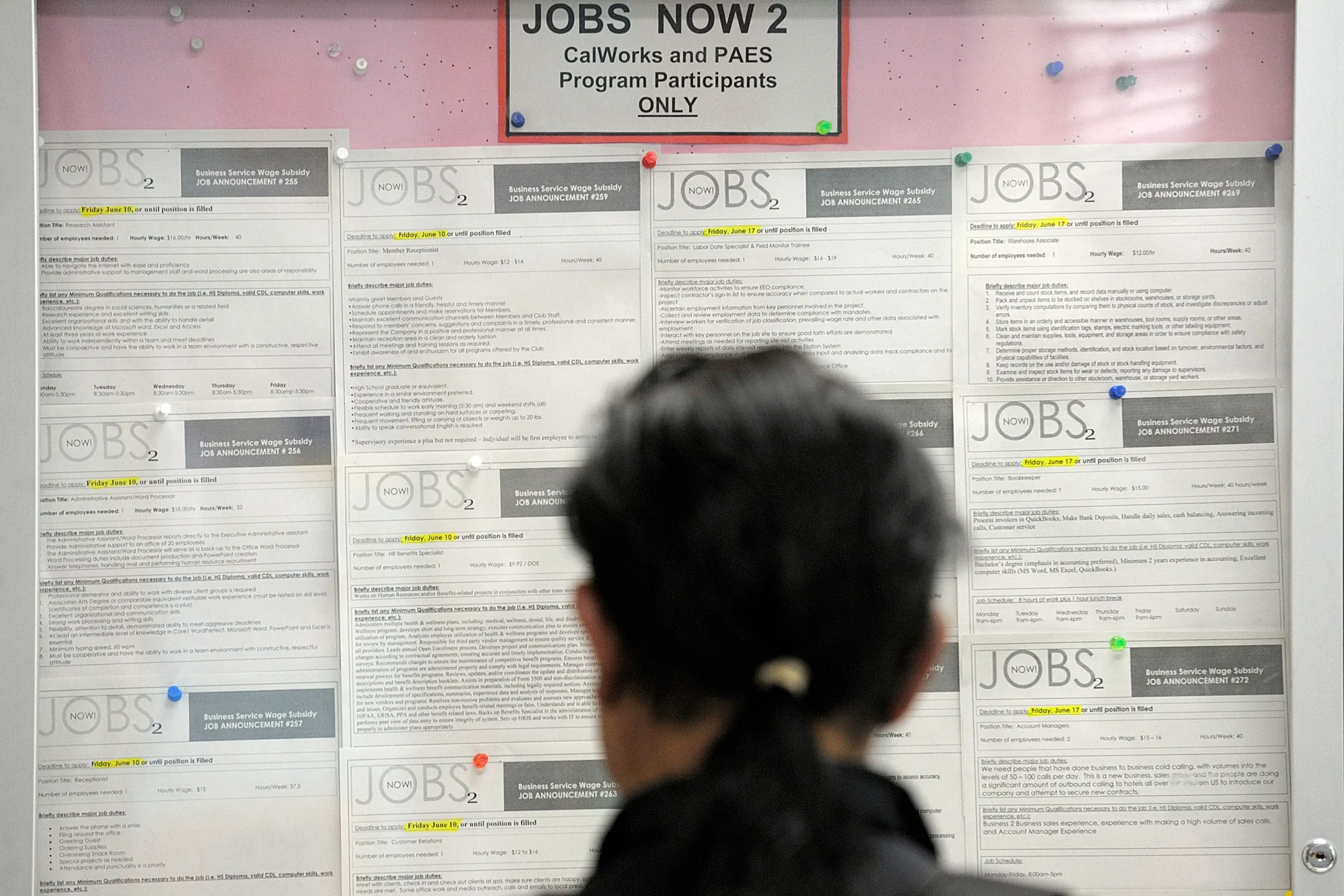

អតិផរណាអាមេរិក ទោះបីជាអត្រាអតិផរណាអាមេរិកមានកម្រិតច្រើនជាងមុនក៏ដោយ ក៏ធនាគារកណ្តាលអាមេរិកនៅតែអាចនឹងកាត់បន្ថយអត្រាការប្រាក់ 4 ដងជាប់គ្នារហូតទៅដល់ខែមករាឆ្នាំ 2026 បន្ទាប់ពីការចេញផ្សាយទិន្នន័យ។ នេះអាចបណ្តាលមកពីភាពទន់ខ្សោយនៃទីផ្សារការងារ ដែលទិន្នន័យការងារដូចជា ទិន្នន័យអ្នកគ្មានការងារធ្វើហើយទាមទារស្វែងរកអត្ថប្រយោជន៍បន្ថែមទៀត មានការកើនឡើងខ្ពស់បំផុតកាលពីយប់មិញ។ នេះបង្ហាញថា ចំនួនអ្នកគ្មានការងារធ្វើនៅតែច្រើននៅអាមេរិក ដោយឆ្លុះបញ្ជាំងពីភាពចុះខ្សោយរបស់ទីផ្សារការងារបន្ថែមទៀត។ នេះក៏មានន័យថាទីផ្សារយប់មិញបានកាត់អត្រាការប្រាក់ដោយសារទីផ្សារការងារខ្សោយជាងមុនជាជាងទៅលើបញ្ហាអតិផរណា។ ក្នុងករណីធម្មតា អតិផរណាដែលខ្លាំងជាងមុននឹងធ្វើឱ្យលទ្ធភាពនៃការកាត់បន្ថយអត្រាការប្រាក់កាន់តែតិចជាងមុន ប៉ុន្តែក្នុងលក្ខខណ្ឌនេះគឺទីផ្សារការងារខ្សោយខ្លាំងពេក ដែលធ្វើឱ្យការកាត់នេះកាន់តែមានច្រើន។ ម្យ៉ាងវិញទៀត កាលណាទីផ្សារការងារកាន់តែធ្លាក់ចុះ តម្រូវការក៏កាន់តែតិច ពេលនោះហើយដែលអត្រាអតិផរណាកាន់តែទាបដូចគ្នា។ ខាងក្រោមនេះគឺជាប្រូបាប៊ីលីតេដែលទីផ្សារបានកំណត់តម្លៃបន្ទាប់ពីការចេញផ្សាយទិន្នន័យ។ ធនាគារកណ្តាលអាមេរិក លោក Trump ក៏បានស្នើសុំឱ្យតុលាការឧទ្ធរណ៍សហព័ន្ធដកអភិបាលសហព័ន្ធលោកស្រី Lisa Cook ចេញពីតំណែងមុនការសម្រេចអត្រាការប្រាក់នៅថ្ងៃទី 18 ខែកញ្ញា ឆ្នាំ 2025 វេលាម៉ោង 1:00 ព្រឹក ម៉ោងនៅកម្ពុជា។ ទោះជាយ៉ាងណាក៏ដោយ យោងតាមមេធាវីរបស់លោកស្រី Cook ទង្វើនេះទំនងជានឹងផ្តល់ផលប៉ះពាល់យ៉ាងធ្ងន់ធ្ងរដល់លក្ខខណ្ឌទីផ្សារ ជាពិសេសនៅពេលដែលភាពមិនច្បាស់លាស់នៅក្នុងទីផ្សារមានកាន់តែច្រើន។ ធនាគារកណ្តាលអឺរ៉ុប (ECB) ធនាគារកណ្តាលអឺរ៉ុប (ECB) បានរក្សាអត្រាការប្រាក់នៅកម្រិត 2.15% ខណៈដែលពួកគេមានទំនុកចិត្តកាន់តែច្រើននៅក្នុងកំណើនសេដ្ឋកិច្ច ហើយអត្រាអតិផរណាឥឡូវនេះកំពុងឈានដល់កម្រិតគោលដៅដូចគ្នា។ សម្រាប់ពេលនេះ មនុស្សមួយចំនួនបានកាត់បន្ថយប្រូបាប៊ីលីតេលើការបន្ទាបអត្រាការប្រាក់នៅឆ្នាំ 2026 ពី 60% ទៅ 50% ហើយនេះក៏មានន័យថាពួកគេកំពុងបង្ហាញសញ្ញានៃការបញ្ចប់វដ្តនៃការកាត់បន្ថយអត្រាការប្រាក់ដូចគ្នា។ ហេតុដូច្នេះហើយ នេះបាននាំឱ្យ EURUSD មានការកើនឡើង បន្ទាប់ពីសុន្ទរកថារបស់ប្រធាន ECB Lagarde ត្រូវបានចេញផ្សាយ។ ពន្ធ គ្រប់គ្នាកំពុងមានគោលដៅដាក់ពន្ធលើក្រុមហ៊ុនផលិតរថយន្តរបស់ចិន។ តួយ៉ាង ម៉ិកស៊ិកបង្កើនពន្ធរហូតដល់ 50% លើរថយន្ត និងផលិតផលផ្សេងទៀត ខណៈដែលសហរដ្ឋអាមេរិកក៏បានដាក់សម្ពាធលើប្រទេស G-7 ឱ្យដាក់ពន្ធខ្ពស់លើឥណ្ឌា និងចិនផងដែរ។ យោងតាមមតិរបស់ Bloomberg “ក្រុមហ៊ុនផលិតរថយន្តរបស់ប្រទេសចិនកំពុងកាត់បន្ថយតម្លៃផលិតកម្មទាបជាងមុន” ក៏មានន័យថា ទោះបីជាមានពន្ធគយក្តី ក៏ប្រទេសចិននៅតែអាចលក់ទំនិញនេះបានដូចគ្នា។ ពោលគឺ មិនរងផលប៉ះពាល់ច្រើនទេនៅក្នុងប្រទេសចិន។ ទោះជាយ៉ាងណាក៏ដោយ យោងតាមរដ្ឋមន្ត្រីពាណិជ្ជកម្មអាមេរិកលោក Lutnich “ជនជាតិអឺរ៉ុបនឹងរារាំងរថយន្តចិន។ រថយន្តចិនមិនមានការប្រកួតប្រជែងទេ ពួកគេត្រូវបានគាំទ្រដោយរដ្ឋាភិបាល”។ សម្រាប់ពេលនេះ យើងមិនប្រាកដទេ ប៉ុន្តែទិន្នន័យពីរដ្ឋមន្ត្រីសេដ្ឋកិច្ចបាននិយាយថា “អ្នកនាំចេញអាស៊ីមួយចំនួននឹងប៉ះពាល់តែ 8.6% នៃពាណិជ្ជកម្មបរទេសម៉ិកស៊ិកប៉ុណ្ណោះ” ។ អុីស្រាអែល-កាតា សហរដ្ឋអាមេរិក ដែលជាសម្ព័ន្ធមិត្តជិតស្និទ្ធបំផុតជាមួយអុីស្រាអែល រួមជាមួយនឹងសមាជិកផ្សេងទៀត កំពុងអំពាវនាវឱ្យមានការបន្ធូរបន្ថយជម្លោះចុងក្រោយរវាងអុីស្រាអែល និងកាតា។ អុីស្រាអែលបានវាយលុកប្រទេសផ្សេងទៀតជាច្រើនដង រួមទាំងកាតា យេម៉ែន ហ្គាហ្សា និងប្រទេសជាច្រើនទៀត ដែលនាំឱ្យក្រុមប្រឹក្សាសន្តិសុខអង្គការសហប្រជាជាតិ ថ្កោលទោសចំពោះទង្វើឈ្លានពានរបស់ខ្លួន។ សូម្បីតែសហរដ្ឋអាមេរិក ដែលពីមុនតែងតែការពារអុីស្រាអែល ឥឡូវនេះក៏ចាប់ផ្តើមបង្ហាញការស្តីបន្ទោសយ៉ាងខ្លាំងក្លាប្រឆាំងនឹងទង្វើនេះផងដែរ ពោលគឺសហរដ្ឋអាមេរិកចាប់ផ្តើមដកថយពីអុីស្រាអែល នៅពេលនិយាយអំពីការវាយប្រហារលើប្រទេសកាតា។ ទោះជាយ៉ាងនេះក្តី កាតាប្តេជ្ញាដោះស្រាយជម្លោះការទូតនេះ ក្នុងកិច្ចប្រឹងប្រែងដើម្បីបញ្ឈប់ការបង្ហូរឈាមនៅហ្គាហ្សា។ |English Version| US inflation Despite having a hotter inflation headline, the Federal Reserve still priced in four straight rate cuts until January 2026 by 25 bps each time right after the data release. This could be a result of a weakening in the labor market conditions, as proven by the undeniable increase in the jobless claims data last night. Initial jobless claims rose to the highest since more than 3 years, indicating higher layoff activities in the United States and raising doubts on the cracking form in labor market. This also means that the market last night priced in the rate cut due to the weak labor market rather than the inflation. In a normal case, stronger inflation would scale back on the rate cuts, but due to weak labor, the rate cut is higher. In other terms, they plan to let the cracking labor market diminish the demand, consumption, and inflation data instead. Below is the probability that the market priced in after the data release. The Federal Reserve Trump also requested the Federal appeals court to remove the Federal Governor Lisa Cook from her position ahead of the Federal Reserve rate decision by September 18, 2025, at 1:00 AM Cambodia time. However, as per Cook’s lawyer, this act will likely deliver a major blow to the market conditions in return, especially when things are not certain lately. The European Central Bank (ECB) The ECB maintained the interest rate at 2.15% as they gained more confidence in the economic growth while the inflation rate is now reaching the desirable level amid the uncertainty reduction. For now, the trade bets on ending the rate cut cycles by lowering the probability of an interest rate cut in 2026 from 60% to 50%. Therefore, this led to the EURUSD strengthening after the ECB President Lagarde’s speeches were released. Tariffs Everyone is aiming for China’s auto manufacturer tariff with Mexico to increase the tariffs up to 50% on cars and other products, while the US also pressures G-7 countries to impose higher tariffs on India and China as well. In accordance with Bloomberg’s opinions, “China’s auto manufacturers’ inherently lower production costs” also mean that even with tariffs, their cars are still competitive with others. Aka—not much affected in China. However, according to US Commerce Secretary Lutnich, “The Europeans will block Chinese cars; they’ll learn. Chinese cars are not competitive; they’re government-backed.” For now, we are unsure, but the data from the economy minister said that “some Asian exporters will only affect 8.6% of Mexican foreign trade.” Israel-Qatar The United States, the closest ally to Israel, along with other members, is calling for the de-escalation of the last conflict between Israel and Qatar. Israel has been repeatedly assaulting/invading other countries, including Qatar, Yemen, Gaza, and more, which has led the United Nations Security Council to condemn its aggressive acts. Even the United States, which previously defended Israel, now also begins to show a strong rebuke against this act as well—aka, the US distances itself when it comes to the attack on Qatar. Regardless, Qatar commits to solving this conflict diplomatically in the effort to stop the bloodshed in Gaza.

What to expect: The ECB rate decision and US Inflation Headline

ការសម្រេចចិត្តលើអត្រាការប្រាក់របស់ធនាគារកណ្តាលអឺរ៉ុប (ECB) តាមដានទៅលើការសម្រេចចិត្តលើអត្រាការប្រាក់របស់ធនាគារកណ្តាលអឺរ៉ុបនៅវេលាម៉ោង 7:15 PM នៅកម្ពុជា ដោយភាគច្រើនជឿជាក់ថាអាចនឹងរក្សាក្នុងកម្រិតដដែល។ នេះអាចដោយសារតែអត្រាអតិផរណារបស់សហភាពអឺរ៉ុបនាពេលបច្ចុប្បន្នកំពុងមានកម្រិតប្រហែលអត្រាគោលដៅចំនួន 2% ដែលអាចជាសញ្ញាមួយដែលធនាគារកណ្តាលកំពុងសម្រេចបាននូវអត្រាគោលដៅប្រចាំឆ្នាំ។ ប៉ុន្តែពួកគេនៅតែមានក្តីបារម្ភចំពោះបញ្ហាអតិផរណា។ លើសពីនេះ របាយការណ៍សន្ទស្សន៍អ្នកគ្រប់គ្រងការទិញបានលើកឡើងពីក្តីបារម្ភទៅលើបញ្ហាតម្លៃក្នុងសេដ្ឋកិច្ច ព្រមទាំងកង្វះផលិតភាពការងារ ដូច្នេះការរក្សាអត្រាការប្រាក់ក្នុងកម្រិតដដែលនេះ អាចនឹងផ្តល់ពេលវេលាមួយចំនួនសម្រាប់ធនាគារកណ្តាលក្នុងការតាមដានទៅលើបញ្ហានេះបន្ថែមទៀត។ ពោលគឺ អាចរក្សាអតិផរណាក្នុងកម្រិតទាបបានដោយមិនរឹតបន្តឹងតឹងពេក ស្របពេលដែលអាចឱ្យកំណើនសេដ្ឋកិច្ចមានសភាពល្អប្រសើរដូចគ្នា។ ដូច្នេះ តាមដានសេចក្តីថ្លែងការណ៍របស់ធនាគារកណ្តាល និងស្វែងរកបញ្ហាដែលពួកគេកំពុងប្រឈមមុខ។ អត្រាអតិផរណារបស់សហរដ្ឋអាមេរិក ក្រៅពីនេះ ទិន្នន័យអតិផរណានៅអាមេរិកក៏នឹងចេញផ្សាយនៅម៉ោង 7:30 PM ម៉ោងនៅកម្ពុជា ហើយគេជឿជាក់ថា អាចនឹងមានការកើនឡើងច្រើនជាងកម្រិតពីមុន។ សូមបញ្ជាក់ផងដែរថា ទិន្នន័យអតិផរណាមកពីអ្នកផលិតកាលពីយប់មិញមានកម្រិតតិចជាងកម្រិតរំពឹងទុក ប៉ុន្តែទីផ្សារមិនសូវមានប្រតិកម្មខ្លាំងនោះទេ។ ដូច្នេះគំនិតរបស់ខ្ញុំគឺ៖ |English Version| The ECB rate decision Checking in for the European Central Bank rate decision tonight at 7:15 pm Cambodia time, with many widely anticipating to see an unchanged rate decision. This comes as the EU’s inflation is now skewing around the restrictive rate of 2%, which could be a sign that the ECB has finally reached the annual target rate. But the tariff concern shall also be monitored regardless. The purchasing managers’ index report has raised some concerns about the pricing and labor productivity shortage; having such a steady rate would leverage them to even hold the inflation tight but not too tight, while leaving some breathing room for the economy to grow as well. Therefore, focus on the statement and find the current pain point from the central bank’s perspective. US Inflation Headline Followed by major US inflation data released at 7:30 PM Cambodian time, with many widely anticipating seeing some rising inflationary pressures on consumption tonight. Last night, wholesale inflation data came in softer than expected, yet the market did not react much. So my thought here is:

Market Pulse: Inflation, Tariffs, and Geopolitical Risks

ទោះបីជាសន្ទស្សន៍តម្លៃអ្នកផលិតនៅអាមេរិកចេញផ្សាយមានកម្រិតទាបជាងមុនកាលពីម្សិលមិញក៏ដោយ ក៏តម្លៃមាសហាក់ដូចជាមិនមានបម្រែបម្រួលខ្លាំងនោះដែរ។ នេះត្រូវបានគេសម្គាល់ថា វិនិយោគិនជាច្រើនកំពុងរង់ចាំទៅលើទិន្នន័យអតិផរណាដ៏ធំមួយទៀតនាយប់នេះ គឺសន្ទស្សន៍តម្លៃទំនិញប្រើប្រាស់ ដោយវាអាចបង្ហាញពីទិសដៅរបស់ធនាគារកណ្តាលអាមេរិកសម្រាប់កិច្ចប្រជុំបន្ទាប់។ ការកាត់បន្ថយអត្រាការប្រាក់ខែកញ្ញាបានកំណត់តម្លៃរួចហើយ ប៉ុន្តែសម្រាប់ខែតុលា និងខែធ្នូវិញ? នោះជាសំណួរដែលត្រូវតាមដាន។ យោងតាមនាយកប្រតិបត្តិក្រុមហ៊ុន Goldman Sachs លោក David Solomon បានលើកឡើងថា “ខ្ញុំនឹងរំពឹងថានឹងមានការកាត់បន្ថយ 25 bps ហើយខ្ញុំគិតថាអ្នកអាចឃើញការកាត់មួយឬពីរផ្សេងទៀត”។ នេះអាចបណ្តាលមកពីការព្រួយបារម្ភអំពីពន្ធនាពេលថ្មីៗនេះ។ និយាយអំពីបញ្ហាពន្ធនេះ ម៉ិកស៊ិកគ្រោងនឹងដំឡើងពន្ធលើរថយន្តពីអាស៊ី ជាពិសេសផ្តោតលើប្រទេសចិនរហូតដល់ 50% ដែលបង្កឱ្យមានភាពតានតឹងខ្លះសម្រាប់កិច្ចព្រមព្រៀងពាណិជ្ជកម្ម ខណៈដែលម៉ិកស៊ិកបានក្លាយជាទិសដៅធំបំផុតសម្រាប់រថយន្តពីប្រទេសចិន។ ចំពោះប្រទេសផ្សេងទៀតដូចជាសហរដ្ឋអាមេរិក និងកាណាដា ពួកគេទំនងជាមិនរងផលប៉ះពាល់ដោយសារកតិកាសញ្ញាពាណិជ្ជកម្មសេរី ដែលត្រូវបានគេស្គាល់ថា USMCA។ ទន្ទឹមនឹងនេះដែរ លោកប្រធានាធិបតី Donald Trump បានជំរុញឱ្យ EU ដាក់ពន្ធ 100% លើឥណ្ឌា និងចិនសម្រាប់ការទិញប្រេងពីរុស្ស៊ី ទោះបីជាមនុស្សជាច្រើននៅតែជឿថាតំបន់អឺរ៉ុបអាចនឹងបដិសេធនឹងសំណើរនេះក៏ដោយ។ ចំណែកប្រទេសរុស្ស៊ី និងអ៊ុយក្រែនវិញ។ ប្រទេសរុស្ស៊ីនៅតែបន្តបំពានដែនអាកាសរបស់ប៉ូឡូញ ហើយប៉ូឡូញបានបាញ់ទម្លាក់យន្តហោះគ្មានមនុស្សបើករបស់រុស្ស៊ីចំនួន 4 ក្នុងចំណោម 19 គ្រឿង។ ជាក់ស្តែង នៅពេលដែលការឈ្លានពាននៅតែបន្ត ប៉ូឡូញក៏ទទួលបានការគាំទ្រយ៉ាងច្រើនសម្រាប់វិស័យការពារដែនអាកាសពីសម្ព័ន្ធមិត្តរបស់សហភាពអឺរ៉ុបផងដែរ។ ហើយសម្រាប់លោក Trump វិញ ឥឡូវនេះគាត់ទទួលស្គាល់ការឈ្លានពានដែលរុស្ស៊ីមានលើប៉ូឡូញខណៈពេលដែលមនុស្សជាច្រើនរំពឹងថានឹងឃើញការកើនឡើងភាពតានតឹង និងការឆ្លើយតបកាន់តែច្រើនពី Trump ។ ទន្ទឹមនឹងនេះ អុីស្រាអែល និងកាតាកំពុងស្ថិតនៅក្នុងស្ថានភាពតានតឹង ដោយប្រទេសកាតាបានផ្ញើលិខិត និងរាយការណ៍ពី “ការបំពានដ៏គួរឱ្យភ្ញាក់ផ្អើល” របស់អុីស្រាអែលទៅកាន់អង្គការសហប្រជាជាតិ ដោយលើកឡើងថាលោក Netanyahu កំពុងដឹកនាំមជ្ឈឹមបូព៌ាចូលទៅក្នុងភាពវឹកវរ។ ហើយអុីស្រាអែលក៏បានចេញការព្រមានដល់ប្រទេសកាតា និងប្រទេសដទៃទៀតដែរ។ ក្នុងពេលជាមួយគ្នានោះ អុីស្រាអែលនៅតែឈ្លានពានយេម៉ែន ដោយមានមនុស្ស 35 នាក់ត្រូវបានសម្លាប់។ |English Version| Despite having a softer print in the producer price index, which is known for the wholesale inflation last night, the gold price did not seem to move much. This could be seen as the act that the investor really awaits for tonight’s big inflation headline—consumer price index, as this will signal the Federal Reserve’s motive for the next meeting. The September rate cut is already priced in, but for the October and December? That’s the real question. As per Goldman Sachs CEO David Solomon, “I would expect a 25 bps cut, and I think you could see one or two other cuts.” This could be due to the recent tariff concerns. Speaking of the tariffs, Mexico plans to hike the tariffs on cars from Asia, specifically targeting China, up to 50%, causing some tension for the trade agreement, as Mexico has become the biggest destination for cars from China. As for other countries such as the US and Canada, they are very unlikely to be affected due to a free-trade pact, known as the USMCA. Meanwhile, President Donald Trump urged the EU to impose a 100% on India and China for purchasing Russian oil, although many still believe this is very likely to be rejected. And for Russia and Ukraine, updated, Russia continues to violate Poland’s airspace, and Poland has shot down 4 out of at least 19 Russian drones. In fact, as the intrusion continues, Poland has received plenty of support for the air defense from the EU allies as well. And for Trump, he now acknowledges the invasion that Russia had on Poland, while many were expecting to see more escalation and response from Trump. Meanwhile, Israel and Qatar are leaning toward a tough time, with Qatar sending out the letter and reporting Israel’s “flagrant violation” to the UN, citing that Israel’s Netanyahu is leading the Middle East into Chaos. And Israel is issuing a warning to Qatar and other nations. At the same time, Israel still invaded Yemen, with 35 people were killed.

US Jobs Data Signals Rate Cuts, Israel-Qatar tensions rise, global trade and conflict escalate.

ស្តង់ដារប្រាក់ខែរបស់សហរដ្ឋអាមេរិក កំណើនការងារនៅសហរដ្ឋអាមេរិកសម្រាប់ឆ្នាំបញ្ចប់ខែមីនា ឆ្នាំ 2025 គឺមានភាពទន់ខ្សោយជាងការរាយការណ៍ដំបូង ដោយចំនួនប្រាក់បៀវត្សរ៍ត្រូវបានគេរំពឹងថានឹងត្រូវបានធ្លាក់ចុះចំនួន 911,000 ។ នេះបង្ហាញពីភាពទន់ខ្សោយនៃទីផ្សារការងារ ដែលគាំទ្រឱ្យធនាគារកណ្តាលអាមេរិកក្នុងការបន្ទាបអត្រាការប្រាក់សម្រាប់ឆ្នាំនេះ នេះបើយោងតាមលោក Sal Guatieri របស់ BMO Capital Markets ។ សូម្បីតែនាយកប្រតិបត្តិរបស់ក្រុមហ៊ុន JP Morgan លោក Dimon ក៏បានលើកឡើងថា ទិន្នន័យនេះកំពុងចុះខ្សោយនោះដែរ។ ទោះជាយ៉ាងណាក៏ដោយ អ្នកខ្លះក៏បានអះអាងដែរថា ទិន្នន័យនេះភាគច្រើនផ្អែកលើកំណត់ត្រាធានារ៉ាប់រងភាពអត់ការងារធ្វើ ដោយមិនរាប់បញ្ចូលកម្មករដែលគ្មានឯកសារដូចជា អន្តោប្រវេសន៍ជាដើម។ សរុបមក ទីផ្សារការងារត្រូវបានបង្ហាញថាខ្សោយ ហើយគាំទ្រការកាត់បន្ថយអត្រាការប្រាក់របស់ធនាគារកណ្តាលអាមេរិក។ អុីស្រាអែល-កាតា៖ ទោះបីជាប៉ុស្តិ៍លេខ 12 របស់អុីស្រាអែលបានរាយការណ៍ថាការវាយប្រហារតាមផ្លូវអាកាសនាពេលថ្មីៗនេះរបស់អុីស្រាអែលនៅក្នុងប្រទេសកាតាត្រូវបានអនុម័តដោយប្រធានាធិបតីលោក Donald Trump ក៏ដោយ ក៏ Trump ក្រោយមកបានបញ្ជាក់ពីការសម្រេចចិត្តនេះគឺរបស់លោក Netanyahu តែម្នាក់ឯងមិនមែនរបស់គាត់ទេ។ លើសពីនេះ រូបលោកក៏បានផ្តល់សញ្ញាថានឹងមានការថ្លែងសេចក្តីថ្លែងការណ៍ពេញលេញអំពីអុីស្រាអែលនៅថ្ងៃស្អែកនោះដែរ។ ទន្ទឹមនឹងនេះដែរ ក្រសួងមហាផ្ទៃរបស់ប្រទេសកាតាបានរាយការណ៍ថា សមាជិកកងកម្លាំងសន្តិសុខម្នាក់បានស្លាប់ក្នុងអំឡុងពេលធ្វើកូដកម្ម និងអ្នកផ្សេងទៀតបានរងរបួស។ នេះបានថ្កោលទោសការវាយប្រហារនេះ ថាជាការរំលោភលើអធិបតេយ្យភាព និងច្បាប់អន្តរជាតិ ដោយបដិសេធការព្រមានពីមុន ស្របពេលដែលប្រទេសកាតាអាចនឹងរក្សាសិទ្ធិក្នុងការឆ្លើយតបត្រឡប់ទៅវិញ។ → ភាពតានតឹងមួយចំនួនកំពុងកើនឡើងពីការវាយប្រហារនេះ ប៉ុន្តែតម្លៃមាសមិ នមានបម្រែបម្រួលខ្លាំងនោះទេ។ រុស្ស៊ី-អ៊ុយក្រែន៖ ខណៈពេលដែលការវាយប្រហារតាមផ្លូវអាកាសរបស់រុស្ស៊ីយ៉ាងព្រៃផ្សៃបានសម្លាប់ជនស៊ីវិលវ័យចំណាស់ 24 នាក់កាលពីថ្ងៃអង្គារ យន្តហោះគ្មានមនុស្សបើករបស់រុស្ស៊ីក៏បានរំលោភលើដែនអាកាសប៉ូឡូញក្នុងអំឡុងពេលវាយប្រហារលើអ៊ុយក្រែន ដែលនាំឱ្យប៉ូឡូញបានប្រើប្រាស់យន្តហោះចម្បាំងរបស់អង្គការណាតូ បង្កើនការការពារដែនអាកាស និងបិទអាកាសយានដ្ឋានជាបណ្តោះអាសន្ន។ នាយករដ្ឋមន្ត្រីប៉ូឡូញបានប្រកាសបិទព្រំដែនជាមួយបេឡារុស្សចាប់ផ្តើមពីថ្ងៃព្រហស្បតិ៍ដោយសារតែការឈ្លានពានរបស់រុស្ស៊ីនិងបេឡារុស្ស។ ជាក់ស្តែងទៅ ប្រធានាធិបតី Karol Nawrocki ជឿថាលោក ពូទីន ប្រហែលជាត្រៀមខ្លួនដើម្បីឈ្លានពានប្រទេសដទៃទៀត។ តុលាការរារាំងលោក Trump ក្នុងការបណ្តេញអភិបាលធនាគារកណ្តាលអាមេរិកលោកស្រី Lisa Cook ចៅក្រមសហរដ្ឋអាមេរិកបានបញ្ឈប់ជាបណ្តោះអាសន្ននូវការប៉ុនប៉ងរបស់លោក Trump ក្នុងការបណ្តេញអភិបាលធនាគារកណ្តាលលោកស្រី Lisa Cook ដោយសម្រេចថាគាត់ទំនងជាខ្វះហេតុផលគ្រប់គ្រាន់ដោយផ្អែកលើការចោទប្រកាន់ពីការក្លែងបន្លំប្រាក់កម្ចីទិញផ្ទះ ពោលគឺកង្វះភស្តុតាង។ |English Version| US payroll benchmark US job growth for the year ending March 2025 was significantly weaker than initially reported, with payrolls expected to be revised down by a record 911,000. This signals a prolonged period of modest growth and a weaker labor market, supporting the case for Federal Reserve rate cuts, according to BMO Capital Markets’ Sal Guatieri. Even the JP Morgan CEO Dimon also suggested that this data is weakening. However, some also argued that the data is mainly based on unemployment insurance records, excluding the undocumented workers such as immigrations. In short, the labor market is proven to be weak, and supports the FED Fund rate cut. Israel-Qatar: Despite Israeli channel 12 reported that Israel’s recent airstrike in Qatar was approved by President Donald Trump, Trump later clarified the decision was Netanyahu’s alone, not his, while signalling that he will give a full statement of Israel tomorrow. Meanwhile, Qatar’s Interior Ministry reported one security force member killed during the strike, with others injured; it condemned the “cowardly” assault as a violation of sovereignty and international law, denying prior warnings and reserving the right to respond. → Some tension is rising from this attack, and the gold has not reached much. Russia-Ukraine Update: While a Russian airstrike brutally killed 24 elderly civilians on Tuesday, Russian drones also violated Polish airspace during strikes on Ukraine, leading Poland to scramble NATO warplanes, heighten air defenses, and close airports temporarily. Poland’s Prime Minister announced a border closure with Belarus starting Thursday due to aggressive Russia-Belarus “Zapad” military drills. In fact, President Karol Nawrocki believes that Vladimir Putin may be prepared to invade other nations Court Blocks Trump’s Bid to Remove Fed Governor Lisa Cook The U.S. judge temporarily halted Trump’s attempt to dismiss Federal Reserve Governor Lisa Cook, ruling he likely lacked sufficient cause based on unproven mortgage fraud allegations from a Trump ally—aka lack of evidence.

Gold Price Direction for September 2025

របាយការណ៍នេះនឹងផ្តល់នូវការវិភាគអំពីកត្តាចម្បងដែលជះឥទ្ធិពលលើតម្លៃមាស និងឱកាសមួយចំនួនចំពោះគូរូបិយប័ណ្ណ USDJPY សម្រាប់វិនិយោគិន។ ***ព័ត៌មានទាំងអស់ដែលបង្ហាញគឺសម្រាប់ក្នុងគោលបំណងអប់រំតែប៉ុណ្ណោះ ហើយមិនគួរត្រូវប្រើប្រាស់ជាដំបូន្មានហិរញ្ញវត្ថុ ឬការណែនាំសម្រាប់ការសម្រេចចិត្តលើការជួញដូរ ឬការវិនិយោគនោះទេ។ ការវិភាគជាមូលដ្ឋាន ឬការវិភាគបែបសេដ្ឋកិច្ច ការសង្ខេបស្ថានភាពសេដ្ឋកិច្ចពីមុន៖ ស្ថានភាពសេដ្ឋកិច្ចអាមេរិកបច្ចុប្បន្នកំពុងបង្ហាញពីភាពទន់ខ្សោយមួយចំនួន ដូចជាភាពថមថយនៃទីផ្សារការងារ ស្របពេលដែលអត្រាអតិផរណាមានកម្រិតលើសពីកម្រិតគោលដៅចំនួន 2%។ ពោលគឺទាំងនេះ បានជំរុញឱ្យធនាគារកណ្តាលអាមេរិកធ្វើការកាត់បន្ថយអត្រាការប្រាក់ចំនួន 3 ដងក្នុងឆ្នាំនេះ ដោយនឹងចាប់ផ្តើមក្នុងខែកញ្ញា ខែតុលា និងខែធ្នូ។ អ្វីដែលសំខាន់នោះគឺថា បុគ្គលល្បីនៅក្នុងទីផ្សារក៏កំពុងមានការសង្ស័យមួយចំនួនទៅលើស្ថានភាពសេដ្ឋកិច្ចអាមេរិកនោះដែរ ពោលគឺក្រុមហ៊ុន JPMorgan រំពឹងថានឹងឃើញការលក់ចេញមួយចំនួននៅក្នុងទីផ្សារភាគហ៊ុនអាមេរិក ខណៈដែលលោក Ray Dalio បានព្រមានអំពីសក្តានុពលនៃការធ្លាក់ចុះនៅលើ ‘ដំណាក់កាលទីប្រាំ’ ដ៏គ្រោះថ្នាក់ខ្ពស់(មានន័យថា សេដ្ឋកិច្ចអាចនឹងប្រឈមមុខនឹងបញ្ហានាពេលខាងមុខ)។ លើសពីនេះ ការព្រួយបារម្ភអំពីទីផ្សារលំនៅឋាន ការកើនឡើងបំណុលជាតិ និងសក្តានុពលនៃការសងប្រាក់វិញចំនួន 1 ទ្រីលានដុល្លារ (ប្រសិនបើតុលាការអាមេរិកពិតជាសម្រេចថាលោក Trump ធ្វើខុសច្បាប់ដាក់ពន្ធមែននោះ) ទាំងអស់នេះអាចរុញច្រានសេដ្ឋកិច្ចអាមេរិកឱ្យកាន់តែអាក្រក់ជាងនេះបានមួយកម្រិតទៀត។ ដូច្នេះ វាសនាសេដ្ឋកិច្ចអាមេរិកនឹងធ្លាក់មកលើការសម្រេចចិត្តលើអត្រាការប្រាក់របស់ធនាគារកណ្តាលអាមេរិក ខណៈពេលដែលធនាគារកណ្តាលជប៉ុនក៏នឹងត្រូវបានគេតាមដានយ៉ាងសកម្មនោះដែរ ដោយសារតែវាប៉ះពាល់ទៅលើភាពតានតឹងនៅក្នុងទីផ្សារ។ ការសម្រេចចិត្តអត្រាការប្រាក់របស់ធនាគារកណ្តាលសំខាន់ៗចំនួន 7 ក្នុងរយៈពេលមួយខែ ទីមួយផ្តោតលើធនាគារកណ្តាលអាេមរិក។ សន្ទស្សន៍តម្លៃអ្នកប្រើប្រាស់ចុងក្រោយ និងសន្ទស្សន៍តម្លៃអ្នកផលិតក្នុងខែនេះនឹងក្លាយជាទិន្នន័យចុងក្រោយដែលត្រូវពិចារណា មុនពេលធនាគារកណ្តាលអាមេរិកសម្រេចចិត្តលើអត្រាការប្រាក់។ → កិច្ចប្រជុំ FED លើកក្រោយគឺនៅថ្ងៃទី 18 ខែកញ្ញា ឆ្នាំ 2025។ ការថយចុះអត្រាការប្រាក់នឹងអាចនាំទៅរកភាពទន់ខ្សោយនៃប្រាក់ដុល្លារអាមេរិក និងបង្កើនតម្លៃមាសកាន់តែខ្ពស់។ ទីពីរ ផ្តោតលើធនាគារកណ្តាលជប៉ុន។ គិតត្រឹមថ្ងៃអាទិត្យនេះ នាយករដ្ឋមន្ត្រីជប៉ុន Shigeru Ishiba បានសម្រេចចិត្តលាលែងពីតំណែងបន្ទាប់ពីការចរចាចុងក្រោយរបស់គាត់ជាមួយប្រធានាធិបតី Donald Trump ដោយបានទម្លាក់ពន្ធពី 25% ទៅ 15% ។ ការផ្លាស់ប្តូរនាយករដ្ឋមន្ត្រីអាចជាទង្វើនៃការផ្លាស់ប្តូរគោលនយោបាយសារពើពន្ធ និងរូបិយវត្ថុ ខណៈពេលដែលនាំមកនូវភាពមិនច្បាស់លាស់នៅក្នុងទីផ្សារ។ ព្រឹត្តិការណ៍ដែលមិនរំពឹងទុកនេះអាចផ្លាស់ប្តូរសេណារីយ៉ូទាំងមូលនៃការចុះខ្សោយនៃ USDJPY ។ ហេតុអ្វី? ពីមុន៖ ការបន្ធូរបន្ថយអត្រាការប្រាក់របស់អាមេរិក និងសក្តានុពលនៃការដំឡើងអត្រាការប្រាក់ពីប្រទេសជប៉ុននឹងធ្វើឱ្យ USDJPY ធ្លាក់ចុះ។ បន្ទាប់ពីការផ្លាស់ប្តូរ៖ ប្រសិនបើនាយករដ្ឋមន្ត្រីថ្មីបន្តផ្តល់សញ្ញានៃការរឹតបន្តឹងគោលនយោបាយរូបិយវត្ថុ នោះសេណារីយ៉ូដដែលនឹងអនុវត្ត។ ប៉ុន្តែប្រសិនបើមិនដូច្នេះទេ នោះឱកាសនៃការធ្លាក់ចុះ USDJPY នឹងត្រូវបានកាត់បន្ថយ។ នេះមានន័យថា USDJPY អាចចុះខ្សោយក្នុងកម្រិតមធ្យម ឬសូម្បីតែផ្លាស់ទីទៅចំហៀងប៉ុណ្ណោះ។ *** កិច្ចប្រជុំរបស់ធនាគារកណ្តាលជប៉ុន (BOJ) បន្ទាប់គឺនៅថ្ងៃទី 19 ខែកញ្ញាឆ្នាំ 2025 ។ លើសពីនេះ ធនាគារកណ្តាលផ្សេងទៀតមកពីប្រទេសកាណាដា ចក្រភពអង់គ្លេស អឺរ៉ុប ឬសូម្បីតែអូស្ត្រាលីអាចនឹងមានភាគរយច្រើនរក្សាអត្រាការប្រាក់កាន់តែយូរជាងនេះ។ ដូច្នេះ លោកអ្នកអាចតាមដានទៅលើតែសេចក្តីថ្លែងការណ៍របស់ពួកគេ បន្ទាប់ពីអត្រារបស់ពួកគេត្រូវបានចេញផ្សាយ។ ភាពតានតឹងភូមិសាស្ត្រនយោបាយ៖ ជម្លោះសង្រ្គាមសំខាន់ៗដែលយើងកំពុងមាននៅពេលនេះ គឺអ៊ីស្រាអែល-ហ្គាហ្សា រុស្ស៊ី-អ៊ុយក្រែន សហរដ្ឋអាមេរិក-វ៉េណេស៊ុយអេឡា ព្រមទាំងលទ្ធភាពនៃការមានសង្គ្រាមរវាងអុីរ៉ង់ និងអាមេរិកលើកម្មវិធីនុយក្លេអ៊ែរ។ ចំណាំសំខាន់នៅទីនេះ៖ ប៉ុន្តែសម្រាប់ពេលនេះ យើងនៅតែឃើញពីភាពតានតឹងតែប៉ុណ្ណោះ ហើយបទឈប់បាញ់មិនទាន់ឃើញមានសញ្ញាណាមួយលេចចេញឡើងនោះទេ។ ជាក់ស្តែង សហរដ្ឋអាមេរិកក៏បានផ្លាស់ប្តូរក្រសួងការពារជាតិរបស់ខ្លួនទៅជានាយកដ្ឋានសង្គ្រាម ដោយបង្កើនការសង្ស័យថាតើការផ្លាស់ប្តូរនេះនឹងដើរតួជាសញ្ញានៃការកើតមានសង្គ្រាមលោកលើកទី 3 ឬការបំផ្លិចបំផ្លាញបន្ថែមទៀតដែរ ឬទេ។ អស្ថិរភាពនយោបាយសកល មិនត្រឹមតែមានការលាលែងតំណែងពីនាយករដ្ឋមន្ត្រីជប៉ុននោះទេ ប៉ុន្តែសូម្បីនៅប្រទេសបារាំង និងឥណ្ឌូនេស៊ី ក៏កំពុងប្រឈមនឹងបញ្ហានយោបាយខ្លះដែរ។ លោក Bayrou របស់បារាំងបានលាលែងពីតំណែងបន្ទាប់ពីបាត់បង់សំឡេងបោះឆ្នោត ខណៈដែលរដ្ឋមន្ត្រីឥណ្ឌូនេស៊ីលោកស្រី Sri Mulyani Indrawati ក៏បានលាលែងពីតំណែងផងដែរ ដែលនាំឱ្យទីផ្សារមួយចំនួនចាប់ផ្តើមចេញពីទីផ្សារ។ សរុបសេចក្តីមក យើងកំពុងឃើញអស្ថិរភាពជាច្រើននៅក្នុងនយោបាយសកល ស្របពេលដែលមានភាពទន់ខ្សោយនៃស្ថានភាពសេដ្ឋកិច្ច និងការកើនឡើងនូវភាពមិនច្បាស់លាស់នៅក្នុងភាពតានតឹងភូមិសាស្ត្រនយោបាយនៅគ្រប់ទីកន្លែង ដោយអាចជាកត្តាជំរុញឱ្យតម្លៃមាសមានការកើនឡើងបាន។ ទោះជាយ៉ាងណាក៏ដោយរឿងមួយដែលត្រូវចងចាំ: ភាពតានតឹងគឺល្អសម្រាប់មាស។ ប៉ុន្តែប្រសិនបើភាពតានតឹងខ្លាំងពេក សូមប្រយ័ត្នចំពោះប្រតិកម្មទីផ្សារ ព្រោះតម្លៃមាសអាចលក់ចេញដោយមិននឹកស្មានដល់ ដោយសារតែការភ័យខ្លាចខ្លាំង។ បើមិនដូច្នេះទេ នៅពេលដែលអ្វីៗកាន់តែច្បាស់ ដូចជាពេលដែលមានបទឈប់បាញ់កើតមានឡើង ធនាគារកណ្តាលអាមេរិកចាប់ផ្តើមរក្សាអត្រាការប្រាក់ និងសេដ្ឋកិច្ចកាន់តែរឹងមាំ ហើយនោះក៏ជំរុញឱ្យមាសធ្លាក់ចុះផងដែរ។ វិភាគបច្ចេកទេស ទិដ្ឋភាពទីផ្សារ Gold — ខែកញ្ញា ឆ្នាំ 2025 តម្លៃ Gold បច្ចុប្បន្នស្ថិតនៅ $3,646.095 ដោយបន្តសន្ទស្សន៍ខ្ពស់ក្នុងទិសឡើង អាស្រ័យលើការរំពឹងថាធនាគារកណ្តាលអាមេរិក នឹងបញ្ចុះអត្រាការប្រាក់។ ក្រាហ្វបង្ហាញពីការបំបែកឡើងលើតំបន់resistance មុនៗយ៉ាងច្បាស់ ដោយមានតំបន់សំខាន់ៗបង្កើតជុំវិញតំបន់ volume និង liquidity។ តំបន់បច្ចេកទេសសំខាន់ៗ រចនាសម្ព័ន្ធ Price Action យុទ្ធសាស្ត្រជួញដូរ ទិដ្ឋភាពទីផ្សារ USDJPY — ខែកញ្ញា ឆ្នាំ 2025 តំបន់បច្ចេកទេសសំខាន់ៗ រចនាសម្ព័ន្ធ Price Action យុទ្ធសាស្ត្រជួញដូរ — USDJPY |English Version| This report provides an analysis of the primary factors influencing gold prices and potential opportunities for the USDJPY, offering insights for investors. ***All information presented is for educational purposes only and should not be interpreted as financial advice or a recommendation for trading or investment decisions. Fundamental Analysis Previous Recap of the Whole Economy: The US economy is making some sloppy progress with the weakness in the job market, while inflation still stays above the restrictive level of 2%. Yet, the fragile market is pushing the Federal Reserve to cut the interest rate 3 times this year, starting in September, October, and December. What is important is that several important figures are also raising some doubts on the US economy, with JPMorgan anticipating seeing some sell-off in the US equity market, while Ray Dalio warned about the potential of a slipback on the highly dangerous ‘fifth stage.’ Plus, housing market concerns, rising national debt, and the potential of a 1 trillion tariff refund if the US court wins over Trump’s illegal act; all of that could push the US economy off the cliff. Therefore, the future of the US economy will fall on the Federal Reserve rate decision, while leaving some spotlight on the Bank of Japan (BOJ) as well, as this could shift some tension in the market. 7 Major Central Banks’ Rate Decisions in One Month First, focus on the Federal Reserve. The last consumer price index and producer price index this month will be the last data to consider before the Fed really eases. → Next FED meeting is on September 18th, 2025. Lowering the rate will potentially lead to weakness in the USD and a higher gold price. Second, focus on the Bank of Japan. As of Sunday, Japanese Prime Minister Shigeru Ishiba decided to resign after his last negotiation with President Donald Trump, lowering the tariffs from 25% to 15%. Changing the prime minister could be an act of shifting the fiscal and monetary policy while bringing uncertainty in the market. This unexpected event could change the whole scenario of having a weakening in the USDJPY. Why? ***Next BOJ meeting is on September 19th, 2025. Furthermore, other central banks from Canada, the UK, Europe, or even Australia will likely hold the interest rate longer. Not much to focus on, but you can look forward to their statement after their rate is released. Geopolitical Tension: The major war conflicts we are having right now are Israel-Gaza, Russia-Ukraine, US-Venezuela, and the potential resurgence of Iran with the US sanctions over its nuclear program. Key note here: But for now, we are still sensing only the tension and not the ceasefire. In fact, the US also changed its Department of Defense to the Department of War, raising some doubt whether this move will act as a signal to WWIII or further destruction. Instability in Global political Not only Japan’s PM resignation, as I mentioned earlier, but even in France and Indonesia, they are also facing some political issues. French Bayrou resigned after losing a confidence vote, while Indonesian Minister Sri Mulyani Indrawati also resigned, which has led to a market sell-off. In conclusion, we are seeing several instabilities in the global political and fragile economy, and rising uncertainty in the geopolitical tension all over the place, which will be very favorable for the gold price. However, one thing to remember: tension is good for gold. But if the tension is too much, watch out for the market reaction, as the gold price could potentially sell off unexpectedly due to extreme fear. Otherwise, when everything becomes clearer, such as when the ceasefire is met, the Federal Reserve’s hawkish stance and a stronger economy come into place, and that also pushes the gold lower. Technical Analysis Gold Market Overview — September 2025 Gold is currently trading at $3,646.095, continuing its bullish momentum amid expectations of a Federal Reserve rate cut. The chart reveals a strong breakout above previous resistance, with key structural levels forming around volume and liquidity zones. Key Technical Zones Price Action Structure Trading Strategy USDJPY Market Overview — September 2025 Key Technical Zones Price Action Structure Trading Strategy — USDJPY

Gold price Update: Multiple factors to consider

ការរំពឹងទុកខ្ពស់សម្រាប់ការកាត់បន្ថយអត្រាការប្រាក់របស់ធនាគារកណ្តាលអាមេរិក បន្ទាប់ពីភាពទន់ខ្សោយនៃទីផ្សារការងារបានបង្ខំឱ្យធនាគារកណ្តាលអាមេរិកកាត់បន្ថយអត្រាការប្រាក់ចំនួន 3 ដងក្នុងឆ្នាំនេះ ក្រុមហ៊ុន JPMorgan ក៏បានព្រមានអំពីលទ្ធភាពដែលអាចមានការធ្លាក់ចុះនៃទីផ្សារភាគហ៊ុនរបស់សហរដ្ឋអាមេរិកនោះដែរ។ ជាក់ស្តែង ភាគរយប្រហែល 80% មានការរំពឹងទុកលើការកាត់បន្ថយអត្រាការប្រាក់ចំនួន 25bps និងនៅសេសសល់គឺមានការរំពឹងទុកទៅលើការកាត់ 50bps នៅថ្ងៃទី 18 ខែកញ្ញាឆ្នាំនេះ។ អស្ថិរភាពសកល យោងតាមប្រភពព័ត៌មាន CNBC តុលាការសហព័ន្ធទាំងពីរបានវិនិច្ឆ័យពន្ធបន្ទាន់របស់ប្រធានាធិបតី Trump ខុសច្បាប់ដែលឥឡូវនេះលោក Trump កំពុងស្វែងរកភស្តុតាងបន្ថែមទៀតដើម្បីទប់ទល់នឹងបញ្ហានេះ។ ប្រសិនបើមិនបានជោគជ័យទេ សហរដ្ឋអាមេរិកអាចនឹងត្រូវសងប្រាក់វិញដល់អ្នកនាំចូលពី 750 ពាន់លានដុល្លារទៅ 1 ទ្រីលានដុល្លារ បើតាមលេខាធិការរតនាគារ Scott Bessent ទោះបីជាគាត់បាននិយាយថាគាត់ពិតជាមានទំនុកចិត្តច្រើនលើករណីនេះក៏ដោយ។ ទន្ទឹមនឹងនោះ រដ្ឋមន្ត្រីក្រសួងហិរញ្ញវត្ថុឥណ្ឌូនេស៊ី Sri Mulyani Indrawati (ដែលមានវិនិយោគិនសកលជាច្រើនមានការរំពឹងទុកខ្ពស់លើលោកស្រីក្នុងការនាំមកនូវស្ថិរភាពបន្ថែមទៀតដល់សេដ្ឋកិច្ចឥណ្ឌូនេស៊ី) ឥឡូវនេះត្រូវបានដកចេញហើយ។ នេះនាំឱ្យមានភាពមិនប្រាកដប្រជា និងភ័យស្លន់ស្លោនៅក្នុងទីផ្សារកាន់តែច្រើន ដែលបណ្តាលឱ្យមានវិនិយោគិនចាកចេញពីទីផ្សារ។ ទីពីរ នាយករដ្ឋមន្ត្រីបារាំងលោក Bayrou បានលាលែងពីដំណែងដោយសារតែការចាញ់ទៅលើសំឡេងឆ្នោត ដោយមានសមាជិកសភាចំនួន 194 នាក់បានបោះឆ្នោតគាំទ្រ និង 364 បានបោះឆ្នោតប្រឆាំង។ ទន្ទឹមនឹងការព្រួយបារម្ភអំពីបំណុល កត្តាទាំងអស់នេះនាំទៅរកអស្ថិរភាព និងធ្វើឱ្យទ្រព្យសកម្មដែលមានសុវត្ថិភាពកាន់តែទាក់ទាញ។ ភាពតានតឹងភូមិសាស្ត្រនយោបាយ៖ ទោះបីជាមានការថ្កោលទោសពីអង្គការសហប្រជាជាតិក៏ដោយ កងកម្លាំងអុីស្រាអែលនៅតែបន្តសម្លាប់ប្រជាជនប៉ាឡេស្ទីនបន្ថែមទៀត និងបំផ្លាញហេដ្ឋារចនាសម្ព័ន្ធនៅក្នុងតំបន់ហ្គាហ្សា។ អុីស្រាអែលបានចេញការព្រមានជម្លៀសថ្មីកាលពីថ្ងៃចន្ទ ដោយគំរាមបំផ្ទុះគ្រាប់បែក ខណៈប្រទេសផ្សេងទៀតដូចជាអេស្ប៉ាញបានដាក់ទណ្ឌកម្មអាវុធដើម្បីដាក់សម្ពាធអុីស្រាអែលឱ្យបញ្ចប់ជម្លោះ។ |English Version| Higher expectations for a rate cut After a weak labor data last week that has forced the Federal Reserve to cut the rate by three times this year, JPMorgan’s trading desk also warned about “sell the news’s events as the investors pull back from the US equity market. Following through on a widely expected interest rate cut on 18 September, with odds more than 80% in 25 bps, while some are leaving on the 50bps rate cut. Global Instability As per CNBC, the two federal courts ruled President Trump’s emergency tariffs illegal, which Trump is now seeking a Supreme Court reversal. If unsuccessful, the U.S. may need to refund importers $750 billion to $1 trillion, per Treasury Secretary Scott Bessent, albeit he said he’s quite confident in this case. Meanwhile, Indonesian Minister of Finance, Sri Mulyani Indrawati, who has a global investor has high expectations in bringing more stability to the Indonesian economy, has now been removed. This led to uncertainty and panic in the market, resulting in a market sell-off. Secondly, French Prime Minister Bayrou resigned due to a loss in a confidence vote, with 194 lawmakers voting in support and 364 voting against. Along with the debt concerns, all of these are leading to more instability and making the safe-haven asset more attractive. Mounting Geopolitical tension: Despite UN condemnation, Israeli forces killed more Palestinians and destroyed infrastructure in Gaza. Israel issued new evacuation warnings on Monday, threatening bombings, while other countries, such as Spain, imposed an arms embargo to pressure Israel to end the conflict.

Market Talk: A Briefing on Last Week’s Events

របាយការណ៍សង្ខេបទិន្នន័យប្រចាំសប្តាហ៍ គិតត្រឹមថ្ងៃទី08 ខែកញ្ញា ឆ្នាំ2025 ខាងក្រោមនេះគឺជារបាយការណ៍សង្ខេបអំពីស្ថានភាពសេដ្ឋកិច្ចសហរដ្ឋអាមេរិក ដែលភាគច្រើនផ្អែកលើព្រឹត្តិការណ៍សំខាន់ៗទាក់ទងនឹងគោលនយោបាយរបស់ប្រធានាធិបតី Donald Trump បញ្ហាពន្ធពាណិជ្ជកម្ម និងបញ្ហាសង្គ្រាមនៅក្នុងសប្តាហ៍នេះផងដែរ។ ការបដិសេធ៖ សូមចំណាំថានេះគ្រាន់តែជាមតិយោបល់តែប៉ុណ្ណោះ។ ព័ត៌មានសំខាន់ៗនៅក្នុងសប្តាហ៍នេះ សូចនាករសេដ្ឋកិច្ច៖ សប្តាហ៍នេះផ្តោតសំខាន់ទៅលើទិន្នន័យការងារ ដែលទិន្នន័យជាច្រើនបង្ហាញពីភាពទន់ខ្សោយនៃទីផ្សារការងារ ដូចអ្វីដែលលោកប្រធានធនាគារកណ្តាលអាមេរិកលោក Powell ព្រមទាំងសមាជិកធនាគារកណ្តាលអាមេរិកផ្សេងទៀតបានរំពឹងទុក។ ចំពោះអតិផរណាវិញ អ្នកខ្លះនៅតែជឿថាតម្លៃទំនិញនៅតែអាចកើនឡើងជាបណ្តោះអាសន្ន ដោយសារតែបញ្ហាពន្ធគយ ទោះបីជាអត្រាអតិផរណាមានកម្រិតលើសពីអត្រាគោលដៅចំនួន 2% ក៏ដោយ។ លើសពីនេះទៅទៀត តម្រូវការប្រើប្រាស់មានសភាពល្អប្រសើរបន្តិចជាពិសេសនៅក្នុងវិស័យសេវាកម្ម។ ដូច្នេះហើយ ហានិភ័យទៅលើទីផ្សារការងារកំពុងជំរុញឱ្យធនាគារកណ្តាលអាមេរិកកាត់បន្ថយអត្រាការប្រាក់សម្រាប់ខែកញ្ញា ស្របពេលដែលពួកគេអាចនឹងបន្តកាត់បន្ថែមទៀតចំនួន 2 ដងក្នុងខែតុលា និងខែធ្នូ។ ធនាគារកណ្តាលអាមេរិក បច្ចុប្បន្ននេះ លោកប្រធានាធិបតី Trump បានលើកឡើងពីបេក្ខជនចំនួន 3 នាក់ដែលអាចឡើងធ្វើជាប្រធានធនាគារកណ្តាលអាមេរិកបាន ពោលគឺមានលោក Waller, Warsh និង Hassett។ រូបលោកទាំង 3 សុទ្ធតែមានទំនោរទៅរកការបន្ទាបអត្រាការប្រាក់បាន។ ជាពិសេសនៅពេលដែលលោក Trump មានក្តីបារម្ភពីហានិភ័យលើទីផ្សារលំនៅឋាន។ ដូច្នេះ ការបន្ទាបអត្រាការប្រាក់អាចនឹងបន្ធូរបន្ថយភាពតានតឹងខ្លះនៅក្នុងបំណុលកម្ចីទិញផ្ទះ។ តុលាការអាមេរិក៖ បន្ទាប់ពីតុលាការអាមេរិកបានព្យាយាមប្តឹងលោកប្រធានាធិបតី Donald Trump ពីបទរំលោភបំពានការដាក់ពន្ធមិនស្របច្បាប់រួចមក លោក Trump ក៏នៅតែបន្តបង្ហោះនៅលើ Truth Social របស់គាត់ថា “សហរដ្ឋអាមេរិកអាចក្លាយជាអ្នកមាន ឬក្រ អាស្រ័យលើសំណុំរឿងរបស់តុលាការកំពូលស្តីពីពន្ធ។ ប្រសិនបើយើងចាញ់សំណុំរឿងរបស់តុលាការ ខ្ញុំគិតថា យើងត្រូវតែលុបចោលកិច្ចព្រមព្រៀងពាណិជ្ជកម្ម” ។ ការលុបចោលនៅទីនេះក៏មានន័យថាពួកគេនឹងត្រូវសងប្រាក់ពន្ធនាំចូលរួមត្រឡប់ទៅម្ចាស់ដើមវិញ ដោយវានឹងជះឥទ្ធិពលអាក្រក់ទៅលើទីផ្សារហិរញ្ញវត្ថុសហរដ្ឋអាមេរិកទាំងមូល។ សូម្បីតែ US Bessent ក៏ព្រមានអំពីរឿងនេះដែរ។ ពាណិជ្ជកម្មជប៉ុន៖ តាមសារព័ត៌មាន The White house ប្រធានាធិបតី Donald Trump បានចុះហត្ថលេខាលើបទបញ្ជាប្រតិបត្តិមួយកាលពីថ្ងៃព្រហស្បតិ៍ដើម្បីអនុម័តកិច្ចព្រមព្រៀងពាណិជ្ជកម្មរវាងសហរដ្ឋអាមេរិកនិងជប៉ុនដោយដាក់ពន្ធ 15% លើការនាំចូលរបស់ជប៉ុនភាគច្រើនជាមួយនឹងបទប្បញ្ញត្តិជាក់លាក់សម្រាប់រថយន្ត យានអវកាស ឱសថទូទៅ និងធនធានធម្មជាតិជាដើម។ ការកាត់បន្ថយពន្ធលើរថយន្តជប៉ុននឹងចូលជាធរមានរយៈពេលប្រាំពីរថ្ងៃបន្ទាប់ពីការបញ្ជាទិញនេះ។ ការអភិវឌ្ឍន៍ភូមិសាស្ត្រនយោបាយ៖ រុស្ស៊ីបានបន្តបើកការវាយប្រហារតាមអាកាសដ៏ធំបំផុតលើអ៊ុយក្រែន ដោយបានបំផ្លាញអគារជាច្រើននៅទូទាំងប្រទេស ជាមួយនឹងយន្តហោះគ្មានមនុស្សបើកចំនួន 810 គ្រឿង និងកាំជ្រួច 13 ដើម។ ជាការឆ្លើយតប រដ្ឋមន្ត្រីក្រសួងរតនាគារអាមេរិក Scott Bessent បាននិយាយថា សហរដ្ឋអាមេរិក និងអឺរ៉ុបនឹងដាក់សម្ពាធសេដ្ឋកិច្ច តាមរយៈការដាក់ពន្ធបន្ថែមទៀតលើទីក្រុងម៉ូស្គូ ក៏ដូចជា “ពន្ធបន្ទាប់បន្សំ” លើអ្នកដែលទិញប្រេងពីរុស្ស៊ី ក្នុងគោលបំណងបញ្ចប់ជម្លោះរវាងរុស្ស៊ី និងអ៊ុយក្រែន។ លោក Trump ក៏បានលើកឡើងផងដែរថា “ខ្ញុំកំពុងគិតអំពីការដកកងទ័ពចេញពីប្រទេសផ្សេងទៀត ប៉ុន្តែខ្ញុំមិនដែលគិតសូម្បីតែការដកកងទ័ពចេញពីប្រទេសប៉ូឡូញ” ។ នេះក៏ជាទង្វើមួយដើម្បីដាក់សម្ពាធបន្ថែមទៀតលើរុស្ស៊ី។ ទោះជាយ៉ាងណា រុស្ស៊ី ចិន និងកូរ៉េខាងជើង ហាក់កាន់តែកៀកនឹងគ្នា ដែលអាចបង្កការគំរាមកំហែងខ្លះប្រឆាំងអាមេរិក។ យោងតាមការបង្ហោះរបស់លោក Trump “សូមគោរពយ៉ាងកក់ក្តៅបំផុតរបស់ខ្ញុំចំពោះលោក Vladimir Putin និង Kim Jong Un នៅពេលអ្នកសមគំនិតប្រឆាំងនឹងសហរដ្ឋអាមេរិក” ។ ទន្ទឹមនឹងនោះ ជម្លោះអុីស្រាអែល-ហ្គាហ្សា នៅតែកាន់តែតានតឹងឡើង បើទោះជាលោក Donald Trump បានប្តេជ្ញាដាក់សំណើថ្មី ដើម្បីបញ្ចប់សង្រ្គាមនៅតំបន់ហ្គាហ្សា ដោយហៅវាថាជាការព្រមានចុងក្រោយសម្រាប់ក្រុមហាម៉ាស។ អាមេរិក-វ៉េណេស៊ុយអេឡា ការវាយប្រហាររបស់សហរដ្ឋអាមេរិកលើទូកល្បឿនលឿនរបស់វេណេហ្ស៊ុយអេឡា ដែលគេសង្ស័យថាដឹកគ្រឿងញៀន បានសម្លាប់មនុស្ស 11 នាក់ ដែលបង្កើនភាពតានតឹងផ្នែកភូមិសាស្ត្រនយោបាយ និងជំរុញឱ្យមានការសង្ស័យរបស់ទីក្រុង Caracas ដែលថាទីក្រុងវ៉ាស៊ីនតោនចង់ផ្តួលរំលំប្រធានាធិបតី Nicolás Maduro ។ |English Version| Weekly Data Summary Report As of September 08, 2025 Below is a summary of the United States, primarily based on critical events related to President Donald Trump, the trade war, and war conflicts within the week. Disclaimer: Please note this is opinion-based; do not take it as investment advice. Key Highlight Event: Economic Indicators: This week mainly focuses on the job data, which several data show having a weakness in the labor market conditions, just like what the Federal Reserve Chair Powell and other FED members suggested. As for inflation, some still believe that pricing will be temporarily sticky due to tariffs, albeit still above the restrictive level of 2%. Demand consumption showed some improvement, especially in the services sector. Therefore, the labor risks are pushing the Federal Reserve to price in a September rate cut while leaving two more rate cuts in October and December easing. The Federal Reserve: Plus, now Trump seems to have narrowed down the Federal Reserve Chair to three candidates, including Waller, Warsh, and Hassett, all in favor of the low interest rate. Especially when Trump acknowledged the risk in the housing market, having a lower interest rate will help ease some tension in the mortgage debt. The US court: After the US court tried to sue President Donald Trump for overriding the authority on tariff imposition, Trump posted on his Truth Social that, “US could be rich or poor, depending on the Supreme Court case on tariffs. If we lose the court case, I guess we’d have to unwind trade deals”. Unwinding here also means that they will need to refund the collective import tariff back to its original owner, threatening the US financial market as a whole. Even the US Bessent also warned about this. Japan Trade: Per the White House, President Donald Trump signed an executive order Thursday to enact a U.S.-Japan trade deal, imposing a 15% tariff on most Japanese imports, with specific provisions for automobiles, aerospace, generic pharmaceuticals, and scarce natural resources. The reduced tariffs on Japanese cars will take effect seven days after the order. Geopolitical Development: Russia continued to launch the largest air attack on Ukraine, damaging several buildings across the country with 810 drones and 13 missiles. In response, US Treasury Secretary Scott Bessent stated that the US and Europe will pressure the economy through imposing more sanctions on Moscow as well as “secondary tariffs” on those that buy Russian oil, aiming to end the conflict between Russia and Ukraine. Trump also mentioned that, “I am thinking about removing troops from other countries, but I never even thought about removing troops from Poland.” This is also an act to put more pressure on Russia. Regardless, Russia, China, and North Korea seem to be getting closer, which could pose some threat against the United States. As per Trump’s post, “Please give my warmest regards to Vladimir Putin and Kim Jong Un as you conspire against the United States of America.” Meanwhile, the Israel-Gaza conflict is still intensifying, albeit Donald Trump vowed to put forward a new proposal to end the war in Gaza, calling it a “final warning” for Hamas. US-Venezuela A U.S. attack on a Venezuelan speedboat, suspected of carrying drugs, killed 11 people, heightening geopolitical tensions and fueling Caracas’ suspicions that Washington seeks to overthrow President Nicolás Maduro.

Everything You Need to Know About Tonight’s Nonfarm Payrolls Data

ទិន្នន័យការងារថ្មីៗរបស់សហរដ្ឋអាមេរិកកំពុងសបញ្ជាក់ពីភាពទន់ខ្សោយនៃទីផ្សារការងារ ដោយសារតែអាជីវកម្មកាន់តែមានការប្រុងប្រយ័ត្នចំពោះការជ្រើសរើសបុគ្គលិកបន្ថែមទៀត ស្របពេលដែលភាពមិនច្បាស់លាស់នៅក្នុងភូមិសាស្ត្រនយោបាយ បញ្ហានយោបាយផ្ទៃក្នុង និងពន្ធគយកំពុងកើតមានឡើង។ ដូច្នេះ បើពិចារណាទៅលើសូចនាករសេដ្ឋកិច្ច ទិន្នន័យភាគច្រើនដូចជា ការធ្លាក់ចុះនៃទិន្នន័យការងារ ADP ការថមថយនៃចំនួនការងារដែលគេជ្រើសរើស ព្រមទាំងការកើនឡើងនៃទិន្នន័យអ្នកគ្មានការងារធ្វើ ហើយទាមទាររកអត្ថប្រយោជន៍ ឬសូម្បីតែកម្រិតការងាររបស់ ISM នៅវិស័យមិនមែនផលិតកម្ម(សេវាកម្ម) និងវិស័យផលិតកម្មក៏ធ្លាក់ចុះក្រោមស្តង់ដារ 50 ដែលបង្ហាញពីការកើនឡើងនៃការបញ្ឈប់ការងារ និងសកម្មភាពជ្រើសរើសបុគ្គលិកនៅក្នុងវិស័យទាំងពីរនេះ។ ចំណែកឯទស្សនវិស័យរបស់ធនាគារកណ្តាលអាមេរិកវិញ សមាជិកជាច្រើននៅតែបន្តជឿជាក់ថាទីផ្សារការងារអាចនឹងបន្តទន់ខ្សោយ ខណៈពេលដែលព្យាករណ៍ថា អត្រាអ្នកគ្មានការងារធ្វើអាចនឹងកើនឡើងរហូតដល់ 4.5% នៅឆ្នាំក្រោយ។ ទន្ទឹមនឹងនេះដែរ សៀវភៅ Beige Book របស់ធនាគារកណ្តាលអាមេរិកក៏បានគូសបញ្ជាក់ពីស្ថានភាពទីផ្សារការងារដែលធ្លាក់ចុះផងដែរ។ → សញ្ញាទាំងនេះ សុទ្ធតែបង្ហាញពីភាពទន់ខ្សោយនៃទីផ្សារការងារ។ ជាមួយនោះ ទីផ្សារឥឡូវនេះកំពុងជឿជាក់ថា អាចមានលទ្ធភាពលើសពី 90% ដែលធនាគារកណ្តាលអាមេរិកអាចនឹងកាត់បន្ថយអត្រាការប្រាក់ ខណៈពេលដែលពួកគេអាចនឹងបន្តកាត់នៅក្នុងខែតុលា និងខែធ្នូនោះដែរ។ ដូច្នេះហើយ ឥឡូវនេះ ទីផ្សារកំពុងរង់ចាំទិន្នន័យនៅយប់នេះ។ ការព្យាករណ៍ទិន្នន័យយប់នេះ ដូច្នេះជាមួយនឹងការព្យាករណ៍ធ្លាក់ចុះមួយចំនួននៅក្នុងទិន្នន័យការងារនៅសហរដ្ឋអាមេរិកនៅយប់នេះ ពោលគឺប្រាក់បៀវត្សរ៍ Nonfarm ត្រូវបានគេរំពឹងថានឹងកើនបន្តិចមកត្រឹម 75K (នៅតែស្ថិតខាងក្រោម 100K) អត្រាគ្មានការងារធ្វើនឹងកើនឡើងដល់ 4.3% និងកំណើនប្រាក់ឈ្នួលប្រចាំឆ្នាំអាចនឹងស្ថិតក្នុងកម្រិតដដែល ដោយទាំងអស់នេះបង្ហាញពីការរំពឹងទុករបស់ទីផ្សារទៅលើភាពទន់ខ្សោយនៃទីផ្សារមួយនេះ។ ដូច្នេះសំណួរនៅទីនេះគឺថាតើនេះមកដូចការរំពឹងទុក ឬទេ? ប្រសិនបើទិន្នន័យទាំងនេះ បានចេញផ្សាយដូចអ្វីដែលបានរំពឹងទុកមែន ឬទាបជាងនេះ → ទីផ្សារការងារនឹងត្រូវបានបញ្ជាក់ថាពិតជាទន់ខ្សោយមែន ហើយធនាគារកណ្តាលអាចនឹងកាត់បន្ថយអត្រាការប្រាក់ម្តងហើយ ម្តងទៀតដូចការរំពឹងទុក → អាចនឹងធ្វើឱ្យប្រាក់ដុល្លារធ្លាក់ចុះខណៈពេលដែលការពង្រឹងតម្លៃមាស។ ប៉ុន្តែប្រសិនបើទិន្នន័យចេញផ្សាយមកមានកម្រិតខ្លាំងជាងនេះ → ផ្ទុយនឹងទិន្នន័យការងារថ្មីៗផ្សេងទៀត → FED អាចពិចារណាកាត់បន្ថយអត្រាការប្រាក់នៅក្នុងកិច្ចប្រជុំបន្ទាប់ឡើងវិញ ទោះបីជាមានការកាត់នៅខែកញ្ញាក៏ដោយ (កាត់តែម្តង)→ USD អាចនឹងឡើងថ្លៃហើយនឹងដាក់សម្ពាធទៅលើតម្លៃមាសជាមិនខាន។ |English Version| Recent US job data are leaning toward fragile labor market conditions as businesses have become more cautious about hiring activities amid the uncertainty in geopolitical, internal political, and tariff risks. Economic indicator vice, This is evidenced by weaker ADP employment changes, lower job openings, rising jobless claims, and even both ISM manufacturing and non-manufacturing employment levels also dropping below the benchmark of 50, which indicates an increase in layoffs and slower hiring activities in both sectors. The Federal Reserve’s POV side, several Federal Reserve members are hinting at the increasing weakness expectation coming to the job data, with some projecting to see a rise in the jobless rate to around 4.5% next year. Meanwhile, the FED’s Beige Book also highlighted sluggish labor market conditions. → all weakness signs for soft labor prints. With that, the market now prices in more than 90% on a rate cut while leaving the other two rate cuts in October and December. Therefore, the market is now awaiting tonight’s data. Tonight’s Data Projection So with some downward projection in tonight’s US job data, Nonfarm Payroll is expected to slowly rise to 75K (still below 100K), the unemployment rate to rise to 4.3%, and wage growth annually to stay the same, all suggesting a higher expectation of seeing some more softening. So the question here is whether this comes as anticipated or what? And if all of which really come as expected or even lower → the fragility of the job market will be confirmed, and the Dovish FED fund rate → will likely weaken the USD while strengthening the GOLD price. But if this comes stronger → contradicts with other recent job data → the FED may consider a rate cut in the next meeting, albeit the September is coming very highly as anticipated. This also means that this data will signal a hawkish rate cut. → USD may become stronger and will put some downward pressure on the GOLD price.

Economic Recap: US labor market, US-Japan 15% trade deal.

ទីផ្សារការងាររបស់សហរដ្ឋអាមេរិកបានបន្តបង្ហាញសញ្ញានៃភាពទន់ខ្សោយ ដោយសារតែទិន្នន័យ ADP Employment changes ក៏ដូចជារបាយការណ៍ JOLTS នៅថ្ងៃពុធសុទ្ធតែបានធ្លាក់ចុះក្រោមទិន្នន័យពីមុន ស្របពេលដែលទិន្នន័យ Challenger Job cuts និង jobless claims សុទ្ធតែបានកើនឡើង។ ទាំងនេះសុទ្ធតែឆ្លុះបញ្ជាំងពីការកាត់បន្ថយចំនួនការងារ និងកំណើននៃអ្នកអត់ការងារធ្វើកាន់តែច្រើននៅក្នុងអាមេរិកនាពេលថ្មីៗនេះ។ ផលិតភាពខ្ពស់ជួយសម្រួលដល់កម្រិតអតិផរណា ប៉ុន្តែតម្រូវការការងារកាន់តែតិច អាចជះឥទ្ធិពលអាក្រក់ទៅកាន់ទីផ្សារការងារ។ ជាក់ស្តែង អភិបាលធនាគារកណ្តាលលោក Christopher Waller ក៏បានកត់សម្គាល់ផងដែរនូវ “ភាពទន់ខ្សោយការងារនេះនាពេលខាងមុខ” ដែលអាចបង្ហាញពីសញ្ញាដែលធនាគារកណ្តាលអាចនឹងកាត់បន្ថយអត្រាការប្រាក់ដើម្បីប្រយុទ្ធប្រឆាំងនឹងភាពថយចុះនេះ។ ចំណែកប្រធានធនាគារកណ្តាលអាមេរិក លោក John Williams បានលើកឡើងពីការព្រួយបារម្ភ ដោយគូសបញ្ជាក់ពីបញ្ហាប្រឈមពីការផ្លាស់ប្តូរកម្លាំងពលកម្មអន្តោប្រវេសន៍ និងរំពឹងថា អត្រាអត់ការងារធ្វើនឹងកើនឡើងដល់ប្រហែល 4.5% នៅឆ្នាំក្រោយ។ គាត់ព្យាករណ៍ពីអតិផរណា PCE នៅចន្លោះ 3.00%-3.25% នៅឆ្នាំនេះ ហើយអាចនឹងថយចុះមកត្រឹម 2.5% នៅឆ្នាំ 2026។ គាត់ក៏កត់សម្គាល់ផងដែរថា ពន្ធគយកំពុងជះឥទ្ធិពលដល់តម្លៃទំនិញ ព្រមទាំងការចាយវាយរបស់ពួកគេនៅទីនោះ ទោះបីជាវាមិនទាន់បង្កឱ្យមានការកើនឡើងអតិផរណារយៈពេលវែងក៏ដោយ។ ទីផ្សារឥឡូវនេះជឿជាក់ថា 99.3% អាចនឹងមានការកាត់បន្ថយអត្រាការប្រាក់របស់ធនាគារកណ្តាលអាមេរិក ដោយសារតែការងារខ្សោយ និងផលិតភាពខ្ពស់កាត់បន្ថយហានិភ័យអតិផរណាបាន។ ដូច្នេះប្រសិនបើប្រាក់បៀវត្សរ៍យប់នេះមានកម្រិតកាន់តែទាប ឬកំណើនប្រាក់ឈ្នួលកាន់តែកាត់បន្ថយ ខណៈពេលដែលអត្រាគ្មានការងារធ្វើកើនឡើង នោះធនាគារកណ្តាលអាេមរិកក៏អាចនឹងបន្ធូរបន្ថយគោលនយោបាយរូបិយវត្ថុកាន់តែច្រើននោះដែរ។ ទោះជាយ៉ាងណាក៏ដោយ ប្រសិនបើទិន្នន័យមានកម្រិតលើសច្រើនពីទិន្នន័យពីមុន នោះទីផ្សារប្រហែលជាត្រូវគិតឡើងវិញអំពីការសម្រេចចិត្តលើគោលនយោបាយរូបិយវត្ថុម្តងទៀត។ អាមេរិក-ជប៉ុន 15% យោងតាមសារព័ត៌មាន Reuters ប្រធានាធិបតី Donald Trump បានចុះហត្ថលេខាលើបទបញ្ជាប្រតិបត្តិមួយកាលពីថ្ងៃព្រហស្បតិ៍នូវកិច្ចព្រមព្រៀងពាណិជ្ជកម្មរវាងសហរដ្ឋអាមេរិក និងជប៉ុន ដោយអនុវត្តពន្ធ 15% លើការនាំចូលរបស់ជប៉ុនភាគច្រើន ជាមួយនឹងច្បាប់ពិសេសសម្រាប់រថយន្ត យានអវកាស ឱសថទូទៅ និងធនធានធម្មជាតិដែលខ្វះខាត។ ពន្ធទាបលើរថយន្តរបស់ជប៉ុននឹងចូលជាធរមានរយៈពេលប្រាំពីរថ្ងៃបន្ទាប់ពីការចុះផ្សាយនៃការបញ្ជាទិញ។ ជាងនេះទៅទៀត លោក Trump នៅតែជំរុញឱ្យអឺរ៉ុបដាក់សម្ពាធលើប្រទេសចិនជុំវិញសង្គ្រាមរបស់រុស្ស៊ី ខណៈដែលលោក Xi របស់ចិនបញ្ជាក់ឡើងវិញនូវទំនាក់ទំនងជាមួយកូរ៉េខាងជើង។ ទាំងអស់នេះកំពុងបង្កើនភាពមិនប្រាកដប្រជាមួយចំនួននៅក្នុងទីផ្សារ ប៉ុន្តែតម្លៃមាសថ្មីៗនេះមិនទាន់មានប្រតិកម្មពេញលេញនៅឡើយទេ ដោយសារទីផ្សារនៅតែរង់ចាំទិន្នន័យការងារនាយប់នេះ។ |English Version| The U.S. labor market continued to show signs of weakness, with ADP reporting lower employment, Challenger cut indicating more job cuts, JOLTS showing fewer openings, and rising jobless claims. High productivity eases inflation but reduces hiring demand, leaving the labor market fragile. In fact, the Federal Reserve Governor Christopher Waller also noted “a continued deterioration” in the labor market conditions that could signal on having an early easing to combat this softness. As for the Federal Reserve, President John Williams raised concerns, highlighting challenges from shifts in immigrant labor and expecting the unemployment rate to rise to about 4.5% next year. He projects PCE inflation at 3.00%-3.25% this year, cooling to 2.5% by 2026. He also notes that tariffs are already impacting prices and consumer behavior, though they have not yet triggered a long-term inflation spike. Markets now see a 99.3% chance of a Fed rate cut, as weak jobs and high productivity lower inflation risks, which give the Fed room to ease monetary policy. In a very simple meaning, the cracks are forming. So if tonight’s payroll miss, or wage growth cools further, while increasing the unemployment rate, then the FED’s path to cut the rate will get even clearer. However, if the data becomes stronger, then the market may need to rethink its economic stance again. US-Japan 15% According to Reuters, President Donald Trump signed an executive order on Thursday formalizing a U.S.-Japan trade agreement, implementing a 15% tariff on most Japanese imports, with special rules for cars, aerospace, generic drugs, and scarce natural resources. The lower tariffs on Japanese autos are set to take effect seven days after publication of the order. Other than this, Trump is still urging Europe to pressure China over Russia’s war, while China’s Xi reaffirms ties with North Korea. All of these are causing some certainty in the market; however, the recent gold price has not reacted fully yet, as the market is still waiting for tonight’s nonfarm payroll data.

Market Recap: US Job Data, the Federal Reserve, the Tariff Legal Act, and War Tension.

ទិន្នន័យការងាររបស់សហរដ្ឋអាមេរិកគឺ របាយការណ៍ Jolts Job openings បានចេញផ្សាយមានកម្រិតទាបជាងទិន្នន័យព្យាករណ៍ ដោយបង្ហាញពីភាពថមថយនៃការជ្រើសរើសបុគ្គលិកបន្ថែមទៀត ស្របពេលដែលចំនួនការងារក៏បន្តធ្លាក់ចុះនោះដែរ។ ទាំងនេះសុទ្ធតែបង្ហាញពីភាពទន់ខ្សោយនៃទីផ្សារការងារ ពោលគឺដូចអ្វីដែលប្រធានធនាគារកណ្តាលលោក Jerome Powell បានរំពឹងទុក។ ជាក់ស្តែង សមាជិកមួយចំនួនរបស់ធនាគារកណ្តាលអាមេរិកពីយប់មិញ ដូចជាលោក Waller, Bostic, Musalem និងសូម្បីតែ Kashkari ដែលតែងតែជឿជាក់លើជំហរបែប Hawkish (FED’s Kashkari) ក៏បានទទួលស្គាល់ពីភាពទន់ខ្សោយនៃទីផ្សារការងារនោះដែរ ខណៈពេលដែលអត្រាអតិផរណាក៏នៅតែមានកម្រិតខ្ពស់ជាងអត្រាគោលដៅ។ ទោះយ៉ាងណាក៏ដោយ ប្រសិនបើកម្លាំងពលកម្មនៅតែបន្តធ្លាក់ចុះ នោះនឹងមានការផ្លាស់ប្តូរទីផ្សារជាមិនខាន (មានន័យថាសេដ្ឋកិច្ចអាចនឹងធ្លាក់ចុះ)។ លើសពីនេះ សមាជិកធនាគារកណ្តាលអាមេរិកភាគច្រើននៅតែរំពឹងទុកលើការកាត់បន្ថយអត្រាការប្រាក់នៅក្នុងខែកញ្ញា ខណៈពេលដែលលើកឡើងថាសេដ្ឋកិច្ចកំពុងធ្លាក់ចុះ ប៉ុន្តែមិនទាន់មានវិបត្តិសេដ្ឋកិច្ចនោះទេ។ សម្រាប់ពេលនេះ វិនិយោគិនក៏ជឿជាក់ទៅលើការកាត់បន្ថយអត្រាការប្រាក់នៅខែកញ្ញា(97.6%) ហើយការកាត់បន្ថែមទៀតអាចនឹងធ្វើឡើងនៅខែតុលាវិញម្តង ដែលបានផ្លាស់ប្តូរពីការកាត់បន្ថយខែធ្នូមុនពេលចេញទិន្នន័យយប់មិញ។ ពន្ធ៖ យោងតាមលោក Trump “សហរដ្ឋអាមេរិកអាចក្លាយជាអ្នកមាន ឬអ្នកក្រ អាស្រ័យលើករណីរបស់តុលាការកំពូលស្តីពីពន្ធ” ដែលឆ្លុះបញ្ចាំងថា ពន្ធគយទាំងនេះបានផ្តល់ឱ្យគាត់នូវអានុភាពដើម្បីធ្វើកិច្ចព្រមព្រៀងជាមួយដៃគូពាណិជ្ជកម្មសំខាន់ៗផ្សេងទៀត និងបង្កើតប្រាក់ចំណូលបន្ថែមសម្រាប់សេដ្ឋកិច្ចសហរដ្ឋអាមេរិក។ ដូច្នេះ ប្រសិនបើតុលាការអាមេរិកពិតជាកាត់ទោសពន្ធគយសកលទាំងនេះថាជាទង្វើខុសច្បាប់មែននោះ វានឹងនាំមកនូវបញ្ហាដល់សេដ្ឋកិច្ច និងទីផ្សាររបស់ពួកគេ។ ភាពតានតឹងភូមិសាស្ត្រនយោបាយ៖ សង្គ្រាម ជាងនេះទៅទៀត លោក Trump នៅតែបន្តដាក់សម្ពាធលើរុស្ស៊ី ខណៈដែលលោកប្រធានាធិបតី Putin នៅតែមិនអាចបត់បែនបានក្នុងការបញ្ចប់សង្រ្គាមនេះ ដោយមិនមានការចូលរួមពីយោធាបាន។ ជាក់ស្តែង អាមេរិកបានជំរុញឱ្យអឺរ៉ុបបញ្ឈប់ការទិញប្រេងពីរុស្ស៊ី។ ជាមួយគ្នានេះ លោក Trump ក៏បានបញ្ជាក់អំពីការប្តេជ្ញាចិត្តរបស់សហរដ្ឋអាមេរិកដោយបញ្ជាក់ថា “យើងនឹងដាក់ទ័ពបន្ថែមទៀតប្រសិនបើពួកគេចង់” ដើម្បីជួយប៉ូឡូញ “ការពារខ្លួន” ។ ជាការឆ្លើយតប លោក ពូទីន បានស្វាគមន៍ប្រធានាធិបតីអាមេរិក លោក ដូណាល់ ត្រាំ ក្នុងការពិភាក្សាបន្ថែមអំពីវឌ្ឍនភាពបច្ចុប្បន្ន ខណៈដែលលើកឡើងថាប្រធានាធិបតីអ៊ុយក្រែន លោក Zelenskyy អាចទៅជួបនៅទីក្រុងមូស្គូ ប្រទេសរុស្ស៊ីបាន ប្រសិនបើពួកគេមានបំណងចង់ពិភាក្សា។ ភាពតានតឹងសង្រ្គាមផ្សេងទៀតរួមមាន អុីស្រាអែល និងក្រុមហាម៉ាស សហរដ្ឋអាមេរិក និងវេណេហ្ស៊ុយអេឡា ដែលបង្ហាញពីលទ្ធភាពនៃការវាយប្រហារកាន់តែច្រើនឡើងប្រឆាំងនឹងអ្នករត់ពន្ធគ្រឿងញៀន។ |English Version| First started with, US Job data–Jolts Job openings report, which came lower than projected reading, showing a slowdown in hiring activities, while the job openings are dropping. All are suggesting to weaken the labor market conditions, just like what the Federal Reserve Chair Jerome Powell has expected. In fact, several Federal Reserve members from last night, such as Waller, Bostic, Musalem, and even Kashkari, who have always believed in a hawkish stance (FED’s Kashkari), are acknowledging the softening in the job market while inflation still weighs on their minds. However, if the labor continues to weaken, then there will be an expected market shift. Regardless, most are still priced in for the rate cut in September while citing that the economy is slowing but not recession yet. For now, investors are betting on a September rate cut, with the odds at 97.6% while moving up their expectations for the next rate cut from December to October. Tariff Development: According to Trump, “The US could be rich or poor, depending on the Supreme Court case on tariffs,” reflecting that these tariffs imposed gave him the leverage to strike a deal with other major trading partners and generate more revenue for the US economy. So if the US court really rules these global tariffs as an illegal act, then this will only bring more distress to their economy and market. Geopolitical Tension: War Other than that, Trump continues to put pressure on Russia as President Putin remains inflexible on ending this war without military involvement. In fact, the US urged Europe to stop purchasing Russian oil and join the proposed sanctions. At the same time, Trump also affirmed the U.S. commitment, stating, “We’ll put more there if they want,” to help Poland “protect itself.” In response, Putin welcomed the US President Donald Trump to further discussion on the current progress while leading the Ukrainian President Zelenskyy to meet in Moscow, Russia. Other war tensions included Israel and Hamas, the US and Venezuela—which hinted at more strikes coming against drug smugglers.