដូចគ្នា ជាពិសេសទាក់ទងនឹងទីផ្សារអាលុយមីញ៉ូម។ ជាក់ស្តែងទីផ្សារនៅតែជឿជាក់ថាអាចនឹងរក្សាអត្រាការប្រាក់នាកិច្ចប្រជុំបន្ទាប់ យោងទៅតាម CME FEDwatch Tool ។ ទស្សនៈរបស់យើង បច្ចុប្បន្ននេះ ក្តីកង្វល់ចម្បងរបស់ខ្ញុំគឺការកើនឡើងអត្រា Deliquency (បំណុលដែលបង់យឺត) រួមជាមួយនឹងការគំរាមកំហែងពន្ធគយ និងបញ្ហាអតិផរណា។ ដូច្នេះ ប្រសិនបើកត្តាទាំងនេះរារាំងការចំណាយរបស់អ្នកប្រើប្រាស់យ៉ាងខ្លាំងនោះ វាអាចនាំឱ្យមានបញ្ហាបំណុល ហើយអាចឈានទៅរកភាពទន់ខ្សោយក្នុងសេដ្ឋកិច្ច។ ដូច្នេះ ជម្រើសអាចមានពីរគឺ រដ្ឋាភិបាលអាចដោះស្រាយលើឱនភាពថវិកាបច្ចុប្បន្ន ឬដំណោះស្រាយលើការសម្រេចចិត្តអត្រាការប្រាក់របស់ FED ។ ខ្ញុំជឿថាការបន្ធូរបន្ថយនឹងមិនអាចជួយអ្វីបានច្រើននៅចំណុចនេះតទៅមុខទេ។ |English Version| Trump’s Speeches The Federal Reserve The Federal Reserve has expressed concerns about the turbulent path of inflation amid ongoing tariff threats. Similarly, Fitch Ratings shares these concerns, particularly regarding the aluminum market. More odds still lean on holding the rate, as per the CME FEDwatch Tool. Our Perspective Currently, my primary concern is the rising delinquency rate, along with the tariff threats and inflation problem. So if these factors significantly restrain consumer spending, it could lead to debt default, and then this will hinder economic growth. So either the government deals with the current budget deficit or the FED’s interest rate decision. I do believe that easing won’t help much at this point onward.

Protected: Key Economic News: The Federal Reserve Speech, Trump Speech, and Australia Wage Growth

There is no excerpt because this is a protected post.

Key Economic News: The Federal Reserve Speech, Trump Speech, and Australia Wage Growth

ធនាគារកណ្តាលនៅអាមេរិក ស្ថានភាពសេដ្ឋកិច្ចអាមេរិកនៅតែមានសភាពរឹងមាំ ទីផ្សារការងារនៅតែល្អប្រសើរ ហើយអត្រាអតិផរណានៅតែមានកម្រិតខ្ពស់ ដូច្នេះហើយបានជាសមាជិកធនាគារកណ្តាលលោកស្រី Daly ជឿជាក់ថាគោលនយោបាយរូបិយវត្ថុគួរតែរក្សាក្នុងកម្រិតដដែលនាពេលបច្ចុប្បន្ន។ នេះបានបង្ហាញថា ធនាគារកណ្តាលនៅតែមានភាពមិនច្បាស់លាស់អំពីឥទ្ធិពលភូមិសាស្ត្រនយោបាយ និងគោលនយោបាយរូបិយវត្ថុលើស្ថានភាពសេដ្ឋកិច្ច ស្របពេលដែលអាចនឹងមានការប្រុងប្រយ័ត្នកាន់តែច្រើនមកលើការសម្រេចចិត្តអត្រាការប្រាក់។ យោងតាម CMEFEDWatch Tool ទីផ្សារជឿជាក់ថាអាចនឹងមានភាគរយចំនួន43.7% ទៅលើការបន្ទាបអត្រាការប្រាក់នៅខែកញ្ញា ស្របពេលដែលអាចនឹងរក្សាអត្រាការប្រាក់នៅក្នុងខែមីនា។ ប្រធានាធិបតីលោក Trump៖ មតិមួយចំនួននិងការរំពឹងទុក៖ អតិផរណាខ្ពស់ + សក្តានុពលនៃភាពអត់ការងារធ្វើខ្ពស់ → តម្រូវការទាប និងកំណើនខ្សោយ។ ប្រទេសអូស្ត្រាលី កំណើនប្រាក់ឈ្នួលនៅក្នុងប្រទេសអូស្ត្រាលីត្រូវបានបញ្ជាក់ថាមានការចេញផ្សាយទិន្នន័យតិចជាងមុន បន្ទាប់ពីការកាត់បន្ថយអត្រាការប្រាក់បែប hawkish របស់ធនាគារកណ្តាលអូស្ត្រាលី (RBA) កាលពីម្សិលមិញ។ ការផ្លាស់ប្តូរនេះបង្ហាញថាតម្រូវការអាចនឹងបន្តថយចុះ ដោយសារតែការរឹតបន្តឹងលើការចាយវាយ។ |English Version| The Federal Reserve Given how strong the US economy is from tight labor markets and bumpy inflation progress, Federal Reserve member Daly still leans toward having a current restrictive policy. This cautious approach hints that the FED is uncertain about the current geopolitical and monetary policy effects on the economy while taking steps at a time on the interest rate decisions. According to the CMEFEDWatch Tool, the market priced in a September rate cut with odds of 43.7%, while the next March rate decision meeting is on holding the rate tight. Trump: Our Thoughts/Expectation: Australia The wage growth in Australia was confirmed to have a softer figure release after the Reserve Bank of Australia’s (RBA) hawkish rate cut yesterday. This change indicates that household consumption is very likely to be restrained by tight budgeting.

Producer Price Index (PPI)

⭐️ គន្លឹះសំខាន់ – Producer Price Index ជាការវាស់វែងនៃការប្រែប្រួលជាមធ្យមរបស់តម្លៃទំនិញ និងសេវាកម្មដែលអ្នកផលិតក្នុងស្រុកទទួលបានសម្រាប់ទិន្នផលរបស់ពួកគេនៅក្នុងរយៈពេលកំណត់មួយ។ – កត្តាដែលជះឥទ្ធិពលលើសូចនាករនេះ។ – សារៈសំខាន់នៃសូចនាករ Producer Price Index ។ – ឥទ្ធិពលនៃសូចនាករ Producer Price Index លើសេដ្ឋកិច្ច។ ⭐️ ឈ្វេងយល់ពី Producer Price Index PPI(Producer Price Index)ត្រូវបានគេប្រើប្រាស់ដើម្បីតាមដានអត្រាអតិផរណាពីទស្សនៈរបស់អ្នកផលិត។ វាជាការវាស់វែងនៃការប្រែប្រួលជាមធ្យមរបស់តម្លៃទំនិញ និងសេវាកម្មដែលអ្នកផលិតក្នុងស្រុកទទួលបានសម្រាប់ទិន្នផលរបស់ពួកគេនៅក្នុងរយៈពេលកំណត់មួយ។ តើទិន្នន័យការទាមទារភាពគ្មានការងារធ្វើតែងតែចេញផ្សាយនៅពេលណា? ទិន្នន័យនេះតែងតែចេញផ្សាយនៅថ្ងៃទី១៣ ឬ ១៥ ម៉ោង ៧:៣០ នាទីយប់ ជារៀងរាល់ខែ ហើយទិន្នន័យ PPI របស់ខែកក្កដា នឹងចេញផ្សាយនៅខែសីហាជានិច្ច។ ⭐️យល់ដឹងបន្ថែមអំពីសូចនាករ Producer Price Index ប្រសិន បើ PPI ខ្ពស់ជាងការរំពឹងទុក នោះវាអាចជំរុញឲ្យអត្រាការប្រាក់ខ្ពស់ជាងមុន ហើយវាក៏អាចបង្កើនតម្លៃរូបិយប័ណ្ណ ដែលជាកត្តា នាំឲ្យរូបិយប័ណ្ណនោះកាន់តែរឹងមាំជាងមុន។ ប្រសិន បើ PPI ថយចុះខ្លាំងជាងការរំពឹងទុក នោះវាអាចជាសញ្ញាថាអតិផរណាកំពុងថយចុះ ហើយអត្រាការប្រាក់អាចនឹងធ្លាក់ចុះ ដែល នាំឲ្យរូបិយប័ណ្ណចុះខ្សោយជាងមុន ។ ⭐️ សារៈសំខាន់នៃសូចនាករ Producer Price Index PPI តាមដានអតិផរណាពីទស្សនៈនៃអ្នកផលិតក្នុងឧស្សាហកម្ម និងអាជីវកម្ម។ ដូចនេះ សូចនាករនេះអាចវាស់វែងការផ្លាស់ប្តូរនៃតម្លៃ មុនពេលអ្នកប្រើប្រាស់ទិញទំនិញ និងសេវាកម្មសម្រេចចុងក្រោយ ដែលជាហេតុដែលអ្នកវិភាគជាច្រើនប្រើវាដើម្បីព្យាករណ៍អតិផរណាមុនពេលទិន្នន័យ CPI ចេញ ។ ⭐️ កត្តាដែលមានឥទ្ធិពលលើ Producer Price Index កត្តាដែលមានឥទ្ធិពលលើ PPI រួមមាន: • តម្លៃនៃវត្ថុធាតុដើម • កម្លាំងពលកម្ម • ការចំណាយផ្សេងៗទៀត ⭐️ឥទ្ធិពលនៃសូចនាករសន្ទស្សន៍តម្លៃអ្នកផលិតលើសេដ្ឋកិច្ច នៅពេលដែល PPI កើនឡើងខ្លាំង វាធ្វើឲ្យអតិផរណាតម្លៃទំនិញប្រើប្រាស់នាពេលអនាគកើនឡើង ជាកត្តាដែលកាត់បន្ថយអំណាចនៃលុយឬការទិញរបស់ប្រជាជន។ ធនាគារកណ្តាលតែងចាំមើលតួលេខ PPI ដើម្បីរក្សាស្ថិរភាពតម្លៃនៅពេលចាំបាច់។ ការកើនឡើងនៃ PPI អាចជំរុញឱ្យ Federal Reserve ដំឡើងអត្រាការប្រាក់ ដើម្បីទប់ស្កាត់អតិផរណា ដែលអាចធ្វើឱ្យការខ្ចីលុយសម្រាប់អាជីវកម្ម កាន់តែថ្លៃ (មានអត្រាការប្រាក់)។ |English Version| ⭐️ Key Takeaways – The Producer Price Index is an economic indicator that is used to assess the inflation rate from the producer’s point of view. – Factors that influence this indicator. – The importance of the Producer Price Index. – The impact of the Producer Price Index on the economy. ⭐️ About Producer Price Index The Producer Price Index (PPI) is an economic indicator that is used to assess the inflation rate from the producer’s point of view. PPI measures the change in the selling prices, or wholesale prices, received by domestic producers for their output. ⭐️ When is Producer Price Index data released? This data is released at 7:30 PM every month usually around the 13th or 15th. July PPI data is scheduled to be released in August. ⭐️Understand more about the Producer Price Index If the PPI is larger than expected, it can push interest rates higher and increase currency value, leading to a stronger currency. If the PPI decreases significantly, it may be a signal that inflation is decreasing and that interest rates may go down, leading to a weaker currency. ⭐️ The importance of the Producer Price Index The Producer Price Index looks at inflation from the perspective of business and industry. This allows us to measure price changes prior to consumer’s final purchases of products and services. Because of this, many analysts use it to anticipate inflation before the CPI. ⭐️ Factors that influence this indicator The factors that influence PPI include: • Price of Raw ingredient • Labor force • Other expense ⭐️ The impact of the Producer Price Index on the economy When the PPI of an economy is rising strongly, it tends to result in future inflation in the prices of consumer goods that discourage consumers from saving and also reduce their purchasing power. Policymakers keep a watch on PPI figures to maintain price stability when required. A jump in the PPI might help prompt the Federal Reserve to hike interest rates in a move to curb inflation, which can make it more expensive for consumers and businesses to borrow money.

Initial Jobless Claims

⭐️ គន្លឹះសំខាន់ – ទិន្នន័យការទាមទារភាពគ្មានការងារធ្វើផ្តល់នូវការយល់ដឹងអំពីសុខភាពនៃទីផ្សារការងារ និងសេដ្ឋកិច្ចទាំងមូល។ – ទិន្នន័យការទាមទារភាពគ្មានការងារធ្វើគឺសំដៅទៅលើចំនួននៃការទាមទារធានារ៉ាប់រងភាពអត់ការងារធ្វើថ្មីដែលបានស្នើសុំរាល់សប្តាហ៍។ – កត្តាដែលជះឥទ្ធិពលលើសូចនាករនេះ។ – សារៈសំខាន់នៃទិន្នន័យការទាមទារភាពគ្មានការងារធ្វើ។ – ផលប៉ះពាល់នៃទិន្នន័យការទាមទារភាពគ្មានការងារធ្វើលើសេដ្ឋកិច្ច។ ⭐️ ឈ្វេងយល់ពីការទាមទារភាពគ្មានការងារធ្វើ វាសំដៅទៅលើចំនួនបុគ្គលិកដែលបានដាក់ពាក្យសុំអត្ថប្រយោជន៍ធានារ៉ាប់រងពីភាពអត់ការងារធ្វើជាលើកដំបូងក្នុងអំឡុងពេលដែលបានផ្តល់ឱ្យ ឬជាធម្មតាក្នុងមួយសប្តាហ៍។ ⭐️ តើទិន្នន័យការទាមទារភាពគ្មានការងារធ្វើតែងតែចេញផ្សាយនៅពេលណា? ការទាមទារភាពគ្មានការងារធ្វើ តែងតែចេញនៅព្រឹកថ្ងៃព្រហស្បតិ៍ វេលាម៉ោង 7:30 យប់ (ម៉ោងនៅកម្ពុជា)។ ⭐️សារៈសំខាន់នៃរបាយការណ៍ការទាមទារភាពគ្មានការងារធ្វើ របាយការណ៍នៃការទាមទារភាពគ្មានការងារធ្វើ គឺមានសារៈសំខាន់ណាស់ ព្រោះវាត្រូវបានចាត់ទុកថាជាសូចនាករសេដ្ឋកិច្ចឈានមុខគេដែលផ្តល់តម្រុយអំពីអ្វីដែលកំពុងកើតឡើងនៅក្នុងទីផ្សារការងារ។ លើសពីនេះទៅទៀត វាក៏បានបង្ហាញអំពីទំនាក់ទំនងបញ្ច្រាសរវាងការទាមទារដំបូង និងការងារ។ ខាងក្រោមនេះគឺជាទំនាក់ទំនងរវាងការទាមទារភាពគ្មានការងារធ្វើ និងអ្នកមានការងារធ្វើ៖ ប្រសិនបើរបាយការណ៍នៃការទាមទារភាពគ្មានការងារធ្វើធ្លាក់ចុះ នោះមានន័យថាអត្រាអ្នកមានការងារធ្វើកើនឡើង ឬយើងអាចនិយាយបានថា អត្រាគ្មានការងារធ្វើមានការថយចុះ ដែលបង្ហាញពីប្រាក់ចំណូលរបស់ប្រជាជនខ្ពស់ជាងមុន ដែលនាំឱ្យការចាយវាយលើការប្រើប្រាស់កាន់តែខ្ពស់ និងធ្វើឱ្យមានកំណើនសេដ្ឋកិច្ចកាន់តែរឹងមាំផងដែរ។ ប៉ុន្តែ ប្រសិនបើបាយការណ៍នៃការទាមទារភាពគ្មានការងារធ្វើកើនឡើង នោះមានន័យថាអ្នកមានការងារធ្វើថយចុះ ឬយើងអាចនិយាយបានថា អត្រាគ្មានការងារធ្វើមានកើនឡើង ដែលបង្ហាញពីប្រាក់ចំណូលរបស់ប្រជាជនទាបជាងមុន ដែលនាំឱ្យការចាយវាយលើការប្រើប្រាស់ទាបជាងមុន និងធ្វើឱ្យកំណើនសេដ្ឋកិច្ចចុះខ្សោយផងដែរ។ ⭐️ កត្តាដែលជះឥទ្ធិពលលើការទាមទារភាពគ្មានការងារធ្វើ កត្តាដែលជះឥទ្ធិពលលើការទាមទារភាពគ្មានការងារធ្វើអាចប្រែប្រួលអាស្រ័យលើលក្ខខណ្ឌសេដ្ឋកិច្ច និងទីផ្សារការងារផ្សេងៗ។ តែទោះជាយ៉ាងណាក៏ដោយ មានកត្តាទូទៅមួយចំនួនដែលអាចប៉ះពាល់ដល់ការទាមទារភាពគ្មានការងារធ្វើរួមមាន៖ -លក្ខខណ្ឌសេដ្ឋកិច្ច៖ – វដ្តអាជីវកម្ម – កត្តាឧស្សាហកម្មជាក់លាក់ – គោលនយោបាយរបស់រដ្ឋាភិបាល។ ⭐️ ផលប៉ះពាល់នៃទិន្នន័យការទាមទារភាពគ្មានការងារធ្វើលើសេដ្ឋកិច្ច ការទាមទារភាពគ្មានការងារគឺជាសូចនាករសេដ្ឋកិច្ចដ៏សំខាន់ដែលឆ្លុះបញ្ចាំងពីសុខភាពនៃទីផ្សារការងារ។ ទិន្នន័យនៃសូចនាករនេះអាចជះឥទ្ធិពលដោយផ្ទាល់ទៅលើអត្រាគ្មានការងារធ្វើ និងការចំណាយរបស់អ្នកប្រើប្រាស់ ស្របពេលដែលទីផ្សារការងារដែលកំពុងតែកើនឡើង និងទំនុកចិត្តអ្នកប្រើប្រាស់ខ្ពស់។ និងផ្ទុយមកវិញ ប្រសិនបើទិន្នន័យនៃសូចនាករនេះកើនឡើងខ្ពស់ នោះវាបង្ហាញពីការធ្លាក់ចុះនៃសេដ្ឋកិច្ច និងកាត់បន្ថយតម្រូវការអ្នកប្រើប្រាស់ផងដែរ។ លើសពីនេះ ការទាមទារភាពគ្មានការងារក៏មានឥទ្ធិពលលើការចំណាយរបស់រដ្ឋាភិបាល ការវិនិយោគអាជីវកម្ម និងការប្រែប្រួលទីផ្សារភាគហ៊ុន ដែលទាំងអស់នេះហើយ ទើបបានជាអ្នកបង្កើតគោលនយោបាយ អាជីវកម្ម និងអ្នកវិនិយោគទាំងឡាយប្រើប្រាស់ទិន្នន័យសូចនាករនេះវាយតម្លៃសុខភាពសេដ្ឋកិច្ចទាំងមូល និងធ្វើការសម្រេចចិត្តប្រកបដោយប្រសិទ្ធភាព។ |English Version| ⭐️ Key Takeaways – Initial Jobless Claims data provides insights into the health of the labor market and the overall economy. – Initial Jobless Claims data refers to the number of new unemployment insurance claims filed each week. – Factors that influence this indicator. – The importance of initial jobless claims. – The impact of initial jobless claims on the economy. ⭐️ Understand about Initial Jobless Claims It refers to the number of individuals who have filed for unemployment insurance benefits for the first time during a given period, typically a week. It is an important economic indicator that provides insight into the health of the labor market. ⭐️ When is the initial jobless claims data released? The report is released on Thursday mornings at 7:30 PM (Cambodia Time). ⭐️ The importance of initial jobless claims The initial jobless claims report is important because it is viewed as a leading economic indicator that provides clues about what’s going on in the job market. Moreover, it usually shows an inverse relationship between initial claims and employment. Below are the relationships between initial claims and employment: If the initial jobless claims fall, it means the employment rate tends to increase, or we can say the unemployment rate tends to decrease. This can signal higher disposable income, leading to higher consumption and stronger economic growth. However, if the initial jobless claims rise, it means the employment rate tends to decrease, or we can say the unemployment rate tends to increase. Therefore, it can signal lower disposable income, lower consumption, and weaker economic growth as well. ⭐️ Factors that influence the Initial Jobless Claims The factors that influence initial jobless claims can vary depending on various economic and labor market conditions. However, some common factors that can impact initial jobless claims include: – Economic conditions – Business cycles – Industry-specific factors – Government policies ⭐️ The impact of initial jobless claims on the economy Initial jobless claims are a critical economic indicator reflecting the health of the job market. They directly impact the unemployment rate and consumer spending, with low claims suggesting a growing job market and higher consumer confidence, while high claims indicate economic contraction and reduced consumer demand. Additionally, jobless claims influence government spending, business investment, and stock market volatility, making it crucial for policymakers, businesses, and investors to gauge the overall economic health and make informed decisions.

Type of Securities and Benefits

មានធ្លាប់ឆ្ងល់ទេថា តើយើងគួរតែវិនិយោគលើមូលបត្របែបណាដែលអាចត្រូវនឹងចំណង់ចំណូលចិត្ត គោលដៅហិរញ្ញវត្ថុ ព្រមទាំងស្ថានភាពសេដ្ឋកិច្ចនាពេលបច្ចុប្បន្ន? ដូច្នេះ ក្រឡេកមើលទៅលើប្រភេទនៃមូលបត្រខាងក្រោមនេះ ដើម្បីឈ្វេងយល់នូវចំណេះដឹងបន្ថែមទៀតផ្នែកហិរញ្ញវត្ថុមុនពេលសម្រេចចិត្តក្នុងការវិនិយោគ ព្រមទាំងទទួលបានឱកាសការងារបន្ថែមទៀត។ តើមូលបត្រគឺជាអ្វី? ប្រភេទនៃមូលបត្រ លោកអ្នកអាចចាត់ទុកវាជាឧបករណ៍ហិរញ្ញវត្ថុដែលលោកអ្នកអាចទិញ ឬលក់ដើម្បីទទួលបានផលចំណេញណាមួយ។ ជាក់ស្តែង នេះត្រូវបានគេជួញដូរនៅក្នុងទីផ្សារហិរញ្ញវត្ថុ ហើយអាចប្រើប្រាស់ក្នុងគោលបំណងផ្សេងៗគ្នារួមទាំងការវិនិយោគ ការព្យាករណ៍ និងការការពារហានិភ័យជាដើម។ មូលបត្រមាន 4 ប្រភេទរួមមានមូលបត្រនៅក្នុងមូលធន មូលបត្របំណុល មូលបត្រតាមនិស្សន្ទវត្ថុ ព្រមទាំងមូលបត្រកូនកាត់ដែលមានមុខងារ និងអត្ថប្រយោជន៍ផ្សេងៗគ្នា។ ប្រសិនបើអ្នករំពឹងថានឹងតម្លៃមូលបត្រនោះអាចនឹងកើនឡើងនោះ លោកអ្នកអាចធ្វើការទិញនាពេលឥឡូវនេះ ហើយទទួលបានផលចំណេញមកវិញនៅពេលក្រោយ។ មូលបត្របំណុល ឬមូលបត្រដែលមានប្រាក់ចំណូលថេរ (ទីផ្សារមូលបត្របំណុល) មូលបត្របំណុល គឺប្រៀបដូចជាការផ្តល់ប្រាក់កម្ចីទៅដល់រដ្ឋាភិបាល ឬក្រុមហ៊ុនដូចគ្នាដែលអាចទទួលបានប្រាក់ចំណូលពីអត្រាការប្រាក់ថេរ ជាមួយនឹងមូលនិធិដើមរបស់អ្នកទាំងអស់នៅកាលបរិច្ឆេទជាក់លាក់រៀងៗខ្លួន (ចំណូលការប្រាក់ប្រចាំឆ្នាំ និងចំនួនប្រាក់ដើមនៅកាលបរិច្ឆេទកំណត់មួយ) បើទោះបីជាលទ្ធភាពដែលទទួលបានប្រាក់ចំណេញវិញទាបជាងក៏ដោយ។ មូលបត្របំណុលមានពីរប្រភេទរួមមាន មូលបត្រមកពីរដ្ឋាភិបាល មូលបត្រមកពីទីភ្នាក់ងារសហព័ន្ធ មូលបត្របំណុលមកពីក្រុមហ៊ុន ព្រមទាំងមូលបត្របំណុលរួមគ្នា។ ឧទាហរណ៍ អ្នកបានទិញមូលបត្របំណុល USD 1000 ហើយទទួលបានអត្រាប័ណ្ណ 10% ប្រចាំឆ្នាំសម្រាប់រយៈពេល 10 ឆ្នាំ បន្ទាប់មកអ្នកនឹងទទួលបាន USD 100 ជារៀងរាល់ឆ្នាំ ហើយចុងក្រោយទទួលបាន USD 1000 នៅឆ្នាំទី 10។ មូលបត្រមូលធន (ទីផ្សារភាគហ៊ុន) នៅពេលអ្នកទិញមូលបត្រភាគហ៊ុន លោកអ្នកនឹងមានកម្មសិទ្ធិមួយនៅក្នុងក្រុមហ៊ុននោះដែលមានន័យថាប្រាក់ចំណេញរបស់អ្នកអាស្រ័យទៅលើភាពជោគជ័យក្រុមហ៊ុននោះ និងផ្ទុយមកវិញ។ មូលបត្រនេះអាចនឹងទទួលបានផលចំណេញច្រើន ប៉ុន្តែហានិភ័យដែលអាចមានក៏មានខ្ពស់នោះដែរ។ មូលបត្រនេះមានពីរប្រភេទដូចជាភាគហ៊ុនធម្មតា(Common Stock) និងភាគហ៊ុនបុរិមា(Preferred Stock)។ មូលបត្រកូនកាត់ ឬទីផ្សារកូនកាត់ ប្រសិនបើអ្នកពិបាកក្នុងការសម្រេចចិត្តជ្រើសរើសរវាងមូលបត្រភាគហ៊ុន និងមូលបត្របំណុល លោកអ្នកអាចពិចារណាទៅលើការជ្រើសរើសយកមូលបត្រកូនកាត់នេះបាន ដោយសារតែវាមានការលាយផ្សំលក្ខណៈម្យ៉ាងម្នាក់។ ពួកគេអាចងាយស្រួលក្នុងការបត់បែនតាមចំណង់របស់វិនិយោគិន ទោះបីជាហានិភ័យអាចនឹងមានខ្ពស់ក៏ដោយ។ ភាគហ៊ុនដែលត្រូវបានប្រើប្រាស់ញឹកញាប់បំផុតគឺ មូលបត្របំណុលដែលអាចបំប្លែងបាន(Convertible Bond) ដែលអាចបំលែងពីមូលបត្រទៅជាភាគហ៊ុនធម្មតាបាន ខណៈដែលភាគហ៊ុនបុរិមា(Preferred Stock) នៅក្នុងមូលបត្រកូនកាត់នេះ (Hybrid Security) អាចឲឲ្យវិនិយោគិនផ្លាស់ប្តូរភាគហ៊ុនបុរិមាទៅជាភាគហ៊ុនធម្មតាបាន។ ទីផ្សារដេរីវេ ឬមូលបត្រតាមនិស្សន្ទវត្ថុ ចុងក្រោយគឺ មូលបត្រដេរីវេ ឬមូលបត្រតាមនិស្សន្ទវត្ថុ (Derivative securities)។ លោកអ្នកអាចចាត់ទុកមូលបត្រនេះជាមូលបត្រដែលអាចព្យាករណ៍អំពីតម្លៃនាពេលអនាគតដោយមិនចាំបាច់មានទ្រព្យសម្បត្តិ(ដូចជាភាគហ៊ុន ឬទំនិញវត្ថុធាតុដើម ឬForex) នៅនឹងខ្លួន។ ប្រសិនបើអ្នករំពឹងថាតម្លៃមាសអាចនឹងកើនឡើង នោះអ្នកអាចទិញវានាពេលនេះដើម្បីទទួលបានប្រាក់ចំណេញ និងផ្ទុយមកវិញចំពោះការលក់ចេញ។ ដោយសារតែទីផ្សារដេរីវេនេះជាទីផ្សារដែលអាចទិញផង ឬលក់ផងដោយមិនមានទ្រព្យក្នុងខ្លួន នេះក៏មានន័យថាលោកអ្នកអាចលក់ចេញនូវទ្រព្យណាមួយនៅពេលដែលតម្លៃអាចនឹងធ្លាក់ចុះ (ពេលលក់នោះ លោកអ្នកមិនមានទ្រព្យក្នុងខ្លួននោះទេ មានតែលក់តម្លៃលើទីផ្សារតែប៉ុណ្ណោះ)។ ដូច្នេះ វិនិយោគិនអាចនឹងទទួលបានផលចំណេញទោះបីជាទីផ្សារនោះកើនឡើង ឬធ្លាក់ចុះ។ នៅក្នុងទីផ្សារនេះ មាន 4 ប្រភេទរួមមាន Swps, Options, Future និង Forward។ ការប្រៀបធៀបរវាងទីផ្សារ ដោយផ្អែកលើតារាងខាងលើនេះ នេះបានសបញ្ជាក់ថាវិនិយោគិនអាចជ្រើសរើសប្រភេទទីផ្សារទៅតាមអ្វីដែលពួកគេពេញចិត្ត។ ជាក់ស្តែង ប្រសិនលោកអ្នកជាប្រភេទវិនិយោគិនដែលកំពុងឈ្វេងរកប្រាក់ចំណេញច្រើន លោកអ្នកអាចជ្រើសរើសយកទីផ្សារភាគហ៊ុនដែលរួមមានភាគហ៊ុនធម្មតា និងភាគហ៊ុនបុរិមា។ លើសពីនេះ លោកអ្នកក៏អាចជ្រើសរើសទៅលើទីផ្សារដេរីវេរួមមាន Forex និងវត្ថុធាតុដើមជាដើម បើទោះបីជាទាំងនេះអាចនឹងមានហានិភ័យច្រើនក៏ដោយ។ ហេតុអ្វីត្រូវវិនិយោគលើមូលបត្រ? ការវិនិយោគនេះគឺមានគុណសម្បត្តិច្រើន ជាពិសេសនៅពេលដែលអ្នកនៅក្មេងដោយសារតែ៖ |English Version| Ever wonder how should we invest in securities that match our preferences, financial goal, and current situation? Now, let’s take a quick look at securities types to gain an upper hand on financial literacy, make more informed investment decisions, and explore further career opportunities. What is securities? Type of Securities Think of it as a financial instrument where you can either buy or sell between two parties in order to gain something from it. They are traded on financial markets and can be used for various purposes, including investment, speculation, and hedging. There are 4 types of securities including the equity security, debt security, derivative securities and hybrid security that serves different responsibility and benefits. If you expect to gain profits from any underlying securities, then you will buy now and get the return later. Debt Security or Fixed-income securities (Bond Market) Debt security is like lending money to a government or company where you will receive a fixed interest income with all your principal funds at the respective specific date (Interest income annually and principal amount at the matured date) albeit the potential for high returns is lower. There are two several types of debt security including Government Securities, Federal Agency Securities, Corporate bond,s and municipal bonds. For Example, you purchase the bond USD 1000 and get a coupon rate of 10% annually for 10 years, then you will get USD 100 each year and finally get USD 1000 at year 10. Equity Security (Stock Market) When you purchase in the equity security, you are now a part of ownership which also means that your profit depends on the company’s success and vice versa. They might have high returns but risk is also quite high for this type. There are two types such as common stock and preferred stock. Hybrid Security If you are indecisive between choosing debt or equity security, consider hybrid security, which offers both combined characteristics. They could be convertible and flexible for investor’s preferences, although the risk could be high. The most frequently used are convertible bonds that can be converted bond to shares of the issuing company’s common stocks while preferred stocks in the hybrid security allow the investor to convert their preferred shares into common shares under any circumstance. Derivative Securities Lastly, derivative securities. Think of them as hedging and speculating on future prices without actually owning any underlying assets like a stock, forex, or commodity. If you expect to see an increase in gold prices, then you purchase it for future gains and vice versa for sale. And they work in two ways, unlike other security that need to have actual assets. This means that you can actually sell the derivative assets despite not owning any if you expect to see a decline in their price. Therefore, investors may profit from both rising and falling markets. There are four types Swaps, Options, Future, and Forward. Comparison between security Based on the above figure, this shows how the investor can choose based on their own preferences. For Instance, if the investor is looking for high return, they may look into equity securities including the common stock and preferred stock while derivative securities such as FOREX, Commodities also highly recommended, albeit all of these could pose high risk in return. Why Invest in Securities? There are various reasons as to why choosing to invest, especially in the early stage would be a very good idea.

Difference between Monetary policy and Fiscal policy

ធ្លាប់កត់សម្គាល់ទេថា បម្រែបម្រួលនៃគោលនយោបាយរបស់ធនាគារកណ្តាលក្តី ឬគោលនយោបាយរដ្ឋាភិបាលក្តីតែងតែធ្វើឱ្យសេដ្ឋកិច្ចមានការផ្លាស់ប្តូរពោលគឺអាចនឹងមានការរីកចម្រើនជាងមុន ឬធ្វើឱ្យធ្លាក់ចុះជាងមុនទៅតាមមធ្យោបាយផ្សេងៗគ្នា។ ប៉ុន្តែអ្វីដែលពេញនិយមនោះគឺ គោលនយោបាយរូបិយវត្ថុ និងគោលនយោបាយសារពើពន្ធ។ និយាយឱ្យសាមញ្ញទៅ ពួកគេអាចប្រើប្រាស់វិធីសាស្ត្រទាំងពីរនេះផ្សេងៗគ្នា ឬប្រើប្រាស់ក្នុងពេលវេលាតែមួយក៏បានដើម្បីប្រយុទ្ធប្រឆាំងនឹងបញ្ហាដែលកំពុងប្រឈម ឬត្រូវបានស្គាល់ថាជា “កំណើនសេដ្ឋកិច្ច”។ ខាងក្រោមនេះគឺជាភាពខុសគ្នារវាងគោលនយោបាយរូបិយវត្ថុ និងគោលនយោបាយសារពើពន្ធ។ គោលនយោបាយរូបិយវត្ថុ គោលនយោបាយរូបិយវត្ថុ គឺជាឧបករណ៍ដែលត្រូវបានប្រើប្រាស់ដោយធនាគារកណ្តាលរួមមាន ធនាគារកណ្តាលនៅអាមេរិក ធនាគារកណ្តាលនៅចក្រភពអង់គ្លេស ធនាគារកណ្តាលនៅតំបន់អឺរ៉ុប ឬធនាគារកណ្តាលនៅអូស្ត្រាលីជាដើម។ ដោយពួកគេនឹងធ្វើការផ្លាស់ប្តូរតាមរយៈអត្រាការប្រាក់ និងការផ្គត់ផ្គង់លុយជាចម្បង។ គោលដៅ៖ ***ប្រសិនបើធនាគារកណ្តាលសម្រេចបាននូវអាណត្តិទាំងនេះដោយមិនធ្វើឱ្យកំណើនសេដ្ឋកិច្ចធ្លាក់ក្នុងវិបត្តិសេដ្ឋកិច្ចនោះ គេនឹងចាត់ទុកវាថាជាសេណារីយ៉ូ “Soft Landing” ។ វិធីសាស្រ្តសំខាន់ៗដែលពួកគេនឹងប្រើ៖ អត្រាការប្រាក់៖ បម្រែបម្រួលលើអត្រាប្រាក់កម្ចីពីធនាគារកណ្តាល។ ប្រតិបត្តិការទីផ្សារបើកចំហ៖ ការកែតម្រូវតាមរយៈការផ្គត់ផ្គង់ប្រាក់នៅក្នុងទីផ្សារមូលបត្របំណុល (ទិញ/លក់មូលបត្របំណុលរដ្ឋាភិបាល)។ អត្រាការបម្រុង៖ ភាគរយតំកល់ដែលធនាគារគារពាណិជ្ជតម្រូវឱ្យរក្សាទុក ដើម្បីការពារពីហានិភ័យផ្សេងៗ។ គោលនយោបាយសារពើពន្ធ ខុសពីគោលនយោបាយរូបិយវត្ថុ គោលនយោបាយសារពើពន្ធត្រូវបានអនុញ្ញាតទាំងស្រុងដោយរដ្ឋាភិបាលនៃសេដ្ឋកិច្ចរៀងៗខ្លួន។ គោលដៅ៖ ស្រដៀងគ្នាទៅនឹងគោលនយោបាយរូបិយវត្ថុដែលមានគោលបំណងជំរុញកំណើនសេដ្ឋកិច្ច និងបង្កើនការងារធ្វើ ប៉ុន្តែពួកគេក៏ចង់សម្រេចបាននូវកត្តាផ្សេងទៀតដូចជា៖ វិធីសាស្រ្តសំខាន់ៗដែលពួកគេនឹងប្រើ៖ តើពួកគេអាចប្រើប្រាស់បានដោយរបៀបណា? ក្នុងអំឡុងពេលដែលមានវិបត្តិសេដ្ឋកិច្ច គោលនយោបាយទាំងពីរអាចធ្វើការរួមគ្នាដើម្បីជំរុញតម្រូវការប្រើប្រាស់ និងជំរុញកំណើនសេដ្ឋកិច្ច។ ការបន្ធូរបន្ថយគោលនយោបាយរូបិយវត្ថុ៖ ចាក់បញ្ចូលសាច់ប្រាក់បន្ថែមទៀតទៅក្នុងសេដ្ឋកិច្ច (តាមរយៈទិញប័ណ្ណរដ្ឋាភិបាល) ឬបន្ថយអត្រាការប្រាក់ និងអត្រាទុនបម្រុង។ គោលនយោបាយសារពើពន្ធពង្រីក៖ បង្កើនការចំណាយរបស់រដ្ឋាភិបាល ឬកាត់បន្ថយពន្ធ។ អំឡុងពេលដែលសេដ្ឋកិច្ចកើនឡើងឆាប់រហ័សហើយកើតមានអត្រាអតិផរណាខ្ពស់ ដែលពួកគេអាចនឹងបន្ទាបទៅរកអត្រា 2% តាមរយៈ៖ ឥទ្ធិពលដែលអាចជះទៅ និងរយៈពេល បញ្ហាប្រឈម និងដែនកំណត់៖ គោលនយោបាយសារពើពន្ធ៖ អាចនឹងប៉ះពាល់ដោយសារតែបញ្ហានយោបាយ ព្រមទាំងការពន្យារពេលក្នុងការអនុវត្តជាដើម។ |English Version| Ever noticed a small change from the central bank or government could either bring growth to economics or put it down, which can be seen through plenty of methods and policies they used? However, the main tools we know are monetary policy and fiscal policy. Simply put, there are many methods that can be implemented through using these two, one way or another, or they can also be used both at the same time to combat the fighting they are against or save the so-called “economic growth.” Below are the key differences between monetary policy and fiscal policy. Monetary policy Monetary policy is a tool widely used by the central bank (such as the Federal Reserve, Bank of England, the European Central Bank, or the Reserve Bank of Australia, etc.), primarily focusing on the interest rates and money supply. Goals: If the central bank achieves these mandates without putting the economy into recession, it is called the “soft landing” scenario. Key approaches they used: Fiscal policy Different from monetary policy, fiscal policy is fully authorized by the governments of their respective economies. Goals: Similar to monetary policy, which aims to increase economic growth and maximize employment, however, they also want to achieve other factors such as: Key approaches they used: How do they work together? During a recession, both policies may work together to boost demand consumption and stimulate economic growth. During a peak where high inflation is very concerning, they may try to lower to an annual target rate of 2% through: Affected Speed and Effect Period: Challenges and limitations: Fiscal Policy: Constrained by political consideration and delay to implementation.